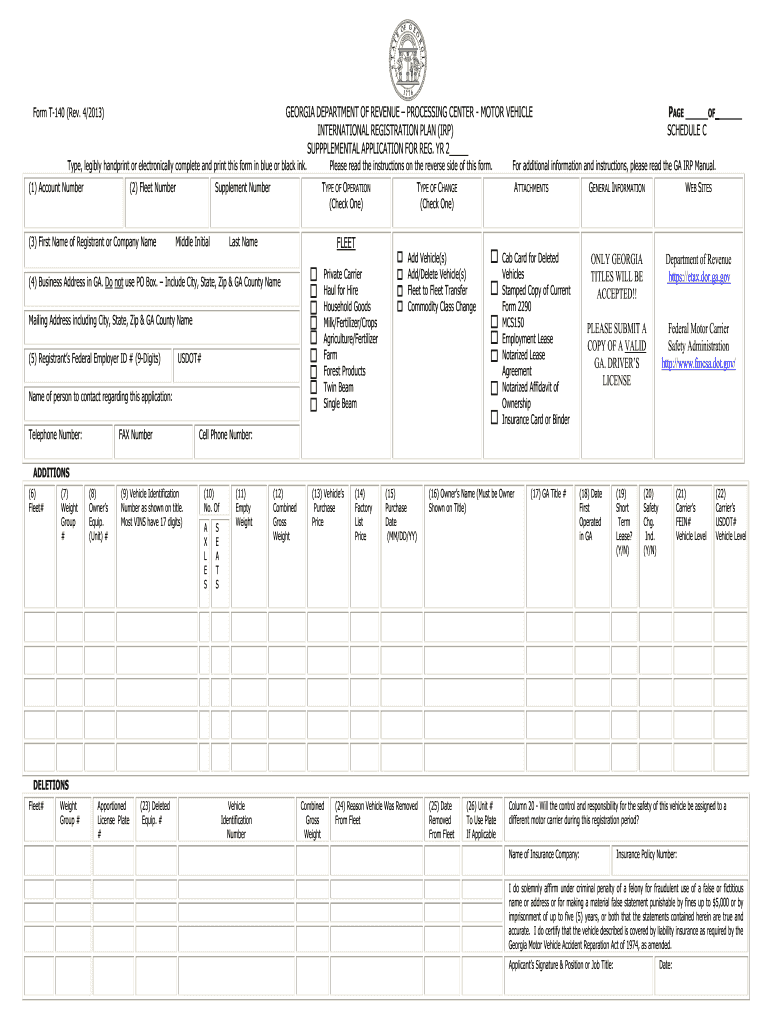

Form T 140 2013

What is the Form T-140

The Form T-140 is a specific tax form used in the United States, primarily for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to disclose particular income or deductions. Understanding the purpose and requirements of Form T-140 is crucial for accurate tax reporting and compliance with federal regulations.

How to use the Form T-140

Using Form T-140 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and receipts for deductions. Next, fill out the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy. Once completed, the form can be submitted either electronically or by mail, depending on the specific instructions provided by the IRS.

Steps to complete the Form T-140

Completing the Form T-140 requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including income and expense records.

- Download the Form T-140 from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any deductions accurately in the appropriate sections.

- Review the completed form for any errors or omissions.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Legal use of the Form T-140

The legal use of Form T-140 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the appropriate deadlines. Failure to comply with these requirements can result in penalties or delays in processing. It is essential to understand the legal implications of submitting this form, especially regarding any claims made within it.

Filing Deadlines / Important Dates

Filing deadlines for Form T-140 are crucial for compliance with tax regulations. Typically, the form must be submitted by April fifteenth of the tax year. However, specific circumstances, such as extensions or changes in tax law, may affect this date. It is advisable to check the IRS website for the most current deadlines to ensure timely submission and avoid penalties.

Required Documents

To complete Form T-140, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for any deductible expenses.

- Previous tax returns for reference.

- Any additional documentation that supports claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

Form T-140 can be submitted through various methods, including:

- Online submission via the IRS e-file system, which is often the fastest option.

- Mailing a physical copy of the form to the designated IRS address.

- In-person submission at local IRS offices, although this option may vary by location.

Quick guide on how to complete form t 140 2009

Complete Form T 140 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to access the necessary form and safely keep it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage Form T 140 on any device using airSlate SignNow applications for Android or iOS and improve any document-related process today.

The simplest way to edit and eSign Form T 140 with ease

- Obtain Form T 140 and click Get Form to begin.

- Use the tools available to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form T 140 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t 140 2009

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form T 140 and how can airSlate SignNow help with it?

Form T 140 is a tax form used in Canada for specific tax-related purposes. With airSlate SignNow, you can easily send, eSign, and manage Form T 140 electronically, streamlining your document workflows and ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for Form T 140?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs. You can start with a free trial to explore how our platform can efficiently handle Form T 140 and then choose a plan that suits your requirements.

-

What features does airSlate SignNow offer for handling Form T 140?

airSlate SignNow provides features such as customizable templates, automatic reminders, and secure storage, all designed to enhance the management of Form T 140. These tools help you maintain accuracy and efficiency when dealing with important tax documents.

-

Can airSlate SignNow integrate with other applications for Form T 140 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and more, to simplify the process of managing Form T 140. This means you can streamline your workflows and access your documents from multiple platforms.

-

How does airSlate SignNow ensure the security of Form T 140?

airSlate SignNow prioritizes security, employing encryption and compliance measures to protect your Form T 140 and other sensitive documents. Our platform ensures that all transmitted data is secure, giving you peace of mind while eSigning and sharing documents.

-

What are the benefits of using airSlate SignNow for Form T 140 over traditional methods?

Using airSlate SignNow for Form T 140 offers numerous benefits, including speed, convenience, and reduced paper waste. Unlike traditional methods, our digital solution allows for faster processing and easy access to forms from any device, enhancing productivity.

-

Is it easy to eSign Form T 140 with airSlate SignNow?

Yes, eSigning Form T 140 with airSlate SignNow is incredibly easy. You can simply upload your document, add the necessary signature fields, and send it to recipients for signing, making the entire process quick and user-friendly.

Get more for Form T 140

Find out other Form T 140

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF