Loan Bond Form

What is the Loan Bond Form

The loan bond form is a legal document that ensures compliance with state regulations for loan brokers. It serves as a guarantee that the broker will adhere to the laws governing lending practices. This bond protects consumers by providing a financial safety net in case the broker fails to meet their obligations. In the United States, each state may have specific requirements regarding the loan broker bond, including the amount of coverage and the conditions under which it must be maintained.

How to Obtain the Loan Bond Form

To obtain the loan bond form, individuals typically need to contact a surety bond provider or an insurance company that specializes in surety bonds. The process generally involves submitting an application that includes personal and business information. After the application is reviewed, the provider will assess the applicant's creditworthiness and may require additional documentation. Once approved, the bond can be issued, allowing the broker to operate legally within their state.

Steps to Complete the Loan Bond Form

Completing the loan bond form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the broker's name, business address, and license number. Next, fill out the form carefully, providing accurate details as required. It is essential to review the form for any errors before submission. After completing the form, it should be signed and submitted to the appropriate regulatory authority along with any required fees.

Legal Use of the Loan Bond Form

The legal use of the loan bond form is crucial for maintaining compliance with state laws. This bond acts as a safeguard for consumers, ensuring that loan brokers operate ethically and responsibly. In the event of a violation or failure to fulfill obligations, consumers can file a claim against the bond. The bond provider is then responsible for compensating the affected parties, which underscores the importance of the bond in protecting consumer interests.

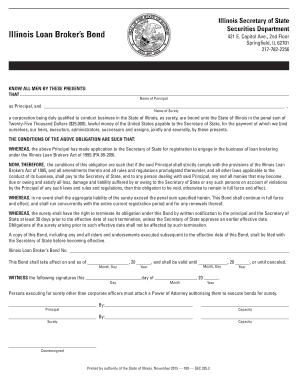

Key Elements of the Loan Bond Form

Several key elements must be included in the loan bond form for it to be valid. These elements typically include:

- The name and address of the loan broker.

- The bond amount, which varies by state.

- The effective date of the bond.

- The signature of the bond principal and the surety company.

- Any relevant state licensing information.

Ensuring that all these components are accurately represented is essential for the bond's legal standing.

State-Specific Rules for the Loan Bond Form

Each state in the U.S. has its own regulations regarding loan broker bonds. These rules can dictate the bond amount, the duration of coverage, and specific compliance requirements. For instance, some states may require additional documentation or periodic renewals of the bond. It is essential for loan brokers to familiarize themselves with their state's specific rules to ensure compliance and avoid penalties.

Penalties for Non-Compliance

Failure to comply with loan broker bond requirements can result in significant penalties. These may include fines, revocation of the broker's license, or legal action from consumers. Additionally, non-compliance can damage a broker's reputation and ability to conduct business. Therefore, maintaining an active and compliant loan bond is crucial for any broker operating in the lending industry.

Quick guide on how to complete loan bond form

Effortlessly prepare Loan Bond Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Loan Bond Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Loan Bond Form with ease

- Locate Loan Bond Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you want to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Loan Bond Form and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan bond form

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is a loan broker bond?

A loan broker bond is a type of surety bond required for companies that act as intermediaries in loan transactions. This bond protects clients by ensuring that the loan broker adheres to state regulations and ethical business practices. It helps build trust with clients, reflecting the broker's commitment to integrity in lending.

-

Why do I need a loan broker bond?

Having a loan broker bond is essential for operating legally in many states as a loan broker. This bond not only ensures compliance with state regulations but also provides clients with financial protection against potential fraud or misrepresentation. In essence, it instills confidence in your clients’ decision to work with your brokerage.

-

How much does a loan broker bond cost?

The cost of a loan broker bond typically ranges based on the bond amount required by the state and your personal credit history. Generally, premiums vary from 1% to 15% of the total bond amount. To get the most accurate pricing, it's wise to consult with a bonding agency that specializes in loan broker bonds.

-

What are the benefits of a loan broker bond?

A loan broker bond offers several benefits, including legal compliance and increased credibility with clients. It protects consumers from unethical practices, thus enhancing your reputation as a trustworthy broker. Ultimately, having this bond can lead to more business opportunities and satisfied clients.

-

How can I obtain a loan broker bond?

To obtain a loan broker bond, you typically need to apply through a surety bond provider. They will assess your financial credentials, including your credit score, and determine the premium based on risk. Once approved, you can purchase the bond and start your operations as a loan broker.

-

Are there any specific requirements for a loan broker bond?

Yes, the requirements for a loan broker bond can vary by state. Generally, you will need to provide personal and business financial information, along with proof of your licensing as a loan broker. It's essential to research the specific regulations in your state to ensure compliance.

-

What happens if a loan broker violates the bond terms?

If a loan broker violates the terms of their bond, clients can file a claim against the bond, seeking compensation for losses incurred due to the broker's misconduct. The surety bond provider may then investigate the claim and potentially cover the damages up to the bond’s limit. This process ensures that loan brokers are held accountable for their actions.

Get more for Loan Bond Form

Find out other Loan Bond Form

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online