Sr22 Insurance Waiver Illinois Form 2013

What is the Sr22 Insurance Waiver Illinois Form

The Sr22 Insurance Waiver Illinois Form is a legal document that demonstrates a driver’s financial responsibility in the state of Illinois. It is often required for individuals who have had their driving privileges suspended or revoked due to various reasons, such as driving under the influence or accumulating too many traffic violations. This form acts as proof that the driver has obtained the necessary liability insurance coverage as mandated by state law. The Sr22 is not an insurance policy itself, but rather a certificate that the insurance company files with the Illinois Secretary of State on behalf of the driver.

How to obtain the Sr22 Insurance Waiver Illinois Form

To obtain the Sr22 Insurance Waiver Illinois Form, individuals typically need to contact their auto insurance provider. Most insurance companies are familiar with the requirements for filing an Sr22 and can assist in the process. It is essential to ensure that the insurance policy meets the state’s minimum liability coverage requirements. Once the insurance company files the form with the state, the driver will receive a copy for their records. If a driver does not have insurance, they will need to purchase a policy that includes an Sr22 before the form can be issued.

Steps to complete the Sr22 Insurance Waiver Illinois Form

Completing the Sr22 Insurance Waiver Illinois Form involves several key steps:

- Contact your insurance provider to request the Sr22 filing.

- Provide any necessary personal information, including your driver's license number and details about your vehicle.

- Ensure your insurance policy meets Illinois state requirements for liability coverage.

- Review the form for accuracy once it is prepared by your insurance company.

- Submit the form to the Illinois Secretary of State, if required, or keep it for your records.

Legal use of the Sr22 Insurance Waiver Illinois Form

The legal use of the Sr22 Insurance Waiver Illinois Form is crucial for individuals who have faced driving infractions that led to license suspension. This form must be maintained for a specific period, usually three years, during which the driver must keep their insurance coverage active. Failure to maintain the required insurance can result in further penalties, including additional fines or an extension of the suspension period. It is important to understand that the Sr22 must be filed correctly and kept up to date to comply with Illinois state laws.

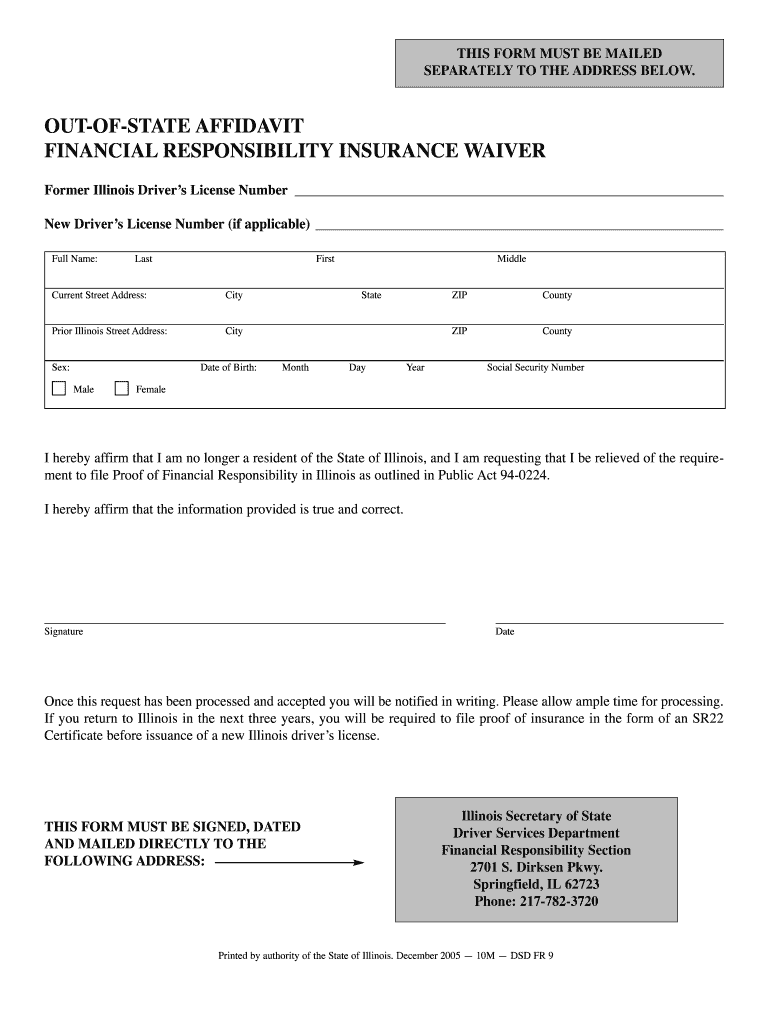

Key elements of the Sr22 Insurance Waiver Illinois Form

Key elements of the Sr22 Insurance Waiver Illinois Form include:

- The driver's full name and address.

- The driver's license number.

- The insurance policy number.

- The effective date of the insurance coverage.

- The insurance company's name and contact information.

- A statement confirming that the driver meets the state's financial responsibility requirements.

State-specific rules for the Sr22 Insurance Waiver Illinois Form

In Illinois, specific rules govern the use of the Sr22 Insurance Waiver. Drivers required to file an Sr22 must do so for a minimum of three years. During this time, they must maintain continuous insurance coverage without any lapses. If the insurance policy is canceled or lapses, the insurance company is obligated to notify the Secretary of State, which can lead to further penalties for the driver. Additionally, the form must be filed by a licensed insurance company in Illinois, ensuring that all state regulations are met.

Quick guide on how to complete sr22 insurance waiver illinois 2005 form

Easy Completion of Sr22 Insurance Waiver Illinois Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environment-friendly substitute to conventional printed and signed paperwork, as you can obtain the accurate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Sr22 Insurance Waiver Illinois Form on any platform using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

The Easiest Method to Edit and eSign Sr22 Insurance Waiver Illinois Form Effortlessly

- Locate Sr22 Insurance Waiver Illinois Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Sr22 Insurance Waiver Illinois Form and maintain outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sr22 insurance waiver illinois 2005 form

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the Sr22 Insurance Waiver Illinois Form?

The Sr22 Insurance Waiver Illinois Form is a document that demonstrates an individual's financial responsibility to the Illinois Secretary of State. This form is typically required for drivers who have had their license suspended or revoked. By filing this form, you can reinstate your driving privileges and ensure you meet state insurance requirements.

-

How do I obtain the Sr22 Insurance Waiver Illinois Form?

You can obtain the Sr22 Insurance Waiver Illinois Form through your insurance provider. Most insurance companies can prepare and file the form on your behalf, making the process more convenient. It's essential to ensure that your insurance meets the state's minimum liability requirements before submission.

-

What are the costs associated with the Sr22 Insurance Waiver Illinois Form?

The costs associated with the Sr22 Insurance Waiver Illinois Form may vary depending on your insurance provider and the coverage you choose. Generally, the form itself may incur a one-time filing fee, and your overall insurance premiums may increase due to the added risk factor. It's best to shop around and compare quotes from different providers.

-

How long is the Sr22 Insurance Waiver Illinois Form valid?

The Sr22 Insurance Waiver Illinois Form remains valid for a period of three years in Illinois, provided you maintain continuous insurance coverage. If you drop your insurance during this time, your insurance company is required to notify the state, which could result in the suspension of your driving privileges. Always ensure that your insurance remains active to avoid complications.

-

Can I file the Sr22 Insurance Waiver Illinois Form online?

Yes, many insurance companies allow you to file the Sr22 Insurance Waiver Illinois Form online for added convenience. By using an online platform, you can quickly complete and submit the form from the comfort of your home. Just make sure to follow up with your provider to confirm that the filing was completed successfully.

-

What happens if I don't file the Sr22 Insurance Waiver Illinois Form?

Failure to file the Sr22 Insurance Waiver Illinois Form when required can lead to the suspension of your driving privileges in Illinois. Additionally, not having this form can result in fines and penalties, which can impact your ability to legally drive. It's crucial to comply with the requirements to avoid further complications.

-

Is the Sr22 Insurance Waiver Illinois Form the same as regular insurance?

No, the Sr22 Insurance Waiver Illinois Form is not a type of insurance but rather a certification of insurance coverage. It indicates that you have the necessary liability coverage required by the state after a license suspension. While it is linked to your insurance policy, it does not replace standard auto insurance.

Get more for Sr22 Insurance Waiver Illinois Form

- Mcdonalds car wash form

- Subtractive colors gizmo answer key form

- Aircraft appraisal form

- Vehicle rendition confidential 56971941 form

- Beeghfs form

- Short loan application form

- Registro obligatorio de comerciantes y negocios censo econmico economic census pr 5251006 servicios services 1 form

- Shared property agreement template form

Find out other Sr22 Insurance Waiver Illinois Form

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement