Claim for CreditRefund of Sales Tax Oklahoma Tax Commission Tax Ok Form

Understanding the Claim for Credit/Refund of Sales Tax

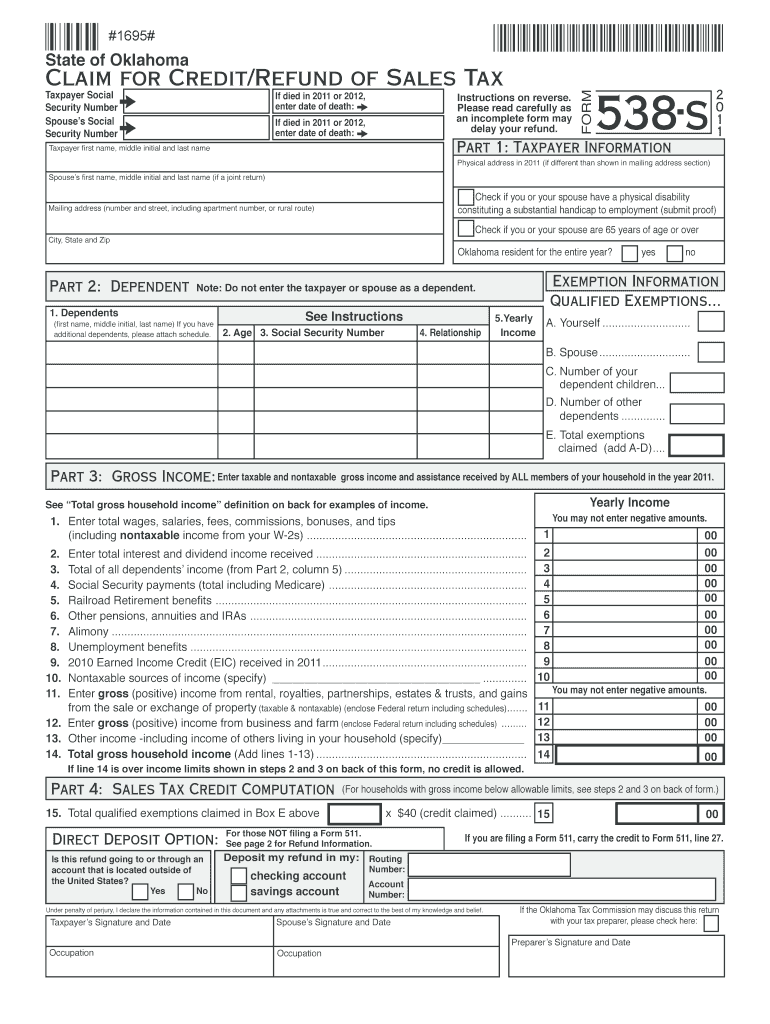

The Claim for Credit/Refund of Sales Tax is a specific form issued by the Oklahoma Tax Commission. This form allows individuals and businesses to request a refund for sales tax paid on certain purchases. It is essential to understand what qualifies for a refund under Oklahoma tax law, as this will guide you in accurately completing the form. Refunds may be applicable for tax paid on items that were later returned, or for purchases that were exempt from sales tax.

Steps to Complete the Claim for Credit/Refund of Sales Tax

Completing the Claim for Credit/Refund of Sales Tax involves several steps. First, gather all necessary documentation, including receipts and proof of tax paid. Next, accurately fill out the form, ensuring that all information is correct and complete. Pay special attention to the sections that require details about the items purchased and the sales tax paid. After filling out the form, review it for accuracy before submission. This will help avoid delays in processing your refund.

Required Documents for the Claim for Credit/Refund of Sales Tax

When submitting the Claim for Credit/Refund of Sales Tax, certain documents are required to support your request. These typically include:

- Receipts or invoices showing the sales tax paid

- Proof of return or exchange if applicable

- Any additional documentation requested by the Oklahoma Tax Commission

Having these documents ready will facilitate a smoother application process and help ensure your claim is processed efficiently.

Eligibility Criteria for the Claim for Credit/Refund of Sales Tax

Eligibility for a sales tax refund in Oklahoma is determined by specific criteria. Generally, you must have paid sales tax on a purchase that qualifies for a refund under state law. This includes situations such as purchasing items that are later returned or items that were incorrectly taxed. Additionally, the request for a refund must be made within a specified timeframe, typically three years from the date of the original purchase. Understanding these criteria is crucial for a successful claim.

Form Submission Methods for the Claim for Credit/Refund of Sales Tax

The Claim for Credit/Refund of Sales Tax can be submitted through various methods. You may choose to file the form online via the Oklahoma Tax Commission's website, which often provides a faster processing time. Alternatively, you can submit the form by mail or in person at your local Oklahoma Tax Commission office. Each method has its own processing times, so consider your needs when choosing how to submit your claim.

Legal Use of the Claim for Credit/Refund of Sales Tax

The Claim for Credit/Refund of Sales Tax is legally recognized under Oklahoma tax law. To ensure that your claim is valid, it must be completed accurately and submitted according to the guidelines established by the Oklahoma Tax Commission. This includes adhering to deadlines and providing all required information. Failure to comply with these legal requirements may result in delays or denial of your refund request.

Quick guide on how to complete claim for creditrefund of sales tax oklahoma tax commission tax ok

Complete Claim For CreditRefund Of Sales Tax Oklahoma Tax Commission Tax Ok seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Claim For CreditRefund Of Sales Tax Oklahoma Tax Commission Tax Ok on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Claim For CreditRefund Of Sales Tax Oklahoma Tax Commission Tax Ok effortlessly

- Obtain Claim For CreditRefund Of Sales Tax Oklahoma Tax Commission Tax Ok and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from your chosen device. Edit and electronically sign Claim For CreditRefund Of Sales Tax Oklahoma Tax Commission Tax Ok and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I claim a refund for income tax that was deducted in excess due to an error in Form 16?

You can claim the same by filing a revised tax return. In the ITR form you must select the tax return type as revised (General information section of ITR) and should fill out the details of previous ITR-V i.e Acknowledgement number and date of filing of tax return. Then fill out the tax return as if you are preparing the tax return for that year very first time. In details of prepaid tax enter the payment you made at the time of income tax demand.Conditions for filing a revised tax return :The revised return should be filed within 1 year from the end of the assessment year (2 years from end of financial year)The original tax return must have been filed within due date.Follow me on my blog TaxYogiIf you need my services contact me @9043414847 / yogeshjain392@outlook.com.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

If you played one of those $10,000 a spin slot machines in Vegas would that mean that anytime it won anything even one credit I would still have to fill out a tax form?

Yes, although they can set the machine to accumulated credit mode, and a staffer will sit by recording each jackpot on a form, then quickly resetting the machine so it’s ready to go again. You get a single W2G at the end of the session.It’s close to impossible to play extremely high-limit machines at any decent speed by feeding it currency and stopping for traditional hand-pays.

-

I made a medicine purchase of INR 2lakhs on behalf of my employer, which was reimbursed to me via salary with an additional tax deduction of INR 45000. How to claim Income tax refund for this?

Employee Reimbursements are not taxable to the employee, it is an expense spent on the company for business purpose.You can claim it as refund by filing your ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

Create this form in 5 minutes!

How to create an eSignature for the claim for creditrefund of sales tax oklahoma tax commission tax ok

How to create an eSignature for the Claim For Creditrefund Of Sales Tax Oklahoma Tax Commission Tax Ok in the online mode

How to make an eSignature for your Claim For Creditrefund Of Sales Tax Oklahoma Tax Commission Tax Ok in Google Chrome

How to create an electronic signature for signing the Claim For Creditrefund Of Sales Tax Oklahoma Tax Commission Tax Ok in Gmail

How to create an electronic signature for the Claim For Creditrefund Of Sales Tax Oklahoma Tax Commission Tax Ok right from your mobile device

How to create an eSignature for the Claim For Creditrefund Of Sales Tax Oklahoma Tax Commission Tax Ok on iOS devices

How to create an electronic signature for the Claim For Creditrefund Of Sales Tax Oklahoma Tax Commission Tax Ok on Android devices

People also ask

-

What is the process to submit a Claim For CreditRefund Of Sales Tax to the Oklahoma Tax Commission?

To submit a Claim For CreditRefund Of Sales Tax to the Oklahoma Tax Commission, you must complete the appropriate refund application form and gather necessary documentation. Once you have all the paperwork ready, you can file it directly with the commission either online or by mail. Utilizing airSlate SignNow can help streamline the signing and submission process, ensuring you don't miss any crucial steps.

-

How does airSlate SignNow help with the Claim For CreditRefund Of Sales Tax?

airSlate SignNow provides an easy-to-use platform that allows you to prepare, send, and eSign documents related to your Claim For CreditRefund Of Sales Tax with the Oklahoma Tax Commission. Our solution simplifies the verification and submission process, ensuring that your claims are processed smoothly and efficiently, saving you time and resources.

-

Is there a cost associated with using airSlate SignNow for tax claims?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including features that assist with your Claim For CreditRefund Of Sales Tax to the Oklahoma Tax Commission. Our plans are designed to be cost-effective, providing excellent value for the features and services offered, including secure storage and easy document management.

-

Can I track the status of my Claim For CreditRefund Of Sales Tax using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your documents, including your Claim For CreditRefund Of Sales Tax submissions to the Oklahoma Tax Commission. You'll receive notifications when documents are viewed and signed, giving you peace of mind throughout the process.

-

What types of documents can I manage for tax claims with airSlate SignNow?

With airSlate SignNow, you can manage a variety of documents necessary for your Claim For CreditRefund Of Sales Tax, including application forms, supporting documentation, and signatures from relevant parties. Our platform supports multiple file formats and ensures that all your documents are organized and easily accessible.

-

Are there integration options available with airSlate SignNow for tax-related tasks?

Yes, airSlate SignNow integrates with numerous applications and software, enhancing your ability to manage your Claim For CreditRefund Of Sales Tax with the Oklahoma Tax Commission. This includes integrations with accounting software and other document management systems, making it easier to streamline your workflow.

-

What security measures does airSlate SignNow have for sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents such as those related to your Claim For CreditRefund Of Sales Tax. We utilize advanced encryption, secure cloud storage, and compliance with industry standards to keep your data safe throughout the signing and submission process.

Get more for Claim For CreditRefund Of Sales Tax Oklahoma Tax Commission Tax Ok

Find out other Claim For CreditRefund Of Sales Tax Oklahoma Tax Commission Tax Ok

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free