Form 5805 Underpayment of Estimated Tax by Individuals and Fiduciaries Form 5805 Underpayment of Estimated Tax by Individuals an 2024-2026

Understanding Form 5805: Underpayment of Estimated Tax

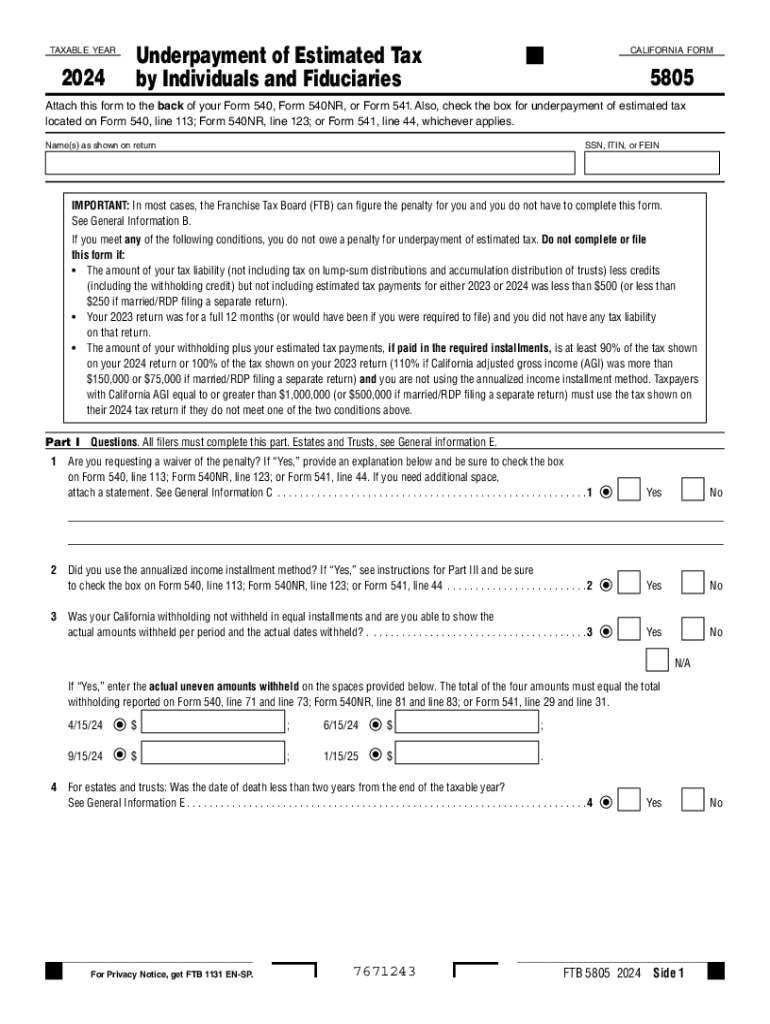

The Form 5805 is a crucial document for individuals and fiduciaries in California who need to report underpayment of estimated tax. This form is specifically designed to help taxpayers calculate any penalties incurred due to insufficient estimated tax payments throughout the year. Understanding this form is essential for compliance with California tax regulations and avoiding unnecessary penalties.

How to Use Form 5805

To effectively use Form 5805, taxpayers must first gather their income information and previous tax payments. The form guides users through the calculation of any potential penalties for underpayment. It is important to follow the instructions carefully to ensure accurate reporting. The form can be filled out manually or through digital means, depending on the taxpayer's preference.

Steps to Complete Form 5805

Completing Form 5805 involves several key steps:

- Gather necessary financial documents, including income statements and prior tax returns.

- Calculate the total estimated tax owed for the year.

- Determine the amount of estimated tax paid during the year.

- Use the form's calculations to assess any penalties for underpayment.

- Review the completed form for accuracy before submission.

Legal Use of Form 5805

Form 5805 is legally required for taxpayers who have underpaid their estimated taxes. It serves as a formal declaration to the California Franchise Tax Board, detailing the taxpayer's situation and any penalties owed. Failure to file this form when necessary may result in additional penalties and interest charges, making it vital for compliance.

Filing Deadlines for Form 5805

Taxpayers must be aware of important deadlines associated with Form 5805. Typically, the form is due when filing the annual tax return. However, if a taxpayer realizes they have underpaid estimated taxes during the year, they should file Form 5805 as soon as possible to mitigate penalties. Keeping track of these deadlines helps ensure compliance and avoid last-minute complications.

Penalties for Non-Compliance

Failing to file Form 5805 or underreporting estimated tax payments can lead to significant penalties. The California Franchise Tax Board imposes penalties based on the amount of underpayment and the duration of the underpayment period. Understanding these penalties can motivate taxpayers to accurately complete and file the form in a timely manner.

Create this form in 5 minutes or less

Find and fill out the correct form 5805 underpayment of estimated tax by individuals and fiduciaries form 5805 underpayment of estimated tax by individuals 772090728

Create this form in 5 minutes!

How to create an eSignature for the form 5805 underpayment of estimated tax by individuals and fiduciaries form 5805 underpayment of estimated tax by individuals 772090728

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow 5805 and how does it work?

airSlate SignNow 5805 is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it easy for users to manage documents from anywhere. With its user-friendly interface, airSlate SignNow 5805 ensures that you can quickly get documents signed without any hassle.

-

What are the pricing options for airSlate SignNow 5805?

airSlate SignNow 5805 offers flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, with options that scale based on your needs. This cost-effective solution ensures that you only pay for what you use, making it an ideal choice for budget-conscious organizations.

-

What features does airSlate SignNow 5805 provide?

airSlate SignNow 5805 includes a variety of features designed to enhance your document management process. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities help businesses streamline their workflows and improve efficiency.

-

How can airSlate SignNow 5805 benefit my business?

By using airSlate SignNow 5805, your business can signNowly reduce the time spent on document signing and management. This solution enhances productivity by allowing team members to focus on core tasks rather than administrative duties. Additionally, it improves customer satisfaction by providing a quick and easy signing experience.

-

Does airSlate SignNow 5805 integrate with other software?

Yes, airSlate SignNow 5805 offers seamless integrations with various software applications, including CRM and project management tools. This capability allows you to connect your existing workflows and enhance your overall productivity. Integrating airSlate SignNow 5805 with your favorite tools ensures a smooth transition and better collaboration.

-

Is airSlate SignNow 5805 secure for sensitive documents?

Absolutely, airSlate SignNow 5805 prioritizes the security of your documents. It employs advanced encryption methods and complies with industry standards to protect sensitive information. You can trust that your documents are safe and secure while using airSlate SignNow 5805.

-

Can I use airSlate SignNow 5805 on mobile devices?

Yes, airSlate SignNow 5805 is fully optimized for mobile devices, allowing you to send and sign documents on the go. The mobile app provides the same features as the desktop version, ensuring that you can manage your documents anytime, anywhere. This flexibility is perfect for busy professionals who need to stay productive.

Get more for Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

- Californm sta tement of phlebo tomy practical form

- Common marriage affidavit form

- Legal relationship marriage affidavit form

- Apd 19 form

- Alberta small business deduction at1 schedule 1 alberta finance finance alberta form

- Show affidavit form

- 2012 tax federal tuition and fees deduction freetaxusa form

- Teen resume form

Find out other Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT