Fl475 Form

What is the FL-475?

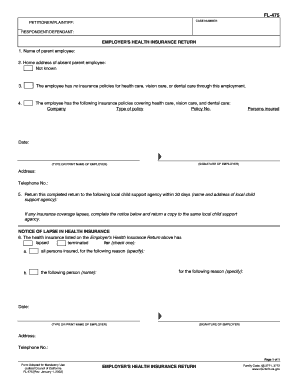

The FL-475, also known as the California Health Insurance Return, is a form used primarily for reporting health insurance coverage in the state of California. This form is essential for individuals and businesses to demonstrate compliance with health insurance mandates. It collects information regarding the type of health coverage held during the tax year, ensuring that taxpayers meet the requirements set forth by the Affordable Care Act (ACA) and state regulations.

How to Use the FL-475

Using the FL-475 involves filling out the necessary information regarding your health insurance coverage. This includes details such as the coverage provider, policy number, and the duration of coverage. The form can be completed electronically or printed for manual submission. It is crucial to ensure accuracy when providing information, as errors can lead to complications during tax filing or potential penalties.

Steps to Complete the FL-475

Completing the FL-475 requires several key steps:

- Gather all necessary documents related to your health insurance coverage.

- Fill out the form with accurate details, including personal information and insurance specifics.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, ensuring it is sent to the correct address.

Legal Use of the FL-475

The FL-475 serves as a legally binding document that verifies health insurance coverage. To ensure its legal standing, it must be completed accurately and submitted in accordance with state regulations. Compliance with the California health insurance laws is essential, as failure to provide this information can result in penalties or fines.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the FL-475. Typically, the form must be submitted by the tax filing deadline, which is usually April 15. However, if additional time is needed, taxpayers may file for an extension, but they must still ensure that the FL-475 is submitted within the extended timeframe to avoid penalties.

Required Documents

To complete the FL-475, you will need several supporting documents, including:

- Health insurance policy details, including provider information.

- Proof of coverage for each month of the tax year.

- Any previous tax returns that may be relevant for reference.

Form Submission Methods

The FL-475 can be submitted through various methods, including:

- Online submission through the California tax website.

- Mailing a printed copy to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete fl475

Effortlessly Create Fl475 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the necessary template and securely save it online. airSlate SignNow equips you with all the tools required to produce, amend, and eSign your documents swiftly without any delays. Manage Fl475 on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented task today.

How to Edit and eSign Fl475 with Ease

- Obtain Fl475 and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers for those purposes.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Fl475 to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fl475

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is FL 475 and how does it relate to airSlate SignNow?

FL 475 refers to a form used in various legal and business processes. With airSlate SignNow, you can easily fill out, sign, and share FL 475 documents electronically, ensuring compliance and efficiency in your workflow.

-

Is airSlate SignNow compliant with FL 475 requirements?

Yes, airSlate SignNow is designed to meet the legal standards required for electronic signatures, including compliance with FL 475. Our platform ensures that all signatures and documents are securely processed, maintaining the integrity of your forms.

-

What features does airSlate SignNow offer for managing FL 475 forms?

airSlate SignNow offers a variety of features for managing FL 475 forms, including customizable templates, automatic reminders, and audit trails. This helps streamline the process of filling out and tracking your FL 475 documents for efficient management.

-

How much does airSlate SignNow cost for handling FL 475 forms?

The pricing for airSlate SignNow varies based on your specific needs and usage. Our plans are designed to be cost-effective, and you can efficiently manage FL 475 forms without breaking the bank, with options that fit different budgets.

-

Can I integrate airSlate SignNow with other tools for FL 475 processing?

Absolutely! airSlate SignNow seamlessly integrates with numerous business applications, making it easy to manage your FL 475 forms in conjunction with other tools. This integration ensures a smoother workflow, allowing you to enhance your overall document management experience.

-

What benefits does airSlate SignNow provide for FL 475 users?

Using airSlate SignNow for FL 475 forms brings numerous benefits, such as improved efficiency, reduced turnaround time, and secure document handling. You can quickly gather signatures and manage documents from anywhere, making it ideal for busy professionals.

-

Is it easy to get started with airSlate SignNow for FL 475 forms?

Yes, getting started with airSlate SignNow to handle FL 475 forms is straightforward. Our user-friendly interface allows you to create, send, and sign documents with ease, requiring minimal setup for new users.

Get more for Fl475

- Mlc potential beneficiary statutory declaration form

- 18779029726 form

- Meat order form template 278211273

- Vicious cogs form

- Sandusky county prevention retention and form

- Ba17 certificate of construction compliance word dealer vehicle registration scheme audit certificate catalogue no 45071415 rta form

- Staffing agreement template form

- Stakeholder agreement template 787747811 form

Find out other Fl475

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast