Publication 910 2018

What is the Publication 910

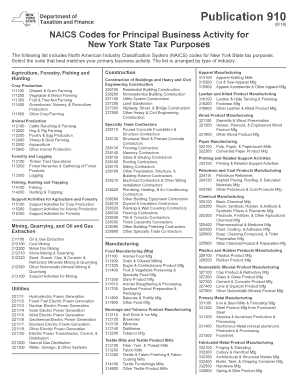

The Publication 910 is a document issued by the New York State Department of Taxation and Finance that provides a comprehensive list of NAICS codes for principal business activities. These codes are essential for businesses operating in New York State, as they help determine tax obligations and compliance requirements. The publication outlines how businesses should classify their activities for tax purposes, ensuring that they align with state regulations.

How to use the Publication 910

To effectively use the Publication 910, businesses should first identify their principal business activity. This involves reviewing the list of NAICS codes provided in the publication and selecting the code that best describes their primary operations. Once the appropriate code is identified, it should be included in tax filings and any relevant documentation submitted to the New York State tax authorities.

Steps to complete the Publication 910

Completing the Publication 910 involves several key steps:

- Obtain a copy of the Publication 910 from the New York State Department of Taxation and Finance.

- Review the list of NAICS codes and identify the code that corresponds to your principal business activity.

- Document the selected NAICS code on your tax forms and any other required filings.

- Ensure that all information is accurate and up to date to avoid compliance issues.

Legal use of the Publication 910

The legal use of the Publication 910 is crucial for businesses to ensure compliance with New York State tax laws. By accurately reporting the NAICS code that corresponds to their principal business activity, businesses can avoid penalties and ensure that they are taxed appropriately. It is important to keep records of the selected code and any related documentation to support compliance during audits or reviews.

State-specific rules for the Publication 910

New York State has specific rules regarding the use of the Publication 910. Businesses must adhere to the guidelines set forth in the publication to ensure that they are using the correct NAICS codes. This includes understanding how the codes relate to different business activities and ensuring that they are reporting accurately to the state tax authorities. Failure to comply with these rules can result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for tax documents that require the NAICS code from the Publication 910 vary depending on the type of business entity and the specific tax forms being submitted. It is essential for businesses to be aware of these deadlines to ensure timely compliance. Generally, businesses should check the New York State Department of Taxation and Finance website for the most current filing dates and requirements.

Quick guide on how to complete publication 910

Complete Publication 910 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Publication 910 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Publication 910 with ease

- Obtain Publication 910 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with the tools that airSlate SignNow makes available specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that necessitate printing out new document copies. airSlate SignNow accommodates your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Publication 910 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 910

Create this form in 5 minutes!

How to create an eSignature for the publication 910

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What are NAICS codes for principal business activity?

NAICS codes for principal business activity are numerical codes used to classify businesses based on their primary activities. These codes are essential for various tax purposes, including those specific to New York State. Understanding your NAICS code is crucial for accurate tax reporting and compliance.

-

How do I find my NAICS code for New York State tax purposes?

To find your NAICS code for principal business activity for New York State tax purposes, you can visit the official NAICS website or refer to the New York State Department of Taxation and Finance. These resources provide searchable databases that help you identify the correct code based on your business's main activities.

-

Why do I need a NAICS code for my business?

Having a NAICS code for principal business activity for New York State tax purposes is essential for tax compliance, obtaining business permits, and applying for loans. It streamlines the reporting process and ensures you are grouped correctly with similar businesses for statistical purposes. Accurate classification can also influence tax incentives and eligibility for grants.

-

What features does airSlate SignNow offer for document signing?

AirSlate SignNow provides a robust platform for eSigning documents, allowing users to send, sign, and manage documents easily. Its user-friendly interface and advanced features like templates and team collaboration boost productivity. This solution can seamlessly integrate with other applications, enhancing your overall workflow efficiency.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Its flexible pricing plans allow users to choose the option that best fits their needs and budgets. Using airSlate SignNow can save you money on paper and postage while ensuring compliance with eSignature laws.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! AirSlate SignNow allows integration with various applications, enhancing your business's functionality. Whether you need connections with CRM systems, project management tools, or document storage solutions, SignNow’s integrations streamline your processes and keep everything in sync.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow offers numerous benefits, including faster document turnaround times, improved efficiency, and enhanced security. The platform helps businesses save time and resources by minimizing the hassle of traditional paper-based signatures. Additionally, it ensures compliance with legal standards for electronic signatures.

Get more for Publication 910

Find out other Publication 910

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure