Form 8050 Rev December Internal Revenue Service 2016

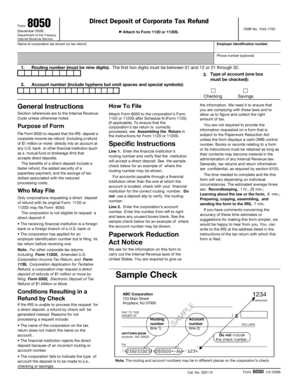

What is the Form 8050 Rev December Internal Revenue Service

The Form 8050 Rev December is a document issued by the Internal Revenue Service (IRS) that serves a specific purpose in tax administration. This form is primarily used for reporting certain tax-related information, ensuring compliance with federal regulations. It is essential for individuals and businesses to understand the purpose of this form to fulfill their tax obligations accurately.

How to use the Form 8050 Rev December Internal Revenue Service

Using the Form 8050 Rev December involves several steps that ensure proper completion and submission. First, gather all necessary information required for the form. This may include personal identification details, financial data, and any supporting documentation. Next, fill out the form carefully, ensuring that all information is accurate and complete. Review the completed form for any errors before submission to avoid delays or issues with the IRS.

Steps to complete the Form 8050 Rev December Internal Revenue Service

Completing the Form 8050 Rev December requires a systematic approach. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Collect all relevant information and documents needed for the form.

- Fill out each section of the form accurately, ensuring all fields are completed.

- Double-check for any mistakes or missing information.

- Sign and date the form as required.

- Submit the form according to IRS guidelines, whether online or via mail.

Legal use of the Form 8050 Rev December Internal Revenue Service

The legal use of the Form 8050 Rev December is crucial for ensuring compliance with tax laws. This form must be completed and submitted in accordance with IRS regulations to be considered valid. Failure to adhere to these guidelines can result in penalties or legal repercussions. It is important to understand the legal implications of submitting this form and to ensure that all provided information is truthful and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8050 Rev December are critical to avoid penalties. The IRS typically sets specific dates for submission, which may vary depending on the type of tax return or the taxpayer's situation. It is essential to stay informed about these deadlines to ensure timely filing. Missing a deadline can lead to additional fees or complications with tax compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 8050 Rev December can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically for convenience and speed.

- Mail: The form can be printed and sent via postal service to the appropriate IRS address.

- In-Person: Some individuals may choose to submit the form in person at designated IRS offices.

Quick guide on how to complete form 8050 rev december 2009 internal revenue service

Effortlessly Prepare Form 8050 Rev December Internal Revenue Service on Any Device

The management of online documents has gained traction among organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any holdups. Handle Form 8050 Rev December Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

The Easiest Method to Edit and Electronically Sign Form 8050 Rev December Internal Revenue Service with Ease

- Obtain Form 8050 Rev December Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your adjustments.

- Choose your delivery method for the form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8050 Rev December Internal Revenue Service and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8050 rev december 2009 internal revenue service

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Form 8050 Rev December Internal Revenue Service used for?

The Form 8050 Rev December Internal Revenue Service is designed for businesses to request a signature and provide necessary information regarding tax documents. It ensures that the IRS receives accurate data, which can help in avoiding penalties. By using airSlate SignNow, you can easily prepare and eSign this form securely online.

-

How can airSlate SignNow help me with the Form 8050 Rev December Internal Revenue Service?

airSlate SignNow offers an intuitive platform to prepare, send, and eSign the Form 8050 Rev December Internal Revenue Service. Our solution enables you to streamline your document processes, ensuring compliance and efficiency. Plus, you can track the status of your documents in real time.

-

Is there a cost associated with using airSlate SignNow for the Form 8050 Rev December Internal Revenue Service?

Yes, airSlate SignNow offers various pricing plans to fit your business needs, including a range of options for handling the Form 8050 Rev December Internal Revenue Service. We provide a cost-effective solution that allows you to save on paper and postage expenses while ensuring compliance with IRS requirements. Visit our pricing page for more details.

-

What features are available in airSlate SignNow for eSigning documents like the Form 8050 Rev December Internal Revenue Service?

airSlate SignNow includes a variety of features for eSigning documents, such as customizable templates, mobile-friendly signing options, and secure cloud storage. You can also track document status and set reminders for signers, making it easy to ensure the timely completion of the Form 8050 Rev December Internal Revenue Service.

-

Can I integrate airSlate SignNow with other software for handling the Form 8050 Rev December Internal Revenue Service?

Absolutely! airSlate SignNow seamlessly integrates with many popular applications and platforms, allowing you to manage your workflows efficiently. This means you can connect your systems directly for filing the Form 8050 Rev December Internal Revenue Service without having to switch between multiple tools.

-

How secure is my information when signing the Form 8050 Rev December Internal Revenue Service with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform to sign the Form 8050 Rev December Internal Revenue Service, your data is encrypted and stored safely in compliance with industry standards. We implement measures such as two-factor authentication to ensure your information remains secure.

-

What are the benefits of using airSlate SignNow for the Form 8050 Rev December Internal Revenue Service?

Using airSlate SignNow for the Form 8050 Rev December Internal Revenue Service provides numerous benefits, including increased efficiency, reduced paper waste, and faster turnaround times. Our platform simplifies the eSigning process, helping you to save time and ensure that your documents are legally binding. This allows your business to focus more on its core activities.

Get more for Form 8050 Rev December Internal Revenue Service

- Prn form

- The unit circle with radians add tangent homeworkdocx mathlore form

- Cell unit review worksheet part 2 form

- Paphos pub leagues rules form

- Lifeforming leadership coaching

- Shawnee mission ks 66201 form

- Alphabet alphabet linkinglinking chartchar a b c d form

- Emergency facilities amp land use agreement form

Find out other Form 8050 Rev December Internal Revenue Service

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT