Corporation Tax Forms 2023-2026

Understanding the Louisville Revenue OL 3 Form

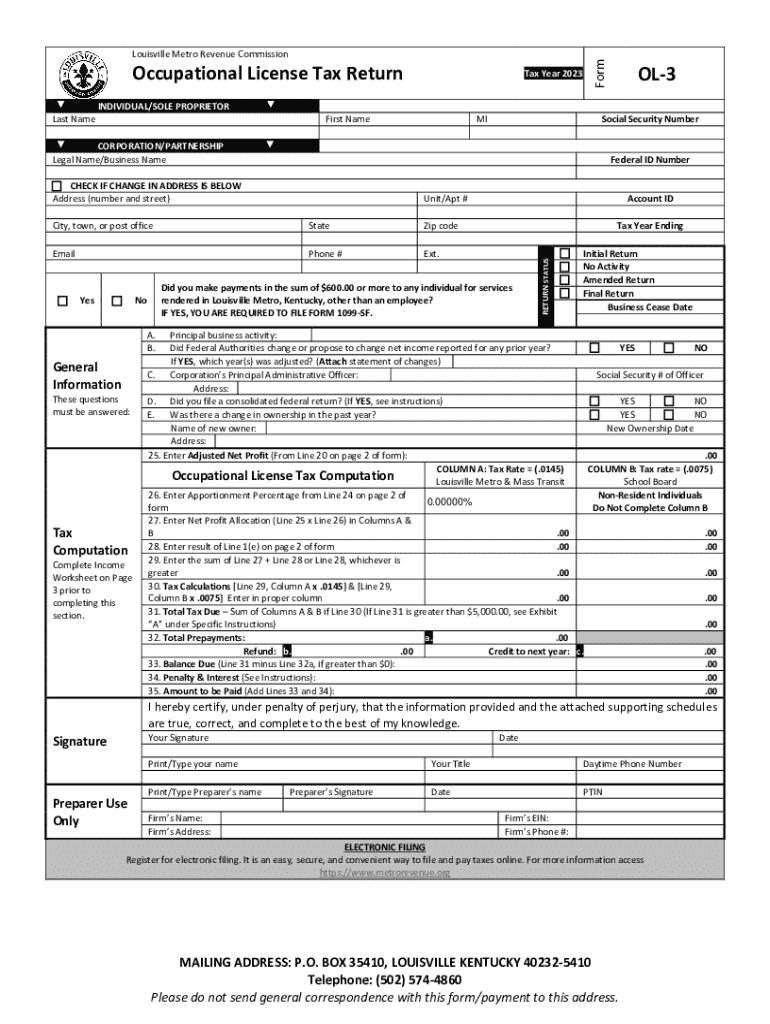

The Louisville Revenue OL 3 form, also known as the Louisville Occupational License Tax Return, is a crucial document for businesses operating within the city. This form is used to report and pay the occupational license tax, which is levied on individuals and businesses engaged in various professions and trades. It is essential for compliance with local tax regulations and helps fund city services.

Steps to Complete the Louisville Revenue OL 3 Form

Completing the OL 3 form requires careful attention to detail. Here are the key steps:

- Gather Required Information: Collect all necessary financial documents, including income statements and expense records.

- Fill Out Personal Information: Enter your name, business name, address, and contact details accurately.

- Report Income: Provide details of your gross receipts and any applicable deductions.

- Calculate Tax Liability: Use the provided tax rates to determine the amount owed based on your reported income.

- Review and Sign: Double-check all entries for accuracy before signing and dating the form.

Filing Deadlines for the OL 3 Form

Timely submission of the Louisville Revenue OL 3 form is critical to avoid penalties. The form is typically due on April 15 each year, aligning with the federal tax deadline. If you are unable to meet this deadline, it is advisable to file for an extension to prevent late fees.

Required Documents for Submission

When preparing to submit the OL 3 form, ensure you have the following documents ready:

- Income Statements: Documents that outline your earnings for the reporting period.

- Expense Records: Receipts and invoices that detail your business expenses.

- Previous Tax Returns: Copies of prior year returns may be necessary for reference.

Submission Methods for the OL 3 Form

The Louisville Revenue OL 3 form can be submitted through various methods to suit your preference:

- Online: Many businesses opt to file electronically through the city’s revenue website.

- Mail: You can send a completed paper form to the designated city revenue office.

- In-Person: Submitting the form in person at the local revenue office is also an option.

Penalties for Non-Compliance

Failure to file the OL 3 form on time or underreporting income can result in significant penalties. The city may impose fines, and interest may accrue on any unpaid taxes. It is essential to stay informed about your filing obligations to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct corporation tax forms

Create this form in 5 minutes!

How to create an eSignature for the corporation tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Louisville Revenue OL 3 and how does it relate to airSlate SignNow?

Louisville Revenue OL 3 is a financial management tool that can be integrated with airSlate SignNow to streamline document signing processes. By using airSlate SignNow, businesses can enhance their revenue management capabilities while ensuring compliance and efficiency in document handling.

-

How does airSlate SignNow improve the efficiency of document signing for Louisville Revenue OL 3 users?

AirSlate SignNow offers a user-friendly interface that simplifies the eSigning process for Louisville Revenue OL 3 users. With features like templates and automated workflows, businesses can signNowly reduce the time spent on document management, allowing for quicker revenue recognition.

-

What pricing plans are available for airSlate SignNow for Louisville Revenue OL 3 users?

AirSlate SignNow offers various pricing plans tailored to meet the needs of Louisville Revenue OL 3 users. These plans are designed to be cost-effective, providing essential features at competitive rates, ensuring that businesses can choose a plan that fits their budget and requirements.

-

Can airSlate SignNow integrate with Louisville Revenue OL 3?

Yes, airSlate SignNow can seamlessly integrate with Louisville Revenue OL 3, allowing for a smooth flow of information between the two platforms. This integration enhances the overall efficiency of document management and revenue tracking, making it easier for businesses to operate.

-

What are the key features of airSlate SignNow that benefit Louisville Revenue OL 3 users?

Key features of airSlate SignNow that benefit Louisville Revenue OL 3 users include customizable templates, real-time tracking, and secure cloud storage. These features help businesses manage their documents more effectively, ensuring that all revenue-related documents are signed and stored securely.

-

How does airSlate SignNow ensure the security of documents for Louisville Revenue OL 3?

AirSlate SignNow prioritizes document security with advanced encryption and compliance with industry standards. For Louisville Revenue OL 3 users, this means that sensitive financial documents are protected throughout the signing process, ensuring confidentiality and integrity.

-

What benefits can businesses expect from using airSlate SignNow alongside Louisville Revenue OL 3?

Businesses can expect increased efficiency, reduced turnaround times, and improved accuracy when using airSlate SignNow with Louisville Revenue OL 3. This combination allows for better management of revenue-related documents, ultimately leading to enhanced operational performance.

Get more for Corporation Tax Forms

- Fillable online sos ga georgia state board of cosmetology form

- Paul d pate application for amended secretary of state 572261039 form

- Everything you need to know about filing medical claims form

- Individual social worker application tricare west form

- Part i employers statement needed for both life or accidental death claims form

- Board of regents of the university system of georgia form

- Download the international patient form fox chase cancer center

- Skin script consent form rejuvalase

Find out other Corporation Tax Forms

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free