W 588aa 2020

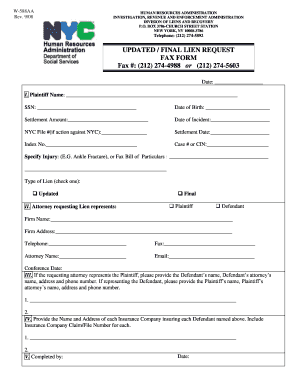

What is the W-588AA

The W-588AA form is used primarily for tax purposes in the United States. It serves as a request for specific tax-related information that may be necessary for various financial transactions or compliance with IRS regulations. This form is essential for individuals and businesses to ensure accurate reporting and adherence to tax obligations.

How to use the W-588AA

Using the W-588AA form involves several steps to ensure proper completion and submission. First, gather all necessary information, including personal identification details and tax-related data. Next, fill out the form accurately, ensuring that all sections are completed as required. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the IRS.

Steps to complete the W-588AA

Completing the W-588AA form involves a systematic approach:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documents, such as identification and financial records.

- Fill in the form carefully, ensuring all information is accurate and complete.

- Double-check for any errors or omissions before submission.

- Submit the form according to the guidelines provided, either electronically or by mail.

Legal use of the W-588AA

The legal use of the W-588AA form is governed by IRS regulations. It is crucial to ensure that the form is filled out correctly to avoid any potential legal issues. The information provided must be truthful and accurate, as discrepancies can lead to penalties or audits. Utilizing an electronic signature solution can help ensure that the form is legally binding and compliant with eSignature laws.

IRS Guidelines

The IRS provides specific guidelines for the W-588AA form, detailing how it should be filled out and submitted. These guidelines include information on eligibility, required documentation, and deadlines for submission. Staying informed about these regulations is essential for compliance and to avoid any potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the W-588AA form may vary depending on the specific circumstances of the filer. It is important to be aware of these dates to ensure timely submission. Missing a deadline can result in penalties or complications with tax filings. Regularly checking the IRS website for updates on important dates can help filers stay informed.

Quick guide on how to complete w 588aa

Accomplish W 588aa seamlessly on any gadget

Digital document administration has become increasingly favored by organizations and individuals alike. It serves as a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage W 588aa across any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to edit and electronically sign W 588aa effortlessly

- Locate W 588aa and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click the Done button to save your alterations.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within just a few clicks from any device of your choosing. Edit and electronically sign W 588aa to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 588aa

Create this form in 5 minutes!

How to create an eSignature for the w 588aa

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is w 588aa in relation to airSlate SignNow?

W 588aa refers to a specific business compliance feature within airSlate SignNow that streamlines the eSigning process for various document types. This feature helps ensure that your digital signatures meet industry standards and are legally binding.

-

How much does airSlate SignNow cost with w 588aa features?

The pricing for airSlate SignNow with w 588aa features is competitive and designed to cater to businesses of all sizes. You can choose from multiple subscription plans that fit different usage needs, making it a cost-effective solution for managing document workflows.

-

What are the key features of airSlate SignNow related to w 588aa?

Key features related to w 588aa include advanced security settings, customizable templates, and real-time tracking of document status. These features enhance usability and help businesses maintain compliance while simplifying the eSigning process.

-

How does w 588aa benefit my business?

Implementing w 588aa in airSlate SignNow provides your business with enhanced document security, quicker turnaround times on signed contracts, and improved overall productivity. It allows you to efficiently manage your documents while ensuring compliance and security.

-

Can airSlate SignNow with w 588aa integrate with other tools?

Yes, airSlate SignNow with w 588aa effectively integrates with a variety of software applications, including CRM systems, cloud storage, and project management tools. This integration enables seamless workflows and facilitates easy access to signed documents.

-

Is there a free trial for airSlate SignNow with w 588aa?

Yes, airSlate SignNow offers a free trial that allows you to explore the w 588aa features and understand how they can benefit your business. This trial period lets you test the platform's capabilities without any financial commitment.

-

What security measures does airSlate SignNow with w 588aa offer?

airSlate SignNow implements robust security measures for its w 588aa features, including end-to-end encryption and compliance with industry standards such as GDPR and HIPAA. These security features ensure that your sensitive documents are protected throughout the eSigning process.

Get more for W 588aa

- Cpat online form

- What you should know about eiv form

- Marion county animal shelter form

- Breakers bookman road elementary after school program richland2 form

- Contact member servicesaiken electric cooperative inc form

- Equestrian release and waiver of liability middleton hunt form

- St mary our lady of the annunciation parish home form

- Homeslam snow removal livonia mi snow removal service form

Find out other W 588aa

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast