Wh38 Form

What is the WH-38?

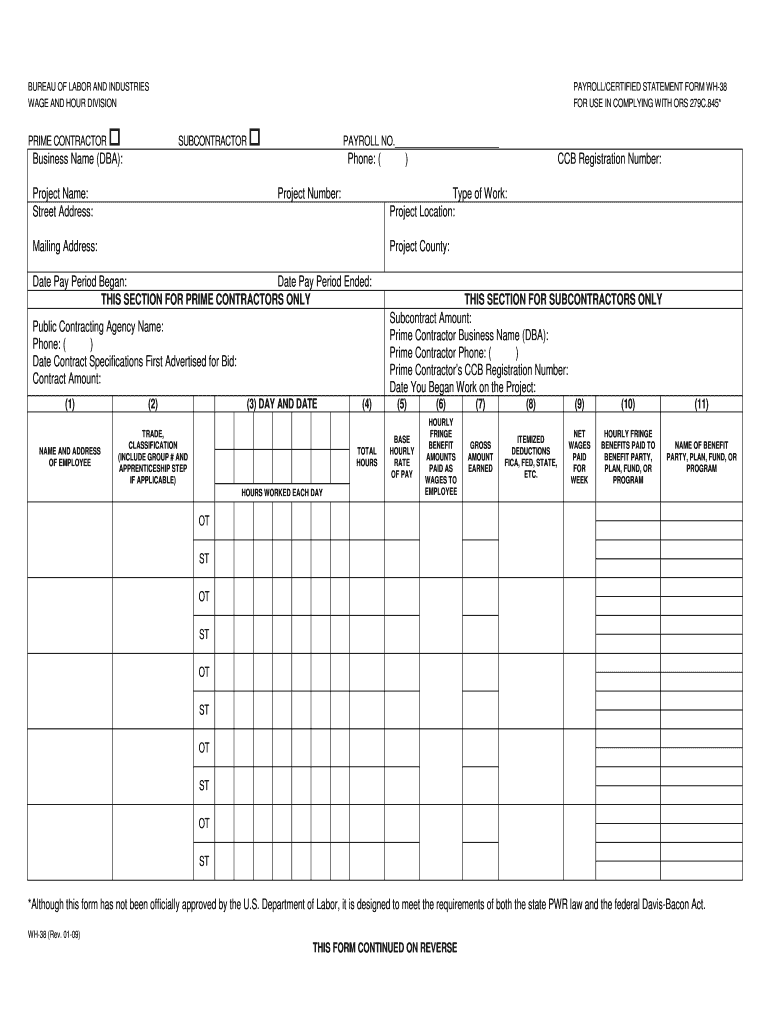

The WH-38, also known as the 38 payroll certified form, is a document used primarily for reporting wages and tax information by employers in the United States. This form is essential for ensuring compliance with federal and state tax regulations. It captures critical data regarding employee earnings, tax withholdings, and other payroll-related information. Understanding the WH-38 is vital for both employers and employees to maintain accurate records and fulfill tax obligations.

How to Use the WH-38

Using the WH-38 involves several straightforward steps. First, employers must gather all necessary payroll data for their employees, including wages, hours worked, and any deductions. Once the information is compiled, it should be accurately entered into the WH-38 form. It is crucial to double-check all entries for accuracy to avoid potential issues with tax authorities. After completing the form, employers can submit it electronically or via mail, depending on their preference and compliance requirements.

Steps to Complete the WH-38

Completing the WH-38 requires careful attention to detail. Here are the key steps:

- Gather employee payroll information, including total earnings and tax withholdings.

- Access the WH-38 form through the appropriate channels, ensuring you have the latest version.

- Fill out the form, making sure to include all required information accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail as per your compliance guidelines.

Legal Use of the WH-38

The WH-38 must be used in accordance with federal and state laws governing payroll reporting. This includes adhering to guidelines set forth by the Internal Revenue Service (IRS) and local tax authorities. Proper use of the WH-38 ensures that employers meet their legal obligations, avoiding penalties and ensuring that employees' tax information is reported accurately. It is important to stay updated on any changes in legislation that may affect the use of this form.

Key Elements of the WH-38

Several key elements must be included in the WH-38 to ensure its validity:

- Employer identification information, including name and tax identification number.

- Employee details, such as name, Social Security number, and total wages.

- Tax withholding information, including federal and state taxes deducted.

- Signature of the employer or authorized representative, certifying the accuracy of the information provided.

Examples of Using the WH-38

Employers in various industries utilize the WH-38 to report payroll information. For instance, a small business owner may use the form to report wages for their employees at the end of the tax year. Similarly, larger corporations may use the WH-38 to ensure compliance across multiple states, accounting for varying tax regulations. Each example highlights the importance of accurate payroll reporting for maintaining legal compliance and supporting employee tax filings.

Quick guide on how to complete wh38

Complete Wh38 effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage Wh38 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric activity today.

How to modify and eSign Wh38 with ease

- Locate Wh38 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to deliver your form: via email, text message (SMS), invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Wh38 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh38

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to wh38?

airSlate SignNow is a powerful electronic signature platform designed to help businesses send and sign documents instantly. The term wh38 relates to the efficiency and effectiveness of the SignNow platform, particularly in streamlining workflows and enhancing document management capabilities.

-

How much does airSlate SignNow cost compared to other solutions like wh38?

airSlate SignNow offers competitive pricing plans that cater to various business needs, making it a cost-effective solution compared to options like wh38. The pricing structure includes monthly and annual subscriptions that provide flexibility and scalability depending on your organization’s requirements.

-

What features does airSlate SignNow offer that are related to wh38?

airSlate SignNow includes essential features such as customizable templates, document tracking, and secure electronic signatures that enhance user experience. Its focus on user-friendly interface and robust functionality makes it a standout choice when considering solutions like wh38.

-

How can airSlate SignNow benefit my business's workflow similar to wh38?

By using airSlate SignNow, businesses can signNowly accelerate their document workflows and reduce turnaround times. This effectiveness in handling eSignatures is comparable to what wh38 offers, facilitating a more streamlined process that can boost productivity and efficiency.

-

What integrations does airSlate SignNow support that may compare to wh38?

airSlate SignNow integrates seamlessly with various software applications, including CRM and project management tools. These integrations provide a level of compatibility and efficiency similar to what wh38 may offer, ensuring that your document workflows coexist harmoniously with your other business tools.

-

Is airSlate SignNow secure for signing sensitive documents like wh38?

Yes, airSlate SignNow employs advanced security protocols to ensure that all documents are signed securely. This level of security is essential when dealing with sensitive information and is comparable to the safety measures provided by solutions like wh38.

-

Does airSlate SignNow offer customer support, comparable to wh38?

Absolutely! airSlate SignNow provides robust customer support options, including live chat, email, and extensive online resources. This commitment to customer service is on par with the support levels you might find with solutions like wh38.

Get more for Wh38

Find out other Wh38

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online