Form 12333 2011

What is the Form 12333

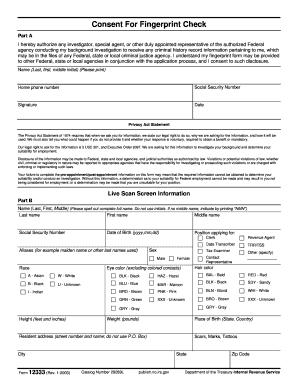

The Form 12333 is a specific document used for reporting certain financial transactions and activities to the relevant authorities. It is essential for compliance with tax regulations and helps ensure transparency in financial dealings. This form is particularly important for individuals and businesses that engage in transactions that may have tax implications or require disclosure to the IRS.

How to use the Form 12333

Using the Form 12333 involves several steps to ensure accurate completion and submission. First, gather all necessary information related to the transactions you need to report. This includes financial details, dates, and any relevant identification numbers. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled, review it for any errors before submitting it to the appropriate agency, either electronically or by mail.

Steps to complete the Form 12333

Completing the Form 12333 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including financial records and identification numbers.

- Access the Form 12333 from a reliable source.

- Fill in your personal information accurately, including name, address, and taxpayer identification number.

- Provide details of the transactions being reported, ensuring all amounts and dates are correct.

- Review the completed form for accuracy and completeness.

- Submit the form according to the instructions provided, either online or via mail.

Legal use of the Form 12333

The legal use of the Form 12333 is crucial for compliance with U.S. tax laws. When filled out correctly, it serves as an official record of reported transactions, which can be referenced by tax authorities. It is important to ensure that all information provided is truthful and accurate to avoid potential legal issues, including penalties for misreporting or failing to file.

Required Documents

To complete the Form 12333, certain documents may be required. These typically include:

- Financial statements related to the transactions being reported.

- Identification documents, such as a Social Security number or Employer Identification Number.

- Any prior correspondence with tax authorities that may pertain to the transactions.

Form Submission Methods

The Form 12333 can be submitted through various methods, depending on the requirements set by the relevant authorities. Common submission methods include:

- Online submission via authorized e-filing platforms.

- Mailing a physical copy to the designated address.

- In-person submission at local tax offices, if applicable.

Penalties for Non-Compliance

Failure to properly complete and submit the Form 12333 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to adhere to all filing deadlines and ensure that the information provided is accurate to avoid these consequences.

Quick guide on how to complete form 12333

Complete Form 12333 effortlessly on any device

Online document management has gained traction with businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without holdups. Handle Form 12333 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 12333 with ease

- Find Form 12333 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your liking. Edit and eSign Form 12333 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12333

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is form 12333 and how can airSlate SignNow help?

Form 12333 is a document that many businesses require for compliance and record-keeping. airSlate SignNow facilitates the signing and sharing of form 12333 efficiently, ensuring that your documents are legally binding and securely stored.

-

Is there a cost associated with using airSlate SignNow for form 12333?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. With competitive pricing, you can easily manage and eSign form 12333 without breaking the bank.

-

What features does airSlate SignNow offer for handling form 12333?

airSlate SignNow provides a range of features such as customizable templates, real-time tracking, and team collaboration tools specifically designed for form 12333. These features enhance efficiency and ensure that all parties can complete the necessary steps swiftly.

-

How can I integrate airSlate SignNow for form 12333 with other software?

airSlate SignNow boasts seamless integration with various platforms such as Google Drive, Salesforce, and Microsoft Office. This allows you to easily import, export, and manage form 12333 alongside your existing tools for a streamlined workflow.

-

What are the benefits of using airSlate SignNow for form 12333?

Using airSlate SignNow for form 12333 improves efficiency, reduces paper usage, and speeds up the signing process. This can lead to faster turnaround times for document approvals and enhanced client satisfaction.

-

Can I create a custom template for form 12333 in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create custom templates for form 12333 that suits your business requirements. This feature enables you to standardize your documents and save time on future submissions.

-

Is airSlate SignNow compliant with legal regulations for form 12333?

Yes, airSlate SignNow complies with all relevant legal regulations and standards for electronic signatures, making it a secure solution for processing form 12333. Your documents will be legally binding and protected under the ESIGN Act and UETA.

Get more for Form 12333

- Philippine eagles club application form

- Employee benefits comparison template form

- Tar 1406 form

- Ctpta form

- Investigational medicinal product dossier form

- Clnletter of authority emv replacement debit card for of remitter segment draft 4 bpi legal 05092018 form

- Division of labor standards enforcement electrician form

- Scdor 111 instr form

Find out other Form 12333

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast