Wi Uct 7842 E 2015-2026

What is the Wi Uct 7842 E

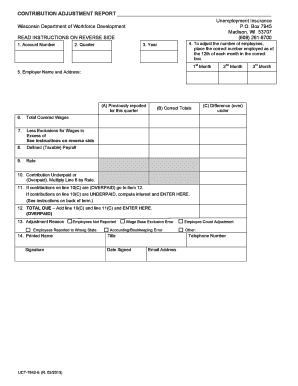

The Wi Uct 7842 E is a specific form used in Wisconsin for reporting adjustments related to contributions. This form is essential for individuals and businesses who need to correct or update their contribution records with the state. It is particularly relevant for those who have made errors in previous filings or need to report changes in their contribution amounts. Understanding the purpose and requirements of the Wi Uct 7842 E is crucial for ensuring compliance with state regulations.

How to use the Wi Uct 7842 E

Using the Wi Uct 7842 E involves several steps to ensure accurate reporting. First, gather all necessary documentation related to your contributions. This includes previous forms filed and any supporting documents that justify the adjustments. Next, carefully complete the form, ensuring that all sections are filled out accurately. Once completed, you can submit the form electronically or via mail, depending on your preference and the specific requirements outlined by the Wisconsin Department of Workforce Development.

Steps to complete the Wi Uct 7842 E

Completing the Wi Uct 7842 E requires attention to detail. Follow these steps:

- Review the instructions provided with the form to understand the specific requirements.

- Fill in your personal information, including your name, address, and identification number.

- Clearly indicate the adjustments you are reporting, specifying the previous and new contribution amounts.

- Attach any relevant documentation that supports your adjustments.

- Double-check all entries for accuracy before submission.

Legal use of the Wi Uct 7842 E

The legal use of the Wi Uct 7842 E is governed by Wisconsin state laws regarding tax and contribution reporting. It is essential to ensure that the form is completed accurately and submitted within the required timeframes to avoid penalties. The form serves as a formal declaration of any adjustments, and failure to comply with the legal requirements can result in legal repercussions or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Wi Uct 7842 E vary depending on the nature of the adjustments being reported. Typically, it is advisable to file the form as soon as discrepancies are identified. Keeping track of important dates, such as the end of the tax year and any specific deadlines set by the Wisconsin Department of Workforce Development, is crucial to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Wi Uct 7842 E can be submitted through various methods to accommodate different preferences. Users can file the form electronically through the Wisconsin Department of Workforce Development's online portal, which is often the fastest method. Alternatively, the form can be mailed to the appropriate state office, or in some cases, submitted in person. Each method has its own processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete wi uct 7842 e

Effortlessly prepare Wi Uct 7842 E on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly, without delays. Handle Wi Uct 7842 E on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and electronically sign Wi Uct 7842 E with ease

- Find Wi Uct 7842 E and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your amendments.

- Choose how you would like to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Wi Uct 7842 E and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wi uct 7842 e

Create this form in 5 minutes!

How to create an eSignature for the wi uct 7842 e

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What are uct forms and how can they benefit my business?

UCT forms are customizable digital documents designed to streamline your business processes. By utilizing uct forms, you can easily capture information, manage approvals, and enhance collaboration within your team. This leads to improved efficiency and reduced turnaround times for document processing.

-

How does airSlate SignNow integrate with uct forms?

AirSlate SignNow provides seamless integration with uct forms, allowing users to eSign and send documents directly through the platform. This integration reduces the hassle of managing multiple applications, enabling you to maintain a cohesive workflow. By using airSlate SignNow, you can enhance the functionality of your uct forms.

-

What features are included with uct forms in airSlate SignNow?

AirSlate SignNow offers a variety of features for uct forms, including customizable templates, real-time tracking, and automated workflows. You can also benefit from features like secure eSignature and document storage, ensuring that your transactions are both efficient and safe. These features help businesses optimize their document management processes.

-

Is there a free trial available for airSlate SignNow with uct forms?

Yes, airSlate SignNow provides a free trial for users to explore the capabilities of uct forms and other features. This trial allows you to understand how uct forms can fit your business needs without any financial commitment. It's a great opportunity to test the platform and see how it can benefit your operations.

-

How does pricing work for uct forms on airSlate SignNow?

The pricing for uct forms on airSlate SignNow is based on a subscription model, which includes various tiers to cater to different business needs. Each plan offers unique features and levels of access to uct forms and eSignature capabilities. You can choose a plan that best fits your budget and business requirements.

-

Can uct forms be used on mobile devices?

Absolutely! Uct forms in airSlate SignNow are fully optimized for mobile use, allowing you to send and eSign documents from any device. This mobile compatibility ensures that you can manage your documents on-the-go, enhancing your productivity and responsiveness. It's perfect for businesses with a mobile workforce.

-

What security features are in place for uct forms?

AirSlate SignNow prioritizes security for all uct forms, employing advanced encryption to protect your data. The platform adheres to compliance standards to ensure that your documents are safely stored and transmitted. With these robust security measures, you can trust that your sensitive information remains confidential.

Get more for Wi Uct 7842 E

- Appeal form for eocco

- Can fin ecs form

- Ypaq form

- Council tax discount for someone with severe mental impairment application for council tax discount for someone with severe form

- Drivers receipt form

- Illinois social worker continuing education courses form

- Warehouse service level agreement template form

- Commercial construction contract template form

Find out other Wi Uct 7842 E

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT