Information Concerning Claims for Treaty Based Exemptions Schedule 91 2011

What is the Information Concerning Claims For Treaty Based Exemptions Schedule 91

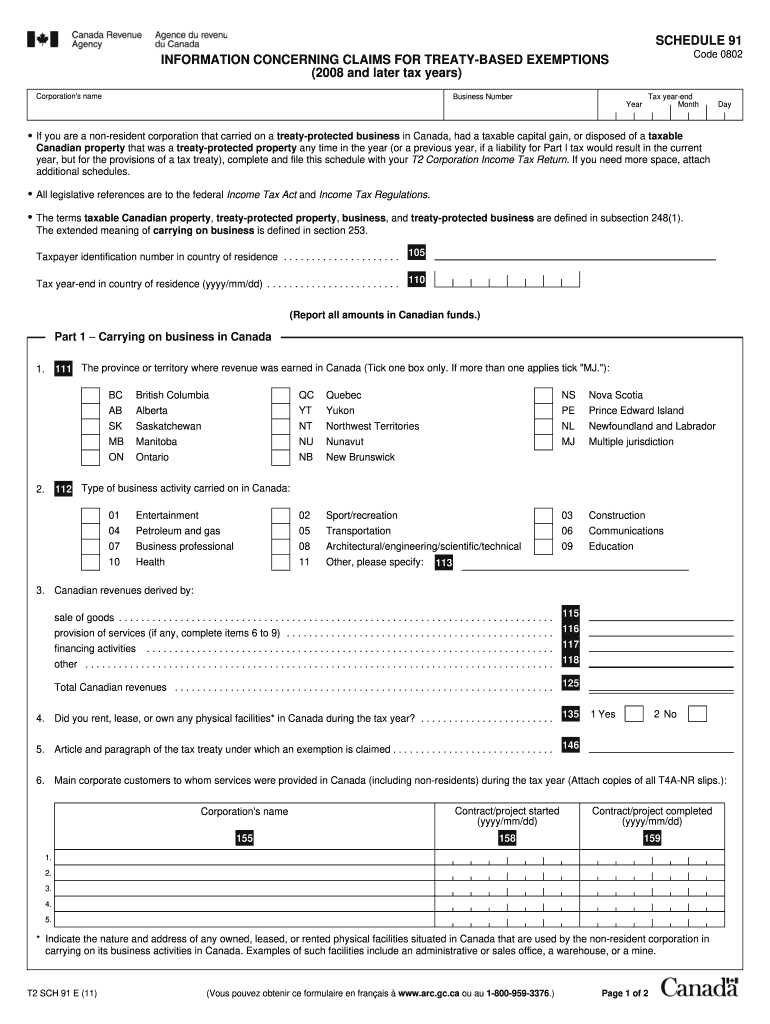

The Information Concerning Claims For Treaty Based Exemptions Schedule 91 is a form used by certain taxpayers to claim exemptions from U.S. tax withholding based on tax treaties between the United States and other countries. This form is essential for non-resident aliens and foreign entities who wish to benefit from reduced withholding rates or exemptions on specific types of income. Understanding this form is crucial for ensuring compliance with U.S. tax laws while taking advantage of treaty benefits.

Steps to complete the Information Concerning Claims For Treaty Based Exemptions Schedule 91

Completing the Information Concerning Claims For Treaty Based Exemptions Schedule 91 involves several key steps:

- Gather necessary information, including your taxpayer identification number and details about the income you are receiving.

- Identify the relevant tax treaty provisions that apply to your situation.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the Information Concerning Claims For Treaty Based Exemptions Schedule 91

The legal use of the Information Concerning Claims For Treaty Based Exemptions Schedule 91 is governed by U.S. tax regulations. To be valid, the form must be completed accurately and submitted in accordance with IRS guidelines. Failure to comply with these regulations can result in penalties, including the potential for higher withholding rates on income. It is important to keep records of the submitted forms and any correspondence with the IRS regarding your claims.

Key elements of the Information Concerning Claims For Treaty Based Exemptions Schedule 91

Key elements of the Information Concerning Claims For Treaty Based Exemptions Schedule 91 include:

- Taxpayer identification information, such as your name and address.

- Details of the income for which you are claiming treaty benefits.

- Specific provisions of the tax treaty that apply to your situation.

- Signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Information Concerning Claims For Treaty Based Exemptions Schedule 91 vary depending on the type of income and the specific tax treaty provisions. Generally, it is advisable to submit the form before the first payment of income subject to withholding. Keeping track of these deadlines is essential to avoid unnecessary withholding and ensure compliance with U.S. tax laws.

Who Issues the Form

The Information Concerning Claims For Treaty Based Exemptions Schedule 91 is issued by the Internal Revenue Service (IRS). This form is part of the broader framework of IRS forms and publications designed to assist taxpayers in understanding their obligations and rights under U.S. tax law. It is important to use the most current version of the form to ensure compliance with any changes in tax regulations.

Quick guide on how to complete information concerning claims for treaty based exemptions schedule 91 2011

Complete Information Concerning Claims For Treaty Based Exemptions Schedule 91 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Information Concerning Claims For Treaty Based Exemptions Schedule 91 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Information Concerning Claims For Treaty Based Exemptions Schedule 91 with ease

- Locate Information Concerning Claims For Treaty Based Exemptions Schedule 91 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that reason.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Adjust and eSign Information Concerning Claims For Treaty Based Exemptions Schedule 91 to guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information concerning claims for treaty based exemptions schedule 91 2011

Create this form in 5 minutes!

How to create an eSignature for the information concerning claims for treaty based exemptions schedule 91 2011

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the purpose of the Information Concerning Claims For Treaty Based Exemptions Schedule 91?

The Information Concerning Claims For Treaty Based Exemptions Schedule 91 provides guidelines for businesses looking to understand and utilize treaty-based exemptions when filing claims. This schedule highlights the requirements and processes involved in ensuring compliance, making it essential for accurate documentation.

-

How does airSlate SignNow support the Information Concerning Claims For Treaty Based Exemptions Schedule 91?

airSlate SignNow streamlines the process of managing the Information Concerning Claims For Treaty Based Exemptions Schedule 91 by allowing businesses to eSign and send necessary documents quickly. Our platform ensures secure storage and easy access to important files, helping users stay compliant while saving time.

-

Is there a cost associated with accessing Information Concerning Claims For Treaty Based Exemptions Schedule 91 through airSlate SignNow?

Yes, while airSlate SignNow offers various pricing plans, accessing information regarding the Information Concerning Claims For Treaty Based Exemptions Schedule 91 is typically included in our packages. We provide cost-effective solutions designed to meet the needs of businesses of all sizes.

-

What features does airSlate SignNow offer for managing Information Concerning Claims For Treaty Based Exemptions Schedule 91?

Our platform provides features such as customizable templates, real-time collaboration, and secure eSigning, all designed to help businesses effectively manage their Information Concerning Claims For Treaty Based Exemptions Schedule 91. These tools enhance productivity and ensure compliance throughout the document lifecycle.

-

Can I integrate airSlate SignNow with applications relevant to Information Concerning Claims For Treaty Based Exemptions Schedule 91?

Yes, airSlate SignNow seamlessly integrates with various applications like CRM systems and cloud storage services. This allows businesses to efficiently manage the Information Concerning Claims For Treaty Based Exemptions Schedule 91 alongside their existing workflows.

-

How does using airSlate SignNow benefit my understanding of Information Concerning Claims For Treaty Based Exemptions Schedule 91?

Using airSlate SignNow can enhance your understanding of the Information Concerning Claims For Treaty Based Exemptions Schedule 91 by simplifying document management and ensuring you have access to the latest information. This support enables businesses to stay informed and compliant with treaty-based exemption claims.

-

What kind of customer support does airSlate SignNow provide for issues related to Information Concerning Claims For Treaty Based Exemptions Schedule 91?

airSlate SignNow offers dedicated customer support to assist with any queries related to Information Concerning Claims For Treaty Based Exemptions Schedule 91. Our team is available via chat, email, and phone to ensure you receive timely and effective assistance.

Get more for Information Concerning Claims For Treaty Based Exemptions Schedule 91

Find out other Information Concerning Claims For Treaty Based Exemptions Schedule 91

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template