Consumer Cfpb Closing Disclosure Form

What is the Consumer Cfpb Closing Disclosure

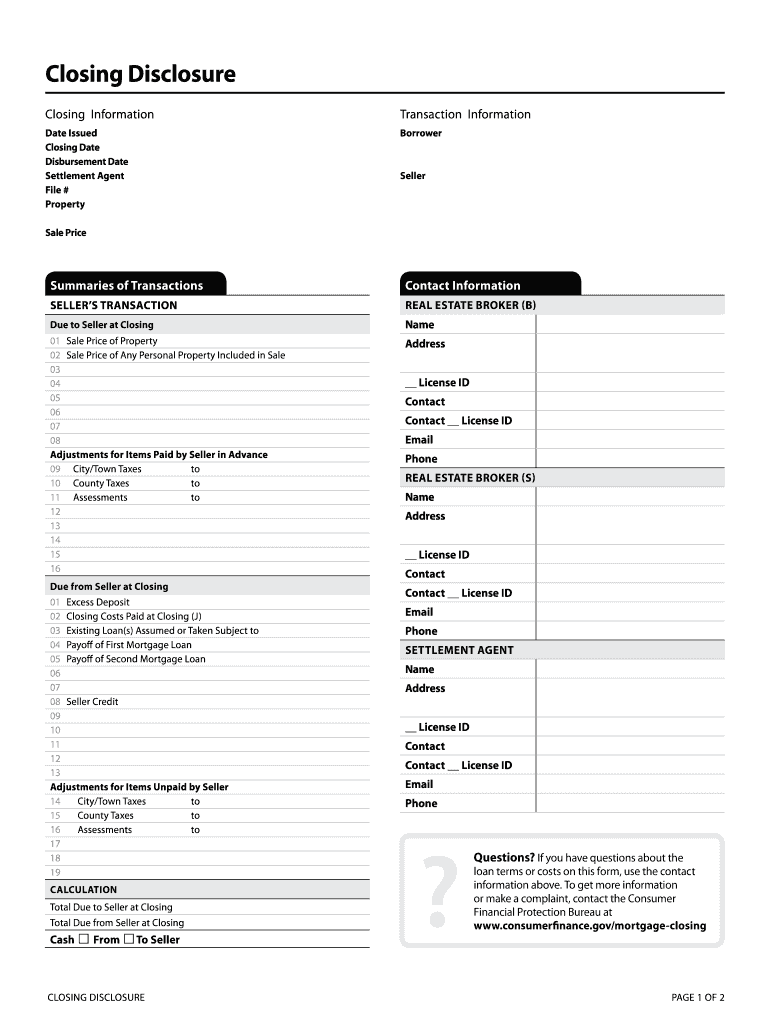

The Consumer CFPB Closing Disclosure is a crucial document that outlines the final terms and costs of a mortgage loan. It is designed to provide borrowers with clear and concise information about the loan they are about to sign. This form includes details such as the loan amount, interest rate, monthly payments, and a breakdown of closing costs. The purpose of the Closing Disclosure is to ensure that consumers understand their financial obligations before finalizing the mortgage agreement.

Key elements of the Consumer Cfpb Closing Disclosure

Understanding the key elements of the Consumer CFPB Closing Disclosure is essential for borrowers. The document typically includes the following sections:

- Loan Terms: This section outlines the loan amount, interest rate, and monthly payment details.

- Projected Payments: Borrowers can see how their payments will change over time, including principal, interest, taxes, and insurance.

- Closing Costs: A detailed breakdown of all closing costs, including lender fees, title insurance, and escrow fees.

- Other Costs: This includes any additional costs that may arise during the loan process, such as homeowner's insurance and property taxes.

- Loan Calculations: This section provides important calculations, including the total cost of the loan over its lifetime.

How to use the Consumer Cfpb Closing Disclosure

Using the Consumer CFPB Closing Disclosure effectively involves reviewing the document carefully before signing. Borrowers should compare the information on the Closing Disclosure with the Loan Estimate they received earlier in the process. This helps ensure that there are no unexpected changes in terms or costs. It is advisable to ask questions about any discrepancies or unclear terms before proceeding with the loan. Additionally, borrowers should keep a copy of the Closing Disclosure for their records, as it serves as a reference for the terms of the mortgage.

Steps to complete the Consumer Cfpb Closing Disclosure

Completing the Consumer CFPB Closing Disclosure involves several important steps:

- Review the document: Carefully read through each section to understand the terms and costs associated with the loan.

- Compare with the Loan Estimate: Check for consistency between the Closing Disclosure and the Loan Estimate previously provided.

- Ask questions: Reach out to your lender for clarification on any terms or figures that are unclear.

- Sign the document: Once you are satisfied with the information, sign the Closing Disclosure to finalize the agreement.

Legal use of the Consumer Cfpb Closing Disclosure

The Consumer CFPB Closing Disclosure is legally binding once signed by the borrower. It must comply with federal regulations outlined by the Consumer Financial Protection Bureau (CFPB). This ensures that the document meets all legal requirements for mortgage disclosures. Borrowers should be aware that any discrepancies or errors in the Closing Disclosure could lead to legal issues, making it essential to review the document thoroughly before signing.

How to obtain the Consumer Cfpb Closing Disclosure

Borrowers typically receive the Consumer CFPB Closing Disclosure from their lender or mortgage broker. It is provided at least three business days before the closing date, allowing ample time for review. If a borrower does not receive the Closing Disclosure, they should contact their lender immediately to request it. Additionally, some lenders may offer electronic versions of the document, making it easier for borrowers to access and review the information.

Quick guide on how to complete consumer cfpb closing disclosure

Complete Consumer Cfpb Closing Disclosure effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Consumer Cfpb Closing Disclosure on any device with airSlate SignNow Android or iOS applications and simplify any document-related operation today.

How to modify and electronically sign Consumer Cfpb Closing Disclosure with ease

- Obtain Consumer Cfpb Closing Disclosure and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools available from airSlate SignNow designed specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Consumer Cfpb Closing Disclosure and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer cfpb closing disclosure

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is a closing disclosure editable pdf?

A closing disclosure editable pdf is a document that provides essential details about a mortgage loan and its final terms. It is designed to be filled in and tailored by users, ensuring that all relevant information is accurately represented before finalizing a transaction.

-

How can I create a closing disclosure editable pdf?

You can easily create a closing disclosure editable pdf using airSlate SignNow's intuitive document editor. By uploading a standard closing disclosure template, you can customize it to meet your specific needs, making it a user-friendly solution for any real estate transaction.

-

Is there a cost associated with using airSlate SignNow for editable pdfs?

Yes, pricing for using airSlate SignNow includes options for individual users and teams, depending on your needs. The cost is competitive, providing an efficient and cost-effective solution for managing documents including closing disclosure editable pdfs.

-

What features does airSlate SignNow offer for editable pdfs?

airSlate SignNow offers a range of features, including customizable templates, eSignatures, document storage, and collaboration tools. These features make it easy to manage closing disclosure editable pdfs alongside other essential documents in your workflow.

-

Can I integrate airSlate SignNow with other software systems?

Yes, airSlate SignNow supports integrations with various software applications, including CRM and project management tools. This allows you to seamlessly manage your closing disclosure editable pdfs and other documents within your existing workflows.

-

How secure is the closing disclosure editable pdf process with airSlate SignNow?

Security is a top priority for airSlate SignNow, which provides robust encryption and compliance with industry standards. Your closing disclosure editable pdfs and other documents are protected throughout the entire process, giving you peace of mind.

-

Can I access my closing disclosure editable pdfs on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access your closing disclosure editable pdfs from any device. Whether you're in the office or on the go, you can easily manage your documents anytime, anywhere.

Get more for Consumer Cfpb Closing Disclosure

- Howard johnson credit card authorization form

- The truss body form reconstructions in morphometrics faculty biol ttu

- Avid tag form 212219240

- 7 3 additional practice answer key form

- Direct deposit agreement template form

- Direct hire agreement template form

- Direct hire staffing agreement template form

- Director agreement template form

Find out other Consumer Cfpb Closing Disclosure

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement