Colorado Earnings Form

What is the Colorado Earnings Form

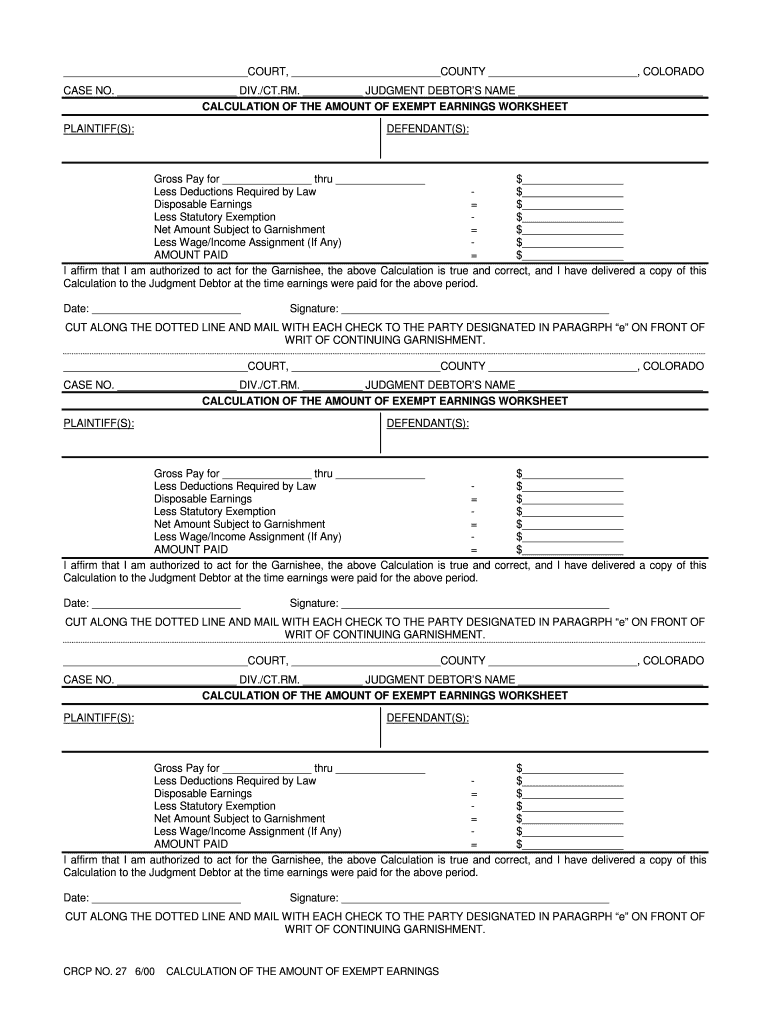

The Colorado Earnings Form, commonly referred to as the Colorado 27, is a crucial document used for reporting income and calculating tax obligations in the state of Colorado. This form is particularly important for individuals and businesses that need to declare their earnings accurately for tax purposes. It serves as a means for the Colorado Department of Revenue to assess income tax liabilities and ensure compliance with state tax laws.

How to use the Colorado Earnings Form

Using the Colorado Earnings Form involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including pay stubs, bank statements, and any other relevant income records. Next, fill out the form with precise information regarding your earnings, deductions, and credits. It is essential to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing. Once completed, the form should be submitted according to the specified methods, which may include online submission, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the Colorado Earnings Form

Completing the Colorado 27 form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, accurately report your total earnings for the year, including wages, bonuses, and any other income sources. Deduct any allowable expenses or credits as outlined in the form instructions. After filling out all sections, review the form for accuracy, ensuring that all calculations are correct. Finally, sign and date the form before submitting it to the Colorado Department of Revenue.

Legal use of the Colorado Earnings Form

The Colorado Earnings Form is legally recognized as a valid document for tax reporting purposes. To ensure its legal standing, it must be completed accurately and submitted on time. Compliance with state tax regulations is essential, as failure to file the form correctly can result in penalties or legal repercussions. Utilizing electronic signature solutions, like those offered by signNow, can enhance the legitimacy of your submission by providing a secure and verifiable method of signing the document.

Key elements of the Colorado Earnings Form

Several key elements are essential when completing the Colorado 27 form. These include personal identification details, total income reported, applicable deductions, and the calculation of tax owed. Additionally, the form may require information about your employment status, such as whether you are self-employed or an employee. Understanding these components is vital for ensuring that your tax return is accurate and compliant with Colorado tax laws.

Eligibility Criteria

Eligibility to use the Colorado Earnings Form generally includes individuals who earn income within the state, whether through employment, self-employment, or other sources. Specific criteria may apply based on income levels, filing status, and residency. It is important to review these criteria to determine if you are required to file the form and to ensure that you meet all necessary qualifications for accurate reporting.

Quick guide on how to complete colorado earnings form

Complete Colorado Earnings Form effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Colorado Earnings Form on any device with airSlate SignNow Android or iOS applications and streamline any document-focused task today.

How to modify and eSign Colorado Earnings Form effortlessly

- Find Colorado Earnings Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Verify all the information and click on the Done button to save your alterations.

- Select your preferred delivery method for your form: by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Modify and eSign Colorado Earnings Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado earnings form

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to colorado 27?

airSlate SignNow is a powerful eSignature solution that empowers businesses to send and eSign documents efficiently. With features tailored for Colorado 27, it enables seamless document management while adhering to state-specific regulations and requirements.

-

What are the pricing options for using airSlate SignNow in colorado 27?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs in colorado 27. You can choose from various options based on the number of users and features required, ensuring a cost-effective solution for your eSignature needs.

-

What features can users expect from airSlate SignNow in colorado 27?

Users in colorado 27 can enjoy a host of features such as customizable templates, in-person signing, and secure storage. These functionality enhancements are geared towards optimizing the eSigning process for local businesses.

-

How does airSlate SignNow improve workflow efficiency in colorado 27?

airSlate SignNow streamlines workflow processes in colorado 27 by enabling quick and easy document signing and routing. This ensures that important documents are managed promptly, enhancing productivity across teams.

-

Are there integration options available for airSlate SignNow in colorado 27?

Yes, airSlate SignNow offers extensive integration capabilities with popular applications used in colorado 27. This allows businesses to easily connect their existing tools and systems, creating a cohesive experience that boosts operational efficiency.

-

What are the security features of airSlate SignNow for users in colorado 27?

Security is a top priority for airSlate SignNow, especially for businesses in colorado 27. The platform employs advanced encryption methods and compliance with data protection laws, ensuring that your sensitive documents remain secure throughout the signing process.

-

Can airSlate SignNow support mobile signing for clients in colorado 27?

Absolutely! airSlate SignNow provides mobile signing capabilities, making it easy for users in colorado 27 to manage documents on the go. This flexibility ensures that signers can complete transactions anytime, anywhere.

Get more for Colorado Earnings Form

- Multiple worksite report georgia form

- Mechanical permit application pdf city of st albert stalbert form

- Aarp delta dental pay my bill form

- Employment application for the melampamp39s diner form

- Youth camp personnel chart ideha ideha dhmh maryland form

- Affidavit of residence the purpose of this form is to verify that the children listed below resides within the boundaries for

- Sf5 deped sample form

- Early termination of tenancy agreement template form

Find out other Colorado Earnings Form

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online