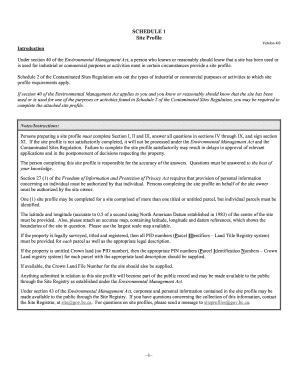

Schedule 1 Profile Form

What is the Schedule 1 Profile

The Schedule 1 profile is a tax form used by individuals to report additional income or adjustments to income that are not included on the main tax return. This form is essential for taxpayers who have specific types of income, such as unemployment compensation, or who wish to claim certain deductions, such as educator expenses or student loan interest. Understanding the Schedule 1 profile is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

How to use the Schedule 1 Profile

Using the Schedule 1 profile involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, complete the form by entering the required information regarding additional income and adjustments. After filling out the Schedule 1 profile, it should be attached to the main tax return form, typically Form 1040, before submission to the IRS.

Steps to complete the Schedule 1 Profile

Completing the Schedule 1 profile involves a systematic approach:

- Gather all necessary documentation related to additional income and deductions.

- Fill out the personal information section at the top of the form.

- Report additional income in Part I, including items such as unemployment compensation or rental income.

- Complete Part II to claim adjustments to income, such as student loan interest or IRA contributions.

- Review the completed form for accuracy and ensure all required information is included.

- Attach the Schedule 1 profile to your main tax return before submitting it to the IRS.

Legal use of the Schedule 1 Profile

The Schedule 1 profile is legally recognized as part of the tax filing process in the United States. To ensure its legal validity, it must be completed accurately and submitted along with the main tax return. Compliance with IRS guidelines is essential to avoid penalties or issues with tax audits. Additionally, using a reliable electronic signature solution can enhance the legal standing of the submitted documents.

Key elements of the Schedule 1 Profile

Key elements of the Schedule 1 profile include:

- Personal Information: Name, Social Security number, and filing status.

- Additional Income: Types of income that must be reported, such as unemployment benefits or alimony.

- Adjustments to Income: Deductions that can reduce taxable income, including educator expenses and student loan interest.

- Signature: Required to validate the form, ensuring that the information provided is accurate and truthful.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 1 profile align with the main tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to keep track of these dates to avoid late filing penalties and ensure timely submission of all required forms, including the Schedule 1 profile.

Quick guide on how to complete schedule 1 profile

Effortlessly Complete Schedule 1 Profile on Any Device

Managing documents online has become increasingly popular among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle Schedule 1 Profile on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Edit and Electronically Sign Schedule 1 Profile

- Obtain Schedule 1 Profile and click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Schedule 1 Profile and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 profile

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a schedule 1 profile in airSlate SignNow?

A schedule 1 profile in airSlate SignNow refers to a specific user configuration that allows businesses to streamline their document signing processes. This profile includes settings that cater to the unique needs of a user or organization, ensuring efficient eSigning and document management.

-

How much does a schedule 1 profile cost in airSlate SignNow?

The cost of a schedule 1 profile in airSlate SignNow varies based on the selected plan. Our pricing is designed to be cost-effective, making it ideal for businesses of all sizes looking to enhance their document workflow without overspending.

-

What features are included in the schedule 1 profile?

The schedule 1 profile includes a comprehensive set of features such as secure electronic signatures, customizable templates, and real-time tracking of document status. These features help ensure a streamlined signing process that meets the specific needs of your organization.

-

What are the benefits of using a schedule 1 profile with airSlate SignNow?

Using a schedule 1 profile with airSlate SignNow allows for greater customization and improved efficiency in document management. This targeted approach helps reduce turnaround times and enhances collaboration among team members and clients.

-

Can I integrate the schedule 1 profile with other software?

Yes, the schedule 1 profile integrates seamlessly with various other software platforms, including CRM and cloud storage solutions. This integration capability enhances workflows and ensures that your document management process is cohesive and efficient.

-

Is it easy to set up a schedule 1 profile in airSlate SignNow?

Setting up a schedule 1 profile in airSlate SignNow is a simple and straightforward process. With user-friendly interface elements and guided prompts, businesses can quickly configure their profiles to suit their specific eSigning requirements.

-

How secure is the schedule 1 profile in airSlate SignNow?

The schedule 1 profile in airSlate SignNow is designed with advanced security protocols to protect sensitive information. With encryption, two-factor authentication, and compliance with legal standards, your documents are safe throughout the signing process.

Get more for Schedule 1 Profile

- 1040 us individual income tax return filing status 2 irs form

- Clarke fire protection products form

- Ontario works mileage form medical or employment november

- Attending physicians statement aps form

- Neuropathic pain a pathway for care developed by the form

- Consent to publish student information carleton ca

- Schedule of expected pension contributions schedule of expected contributions to be filed with the alberta superintendent of form

- Letter of intent usports form

Find out other Schedule 1 Profile

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe