Wisconsin Real Estate Transfer Return Form

What is the Wisconsin Real Estate Transfer Return

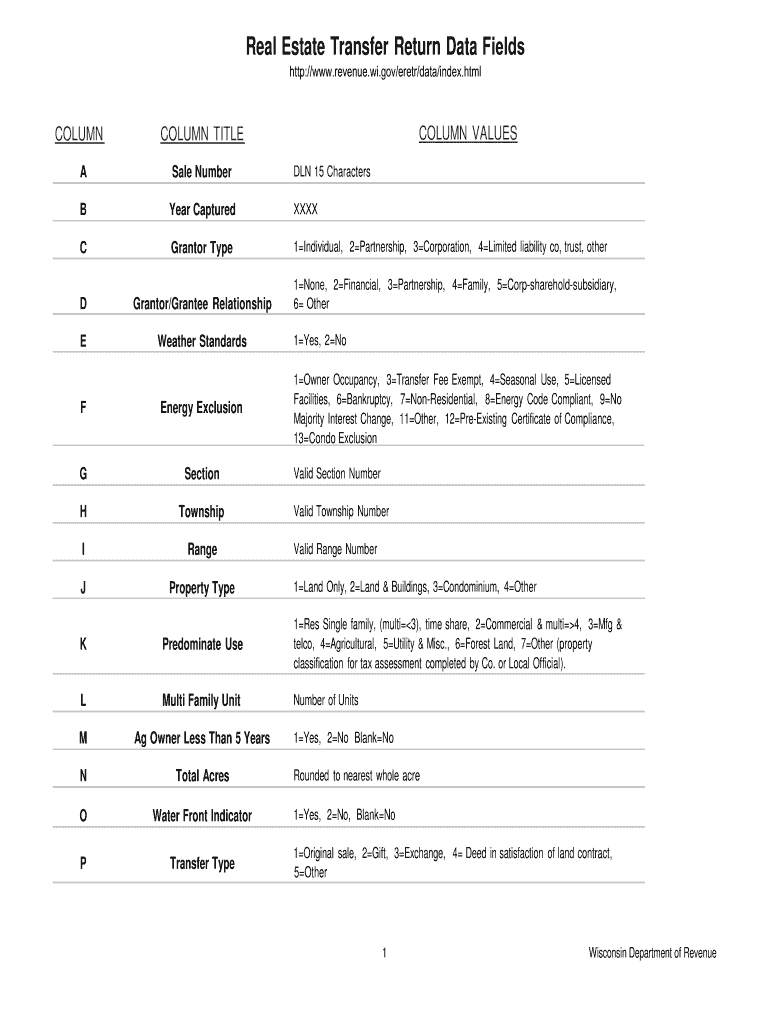

The Wisconsin Real Estate Transfer Return is a mandatory form used during the sale or transfer of real property in Wisconsin. This form documents the transfer of ownership and is essential for calculating the real estate transfer tax. It provides the state with necessary information about the transaction, including the parties involved, the property details, and the sale price. Completing this form accurately is crucial to ensure compliance with state regulations and to avoid potential penalties.

Steps to complete the Wisconsin Real Estate Transfer Return

Completing the Wisconsin Real Estate Transfer Return involves several key steps:

- Gather necessary information about the property, including its legal description, address, and sale price.

- Identify the parties involved in the transaction, including the buyer and seller.

- Fill out the transfer return form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any required payment for the transfer tax.

Key elements of the Wisconsin Real Estate Transfer Return

The Wisconsin Real Estate Transfer Return includes several important elements that must be accurately filled out:

- Property Information: This includes the property address, legal description, and parcel number.

- Parties Involved: Names and addresses of the buyer and seller must be provided.

- Sale Price: The total amount for which the property is being sold.

- Transfer Tax Calculation: The form includes a section for calculating the applicable transfer tax based on the sale price.

Required Documents

When completing the Wisconsin Real Estate Transfer Return, certain documents are typically required:

- Proof of ownership, such as a deed or title.

- Identification for both the buyer and seller.

- Any existing liens or encumbrances on the property.

- Documentation supporting the sale price, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Wisconsin Real Estate Transfer Return can be submitted through various methods:

- Online: Many counties in Wisconsin allow electronic submission of the transfer return through their official websites.

- Mail: Completed forms can be mailed to the appropriate county office for processing.

- In-Person: Individuals may also choose to submit the form in person at their local county office.

Penalties for Non-Compliance

Failure to complete and submit the Wisconsin Real Estate Transfer Return can result in penalties. These may include:

- Fines imposed by the state for late or incorrect filings.

- Delays in the processing of the property transfer.

- Potential legal complications arising from non-compliance with state regulations.

Quick guide on how to complete wisconsin real estate transfer form

Easily Prepare Wisconsin Real Estate Transfer Return on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Wisconsin Real Estate Transfer Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The Easiest Way to Modify and eSign Wisconsin Real Estate Transfer Return Effortlessly

- Obtain Wisconsin Real Estate Transfer Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that task.

- Generate your signature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to store your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign Wisconsin Real Estate Transfer Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How do I become a real estate agent in Wisconsin?

Whether you’re just getting started or you consider yourself a senior real estate agent, there are always ways to improve your success with property sales and listings. Becoming a successful real estate agent doesn’t happen overnight – it takes practice and a ton of commitment. Here are fives ways you can improve your success rates as a real estate agent:Be driven.As a real estate agent, you should always be driven and determined to sell a property – regardless if it’s residential or commercial.A great way to do this is to make a list of your personal goals for whichever project you’re working on.Then, meticulously write out each step that will help you signNow your goals – and get to it!Be resilient.There’s no doubt that as a real estate agent you’ll have both good and bad days, but it’s important to keep moving forward and not let yourself get down.Be committed – don’t give up on a project or listing just because something gets in the way.Remember, life will always throw curve balls – what matters most is how you handle them.Learn from your mistakes.There will be times where you make a mistake with a client or listing, but don’t let it affect you too much (we all make mistakes, in every profession).Learn how to adapt and grow from the mistakes you make so that you can push yourself to be a stronger, more successful agent.Mistakes aren’t fatal – they’re usually fixable, but you should know when it’s appropriate to just walk away.Believe in yourself and the people around you.Have faith that you will succeed in this business, and that the people in your agency will too.Always be there to lend a helping hand, because chances are you will need one from your peers at some point.Maintain a positive attitude and likable personality.Successful real estate agents are always likable – be a people person. Nobody wants to do business with someone who comes off cold.Maintaining a positive attitude will help fellow agents as well as yourself feel more determined and will bring more value to your work.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

Create this form in 5 minutes!

How to create an eSignature for the wisconsin real estate transfer form

How to create an eSignature for your Wisconsin Real Estate Transfer Form in the online mode

How to make an electronic signature for your Wisconsin Real Estate Transfer Form in Google Chrome

How to create an electronic signature for putting it on the Wisconsin Real Estate Transfer Form in Gmail

How to create an eSignature for the Wisconsin Real Estate Transfer Form right from your smartphone

How to make an electronic signature for the Wisconsin Real Estate Transfer Form on iOS devices

How to make an eSignature for the Wisconsin Real Estate Transfer Form on Android devices

People also ask

-

What is the Wisconsin real estate transfer return?

The Wisconsin real estate transfer return is a document that must be completed when property ownership is transferred in Wisconsin. This form provides information about the property, the buyer, and the seller, and helps ensure compliance with state tax regulations related to real estate transactions.

-

How do I complete the Wisconsin real estate transfer return?

To complete the Wisconsin real estate transfer return, you can access the form online or through your local county office. It requires specific details such as property identification, sale price, and buyer/seller information. Using airSlate SignNow can streamline this process by allowing you to fill out and eSign the document easily.

-

Are there any fees associated with filing the Wisconsin real estate transfer return?

Yes, there may be fees associated with filing the Wisconsin real estate transfer return depending on the county in which the property is located. These fees can vary and are typically related to recording the transfer with the county register of deeds. It is beneficial to check with local officials for exact cost details.

-

Can airSlate SignNow assist me in managing my Wisconsin real estate transfer return?

Absolutely! airSlate SignNow provides an efficient platform for managing your Wisconsin real estate transfer return. With features like eSigning and document storage, you can easily complete necessary paperwork, save time, and ensure accuracy in your transactions.

-

What features does airSlate SignNow offer for real estate transactions?

airSlate SignNow offers a variety of features for real estate transactions, including customizable templates for documents like the Wisconsin real estate transfer return, robust eSigning capabilities, and integration options with other platforms. These features simplify the entire process and ensure a smooth experience for both buyers and sellers.

-

Is airSlate SignNow compliant with Wisconsin real estate laws?

Yes, airSlate SignNow is designed to comply with Wisconsin real estate laws, including the requirements for the Wisconsin real estate transfer return. The platform regularly updates its templates and practices to align with state regulations, ensuring that you can confidently manage your documents.

-

How does airSlate SignNow enhance the efficiency of filing my Wisconsin real estate transfer return?

airSlate SignNow enhances the efficiency of filing your Wisconsin real estate transfer return by providing a digital platform where documents can be completed and eSigned securely online. This reduces the need for paper forms and in-person meetings, allowing for quicker processing and reduced turnaround times.

Get more for Wisconsin Real Estate Transfer Return

Find out other Wisconsin Real Estate Transfer Return

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT