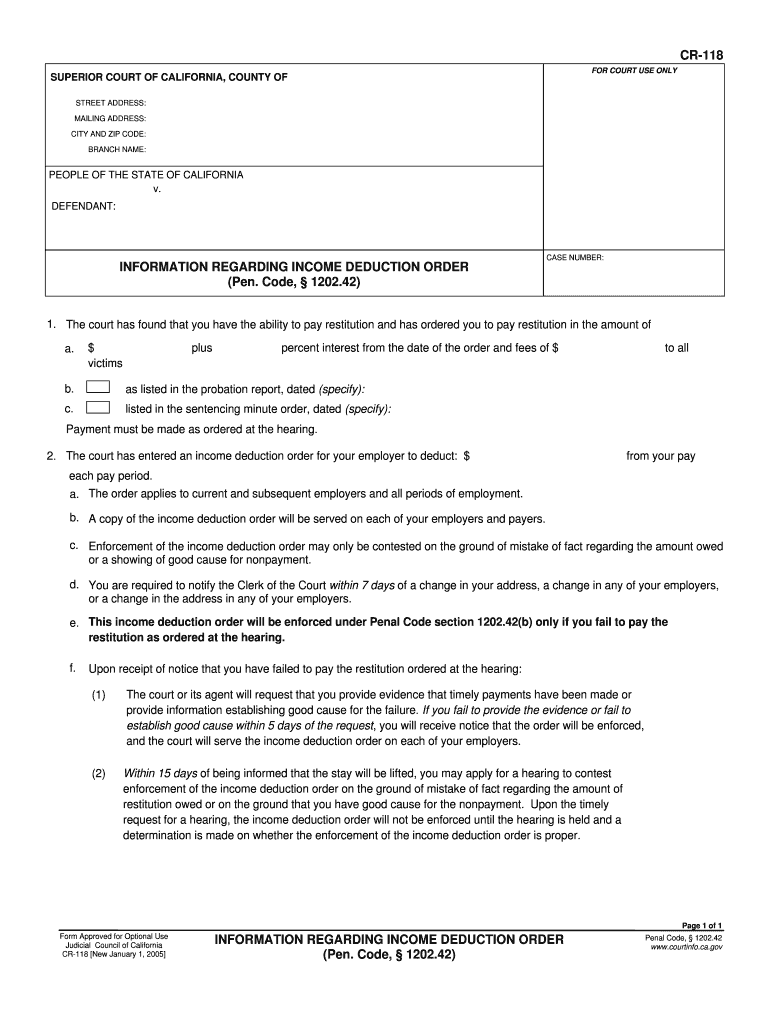

Cr 118 Form

What is the CR 118?

The CR 118 is a specific form used in California for reporting income deductions. This form is essential for individuals seeking to document their income accurately, particularly for tax purposes. It provides a standardized way to present information regarding income, ensuring compliance with state regulations. Understanding the CR 118 is crucial for proper tax reporting and can help avoid potential issues with the California tax authorities.

How to Use the CR 118

Using the CR 118 involves filling out the form with accurate details regarding your income and deductions. It is important to gather all necessary information before starting, including income statements and any relevant documentation. The form can be completed electronically, which streamlines the process and enhances accuracy. Once filled out, it should be submitted according to the guidelines set by the California tax authorities.

Steps to Complete the CR 118

Completing the CR 118 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and deduction records.

- Access the CR 118 form through the appropriate channels, ensuring you have the latest version.

- Fill out the form accurately, entering your income and any deductions you are claiming.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the submission guidelines provided by the state.

Legal Use of the CR 118

The CR 118 is legally binding when completed and submitted according to state regulations. It is crucial that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal repercussions. The form must adhere to the guidelines set forth by the California tax authorities to ensure its validity.

Required Documents for the CR 118

To complete the CR 118, several documents may be required, including:

- Income statements, such as W-2s or 1099s.

- Records of any deductions you plan to claim.

- Identification information, which may include your Social Security number.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in your reporting.

Filing Deadlines for the CR 118

It is important to be aware of the filing deadlines associated with the CR 118. Typically, forms must be submitted by specific dates to avoid penalties. Keeping track of these deadlines ensures that you remain compliant with California tax laws and can help you avoid unnecessary complications.

Quick guide on how to complete cr 118

Effortlessly Prepare Cr 118 on Any Device

Digital document management has gained signNow traction among organizations and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without complications. Manage Cr 118 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Edit and Electronically Sign Cr 118

- Obtain Cr 118 and click on Get Form to begin.

- Use the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that require printing new document versions. airSlate SignNow manages all your document administration needs in just a few clicks from any chosen device. Modify and electronically sign Cr 118 and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cr 118

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is CR 118 in the context of airSlate SignNow?

CR 118 refers to a crucial document management process that airSlate SignNow supports, allowing users to streamline their electronic signatures. This process enhances the efficiency of document handling, ensuring that businesses can quickly send, sign, and store critical documents securely.

-

How does airSlate SignNow support compliance with CR 118?

AirSlate SignNow ensures compliance with CR 118 by providing secure and legally binding electronic signatures that meet regulatory standards. This makes it easier for businesses to stay compliant while managing their legal documents effectively.

-

What are the pricing options for using airSlate SignNow with CR 118?

AirSlate SignNow offers flexible pricing plans catering to different business needs while utilizing CR 118. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can take advantage of advanced eSigning features without straining their budgets.

-

What features does airSlate SignNow offer for CR 118 document management?

AirSlate SignNow provides a range of features for CR 118, including real-time document tracking, customizable templates, and multi-party signing capabilities. These features enhance the user experience and streamline the signing process across various document types.

-

How can I integrate airSlate SignNow with CR 118 in my existing workflow?

Integrating airSlate SignNow for CR 118 into your existing workflow can be done seamlessly with our API and various third-party applications. This allows businesses to incorporate eSigning and document management without signNow disruptions to their current processes.

-

What benefits does airSlate SignNow provide for managing CR 118 documents?

The benefits of using airSlate SignNow for CR 118 documents include increased efficiency, reduced turnaround time for signatures, and improved document security. These advantages lead to faster business operations and enhanced client satisfaction.

-

Is airSlate SignNow suitable for small businesses needing CR 118 solutions?

Absolutely! airSlate SignNow is designed to meet the needs of small businesses looking for efficient CR 118 solutions. Our affordable pricing and user-friendly interface make it easy for small teams to implement effective document management practices.

Get more for Cr 118

- Amtgard waiver form

- North carolina rocky mount form

- Form 4a 206 request for hearing

- Application for the refund of payment for approved equipment 405665535 form

- Power of attorney california form

- Chapter 11 my relapse prevention plan angelfire form

- Ordering information child care licensing inquiry packets dcf f cfs2022 child care licensing

- Authorization to administer medication child care centers dcf f cfs0059 form

Find out other Cr 118

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF