How to Send Form Nr6 to Cra 2006

Understanding the nr 6 form

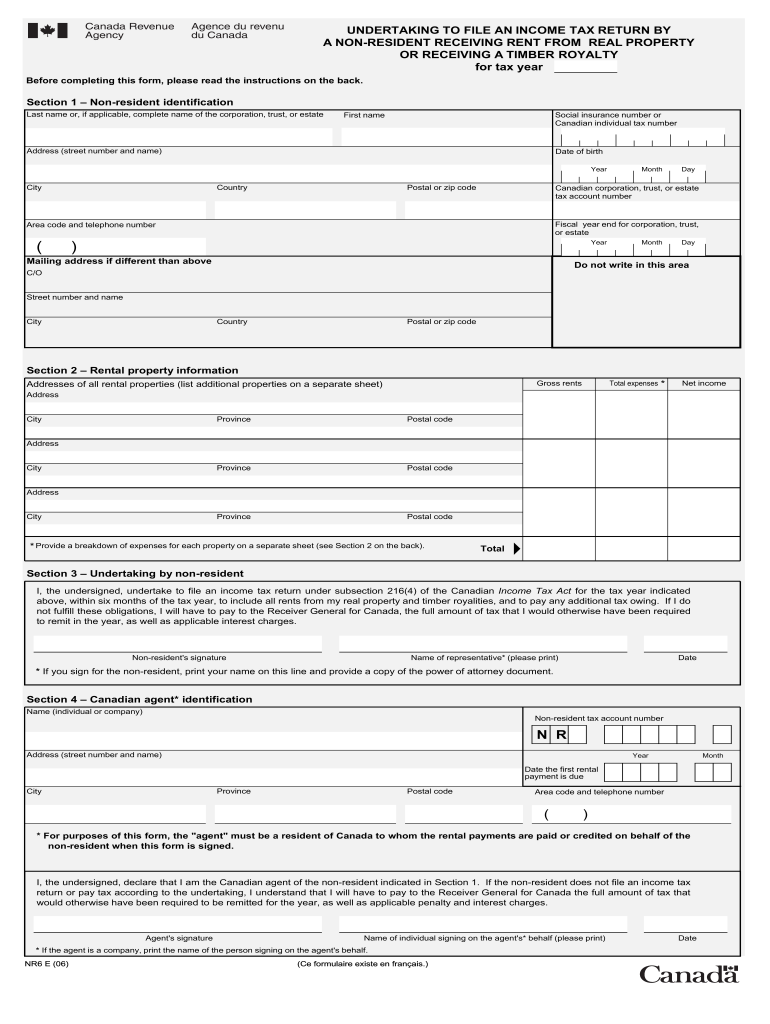

The nr 6 form is a crucial document used primarily for tax purposes in the United States. It is often required by the Canada Revenue Agency (CRA) for individuals or businesses reporting specific income types. This form helps ensure compliance with tax regulations and facilitates accurate reporting of income earned. Understanding the nuances of the nr 6 form is essential for anyone required to submit it, as it can impact tax obligations and potential refunds.

Steps to complete the nr 6 form

Completing the nr 6 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details, income sources, and any relevant deductions. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it thoroughly for any errors or omissions before submission. This attention to detail can prevent potential issues with the CRA.

How to send the nr 6 form to CRA

Submitting the nr 6 form to the CRA can be done through various methods. You can choose to send it via traditional mail, ensuring it is properly addressed and stamped. Alternatively, many individuals opt for electronic submission, which can be completed through the CRA's online portal. This method is often faster and provides immediate confirmation of receipt. Whichever method you choose, ensure that you keep a copy of the submitted form for your records.

Legal use of the nr 6 form

The legal validity of the nr 6 form hinges on its proper completion and submission. When filled out accurately, it serves as a legally binding document that can be used in tax assessments and audits. Compliance with relevant tax laws is essential, as failure to submit the form or inaccuracies can lead to penalties. Utilizing a reliable eSignature solution can further enhance the legal standing of the completed form, ensuring that it meets all necessary requirements.

Required documents for the nr 6 form

When preparing to fill out the nr 6 form, it is essential to have several documents on hand. These typically include personal identification, such as a Social Security number, and documentation of income sources like W-2s or 1099s. Additionally, any receipts or records supporting deductions claimed on the form should be gathered. Having these documents readily available will streamline the completion process and help ensure accuracy.

Filing deadlines for the nr 6 form

Filing deadlines for the nr 6 form are crucial to avoid late penalties. Generally, the form must be submitted by a specific date each tax year, which is typically aligned with the annual tax filing deadline. It is important to stay informed about any changes to these dates, as they can vary from year to year. Marking these deadlines on your calendar can help ensure timely submission and compliance with tax regulations.

Examples of using the nr 6 form

The nr 6 form is commonly used in various scenarios, particularly for individuals and businesses reporting income from investments or freelance work. For instance, a freelancer may use the form to report earnings from multiple clients, while an investor might use it to declare income from dividends or interest. Understanding these examples can help clarify when and how to utilize the nr 6 form effectively.

Quick guide on how to complete how to send form nr6 to cra

Effortlessly Prepare How To Send Form Nr6 To Cra on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without complications. Handle How To Send Form Nr6 To Cra on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest method to edit and electronically sign How To Send Form Nr6 To Cra with ease

- Find How To Send Form Nr6 To Cra and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or forgotten documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign How To Send Form Nr6 To Cra while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to send form nr6 to cra

Create this form in 5 minutes!

How to create an eSignature for the how to send form nr6 to cra

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the nr 6 form and how can airSlate SignNow help me with it?

The nr 6 form is a crucial document in various business processes, and airSlate SignNow simplifies its handling. With our platform, you can easily create, send, and eSign the nr 6 form, ensuring that it is completed quickly and securely. Our user-friendly interface makes it accessible for everyone, from small businesses to large enterprises.

-

Is there a cost associated with using airSlate SignNow for the nr 6 form?

Yes, there are several pricing plans available for airSlate SignNow that can cater to different business needs when handling the nr 6 form. Our plans are designed to be cost-effective, ensuring you get the best value for features that simplify document management, including eSigning the nr 6 form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the nr 6 form?

airSlate SignNow offers a variety of features that enhance the management of the nr 6 form. These include templates, customizable fields, and automated workflows that ensure your document processes are streamlined. Additionally, our secure eSigning technology guarantees that your nr 6 forms are signed and stored safely.

-

Can I integrate airSlate SignNow with other applications when handling the nr 6 form?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, enhancing the usability of the nr 6 form across your tools. You can easily connect with platforms like Google Drive, Dropbox, and many more, allowing for efficient document management and workflow automation.

-

How secure is airSlate SignNow for signing the nr 6 form?

Security is a top priority at airSlate SignNow. Our platform implements advanced encryption and compliance with global standards, ensuring that your nr 6 form and other documents are protected from unauthorized access. You can confidently eSign and manage your documents with peace of mind.

-

Can I track the status of my nr 6 form sent via airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your nr 6 form. You can easily see when your document has been sent, viewed, and signed, ensuring you stay updated on its progress. This visibility enhances communication and efficiency in document handling.

-

Is airSlate SignNow easy to use for the nr 6 form management?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it simple to manage the nr 6 form. Our intuitive interface allows users of all technical abilities to create, send, and eSign documents effortlessly. You can get started quickly and focus on completing your document processes.

Get more for How To Send Form Nr6 To Cra

- 727 418 3543 weekly pool service agreement st petersburg fl form

- Bmv 4705 request for special plates ohio bmv forms online case

- Tr 579 form

- 3 form vi a see rule 252 viii contract labourrampa central col gujarat gov

- Mmr meningitis forms long island university

- Customer application form

- Rl 31 cs fill and sign printable template online form

- Asking the pleasure of your company in an invitation form

Find out other How To Send Form Nr6 To Cra

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter