Tax Credit Tenant Information Form 2018-2026

What is the Tax Credit Tenant Information Form

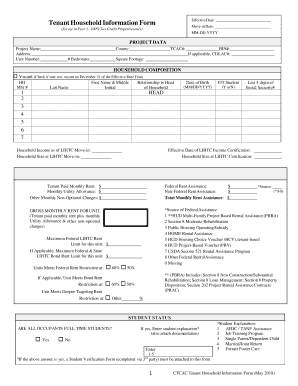

The Tax Credit Tenant Information Form is a crucial document used by property owners and managers to gather essential data from tenants applying for housing tax credits. This form helps determine eligibility for various federal and state tax credit programs designed to assist low-income families. By collecting information on household income, composition, and other relevant factors, the form ensures compliance with tax credit regulations and facilitates the allocation of resources to those in need.

How to use the Tax Credit Tenant Information Form

Using the Tax Credit Tenant Information Form involves several steps that ensure accurate data collection and compliance with legal requirements. First, tenants need to obtain the form from their property manager or housing authority. Once in possession of the form, tenants should carefully fill out all required fields, providing truthful and complete information regarding their household income and members. After completing the form, tenants must submit it to the appropriate authority for review, ensuring that all documentation is included to support their application.

Steps to complete the Tax Credit Tenant Information Form

Completing the Tax Credit Tenant Information Form involves a systematic approach to ensure all necessary information is provided. Here are the key steps:

- Gather required documentation, including proof of income, identification, and any other relevant financial records.

- Fill out personal information, including names, addresses, and contact details of all household members.

- Detail the income sources for each household member, ensuring accuracy in reporting amounts.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the designated authority, either online or in person, as instructed.

Key elements of the Tax Credit Tenant Information Form

Understanding the key elements of the Tax Credit Tenant Information Form is essential for accurate completion. The primary components include:

- Household Information: Names and details of all individuals residing in the unit.

- Income Details: Comprehensive listing of all income sources, including wages, benefits, and any additional earnings.

- Eligibility Questions: Specific inquiries to determine if the household meets the criteria for tax credit assistance.

- Signature Section: A space for tenants to sign and date the form, affirming the accuracy of the information provided.

Legal use of the Tax Credit Tenant Information Form

The legal use of the Tax Credit Tenant Information Form is governed by various federal and state regulations. It is essential that the form is filled out accurately and submitted in accordance with the guidelines provided by housing authorities. The information collected is used to verify eligibility for tax credits, and any discrepancies or false information can lead to penalties or disqualification from the program. Therefore, it is crucial to ensure that all data is truthful and well-documented.

Eligibility Criteria

Eligibility for the Tax Credit Tenant Information Form typically hinges on several factors, including household income, family size, and specific state or federal guidelines. Generally, applicants must demonstrate that their income falls below a certain threshold relative to the area median income. Additionally, households may need to meet specific criteria related to citizenship or residency status. Understanding these criteria is vital for tenants seeking assistance through tax credit programs.

Quick guide on how to complete tax credit tenant information form

Complete Tax Credit Tenant Information Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without any delays. Handle Tax Credit Tenant Information Form on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

How to edit and electronically sign Tax Credit Tenant Information Form effortlessly

- Obtain Tax Credit Tenant Information Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal significance as a conventional ink signature.

- Review all the information and then click the Done button to save your modifications.

- Decide how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tax Credit Tenant Information Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax credit tenant information form

Create this form in 5 minutes!

How to create an eSignature for the tax credit tenant information form

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a tenant information form and why is it important?

A tenant information form is a document used by landlords and property managers to gather essential details about potential tenants. It helps streamline the rental process by ensuring all necessary information is collected upfront, such as employment history and rental references, thereby minimizing disputes in the future.

-

How can airSlate SignNow help manage tenant information forms?

With airSlate SignNow, you can easily create, send, and eSign tenant information forms. Our platform provides a user-friendly interface that allows for the quick collection of tenant data while ensuring compliance with legal standards, making your property management workflows more efficient.

-

Is airSlate SignNow cost-effective for managing tenant information forms?

Yes, airSlate SignNow offers a cost-effective solution for managing tenant information forms. Our pricing plans are designed to suit different businesses, helping you save money while enjoying extensive features for document signing and management.

-

What features does airSlate SignNow offer for tenant information forms?

AirSlate SignNow provides features such as customizable templates for tenant information forms, seamless eSignature capabilities, and the ability to track form completion status. These functionalities help ensure that you can efficiently manage your rental applications and related documents.

-

Are there any integrations available for tenant information forms with airSlate SignNow?

Absolutely! airSlate SignNow integrates with numerous applications such as Google Workspace, Salesforce, and various CRM systems. This allows you to share and manage your tenant information forms smoothly within your existing tools, enhancing overall productivity.

-

Can I customize my tenant information form using airSlate SignNow?

Yes, you can fully customize your tenant information form with airSlate SignNow. Our platform allows you to add fields, questions, and branding to ensure that the form meets your specific requirements and reflects your business's identity.

-

How can I ensure the security of tenant information forms sent via airSlate SignNow?

AirSlate SignNow emphasizes the security of your tenant information forms with features like SSL encryption, secure storage, and controlled access. These measures help protect sensitive tenant data throughout the document signing process.

Get more for Tax Credit Tenant Information Form

Find out other Tax Credit Tenant Information Form

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document