Cp565 Form

What is the Cp565

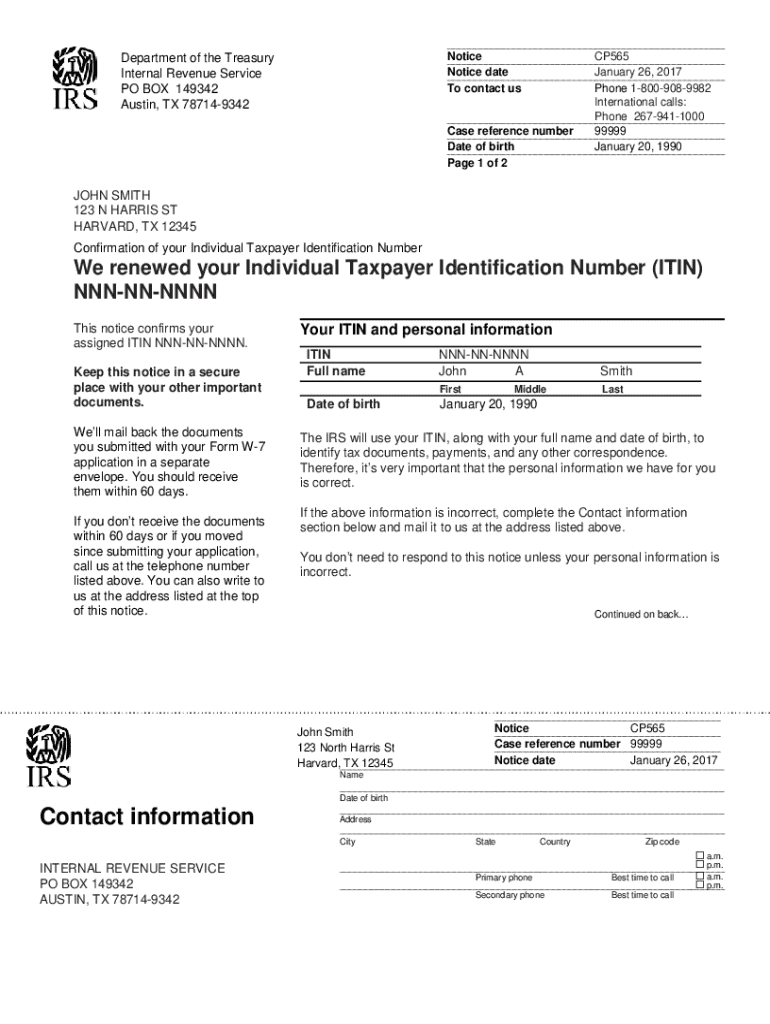

The Cp565 is an IRS notice that serves as a taxpayer identification number assignment for individuals who have applied for an Individual Taxpayer Identification Number (ITIN). This form is crucial for non-resident aliens and others who are not eligible for a Social Security Number but need to comply with U.S. tax laws. The Cp565 provides the taxpayer with a unique identification number that enables them to file taxes and fulfill their tax obligations in the United States.

How to use the Cp565

Using the Cp565 involves referencing the assigned ITIN for various tax-related activities. Taxpayers should include their ITIN on all tax returns, forms, and documents submitted to the IRS. It is essential to keep the Cp565 notice in a safe place, as it contains the ITIN and other important information. Taxpayers may also need to provide a copy of the Cp565 when applying for certain financial services or benefits that require tax identification.

Steps to complete the Cp565

Completing the Cp565 itself is not necessary, as it is an informational notice issued by the IRS. However, when applying for an ITIN, taxpayers must fill out Form W-7, which is the application for an ITIN. Once the IRS processes the W-7 application, they will issue the Cp565 notice. It is important to ensure that all information on the W-7 is accurate to avoid delays in receiving the Cp565 notice.

Legal use of the Cp565

The Cp565 is legally binding as it is an official document from the IRS. Taxpayers must use the ITIN assigned on the Cp565 for all tax filings and reporting. It is essential to understand that the ITIN is used for tax purposes only and does not grant the taxpayer any immigration status or work authorization in the United States. Compliance with IRS regulations regarding the use of the Cp565 is crucial to avoid penalties or issues with tax filings.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Cp565 and ITINs. Taxpayers should refer to IRS publications and resources to understand their responsibilities and the proper use of their ITIN. It is important to keep the IRS informed of any changes in personal information, such as name or address, to ensure that the Cp565 remains accurate and up to date.

Required Documents

To obtain an ITIN and subsequently receive the Cp565, taxpayers must submit Form W-7 along with required documentation. This typically includes proof of identity and foreign status, such as a passport or national identification card. Other supporting documents may be required depending on the taxpayer's specific situation. It is advisable to review the IRS guidelines carefully to ensure all necessary documents are included with the application.

Who Issues the Form

The Cp565 is issued by the Internal Revenue Service (IRS) once an individual’s application for an ITIN has been processed. The IRS is the authoritative body responsible for assigning ITINs and ensuring compliance with U.S. tax laws. Taxpayers should ensure that they follow all IRS procedures when applying for an ITIN to receive their Cp565 notice promptly.

Quick guide on how to complete cp565

Effortlessly Prepare Cp565 on Any Device

The management of online documents has become increasingly favored by both companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Cp565 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Easiest Way to Edit and Electronically Sign Cp565 Effortlessly

- Access Cp565 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Cp565 to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp565

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

How do I know if my ITIN is expired?

To determine if your ITIN is expired, you should check the format of your ITIN. If it was issued before 2013 and has not been used on a federal tax return for three consecutive years, it may be expired. Contacting the IRS or reviewing their guidelines can also provide clarity.

-

What are the consequences of using an expired ITIN?

Using an expired ITIN can prevent you from filing your tax returns and receiving certain tax benefits. The IRS may reject your returns if your ITIN is expired, which can delay any potential refunds. It’s essential to verify your ITIN's status to avoid these issues.

-

How often do I need to renew my ITIN?

ITINs need to be renewed if they have not been used on a federal tax return for the past three years or if they were issued before 2013. Keeping your ITIN active is essential for compliance and eligibility for certain tax credits. Always check IRS guidelines for the latest renewal requirements.

-

How do I renew my expired ITIN?

To renew your expired ITIN, you need to complete IRS Form W-7 and submit it along with the required documentation. Make sure to indicate that you are renewing your ITIN, and include a current tax return. Following the correct procedure is crucial to successfully renewing your ITIN.

-

Can I track the status of my ITIN renewal?

Currently, the IRS does not offer an online way to track the status of your ITIN renewal. However, you can call the IRS helpline for updates. It's advisable to keep a record of your submission date and documents for reference.

-

Will airSlate SignNow help me manage my ITIN-related documents?

Yes, airSlate SignNow provides a streamlined platform to manage and eSign your ITIN-related documents securely. You can upload, share, and sign documents from any device, ensuring that your ITIN renewal process is efficient and organized. This feature is especially helpful for tracking submissions.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers various features including document templates, team collaboration, and secure storage. You can easily create, send, and eSign documents while tracking their progress. These features make it simple to manage important documents like those related to your ITIN.

Get more for Cp565

- Form gst drc 14 word format

- Engineering permit application pompano beach form

- Switzerland visit visa from form

- Amhr registration application form

- Employee ergonomics survey pdf ergonomics plus form

- Penfed hardship application form

- Dealers listing of licensed salespersons form

- Tenant lease agreement template form

Find out other Cp565

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter