Wisconsin Garnishment Exemption Worksheet 2010-2026

What is the Wisconsin Garnishment Exemption Worksheet

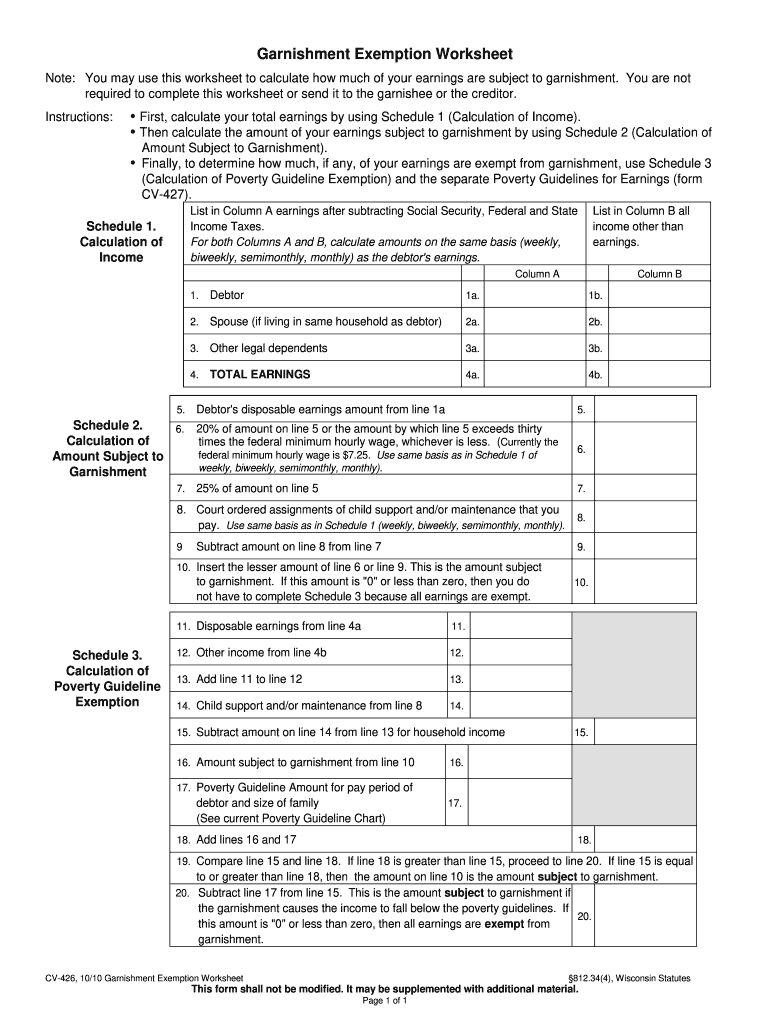

The Wisconsin Garnishment Exemption Worksheet is a legal document designed to help individuals protect their income from garnishment under certain circumstances. This worksheet allows debtors to claim exemptions that may apply to their income, ensuring that they retain a portion of their earnings necessary for living expenses. It is particularly relevant for individuals facing wage garnishment due to unpaid debts, allowing them to assert their rights under Wisconsin law.

How to use the Wisconsin Garnishment Exemption Worksheet

Using the Wisconsin Garnishment Exemption Worksheet involves several straightforward steps. First, gather all necessary financial information, including income sources and amounts. Next, accurately complete the worksheet by filling in the required fields, such as your name, address, and details about your income. It is crucial to provide truthful and complete information to ensure the worksheet is valid. Once completed, submit the worksheet to the appropriate court or creditor handling your garnishment case.

Steps to complete the Wisconsin Garnishment Exemption Worksheet

Completing the Wisconsin Garnishment Exemption Worksheet requires careful attention to detail. Follow these steps:

- Obtain the worksheet from a reliable source, such as a legal aid office or court website.

- Fill in your personal information, including your name and contact details.

- List all sources of income, including wages, benefits, and any other earnings.

- Identify and claim any exemptions that apply to your situation, such as those for basic living expenses.

- Review the completed worksheet for accuracy before submission.

- Submit the worksheet to the court or creditor as instructed.

Legal use of the Wisconsin Garnishment Exemption Worksheet

The legal use of the Wisconsin Garnishment Exemption Worksheet is essential for individuals seeking to protect their income from garnishment. This worksheet must be filled out accurately and submitted in compliance with state laws. By claiming exemptions, individuals can legally reduce the amount of income subject to garnishment, which can help them maintain financial stability. Understanding the legal framework surrounding this worksheet is crucial for its effective use.

Key elements of the Wisconsin Garnishment Exemption Worksheet

Several key elements define the Wisconsin Garnishment Exemption Worksheet. These include:

- Personal Information: Basic details such as your name and address.

- Income Details: Comprehensive listing of all income sources.

- Exemption Claims: Specific exemptions that apply to your financial situation.

- Signature: Your signature certifying that the information provided is accurate.

Eligibility Criteria

To utilize the Wisconsin Garnishment Exemption Worksheet, individuals must meet specific eligibility criteria. Generally, this includes being a debtor facing garnishment and having income that qualifies for exemption under Wisconsin law. Common exemptions may include income from social security, unemployment benefits, and certain public assistance programs. It is important to review these criteria carefully to determine eligibility before completing the worksheet.

Quick guide on how to complete wisconsin garnishment exemption worksheet

Handle Wisconsin Garnishment Exemption Worksheet effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files swiftly without delays. Manage Wisconsin Garnishment Exemption Worksheet on any platform using airSlate SignNow Android or iOS applications and ease any document-related procedure today.

The best method to modify and eSign Wisconsin Garnishment Exemption Worksheet without strain

- Obtain Wisconsin Garnishment Exemption Worksheet and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and eSign Wisconsin Garnishment Exemption Worksheet and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin garnishment exemption worksheet

Create this form in 5 minutes!

How to create an eSignature for the wisconsin garnishment exemption worksheet

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a 2024 garnishment printable worksheet?

A 2024 garnishment printable worksheet is a tool designed to help individuals calculate the appropriate amount of wages that can be garnished from their paycheck under state and federal guidelines. This worksheet simplifies the process, ensuring that deductions comply with legal standards. Using this worksheet can help prevent over-garnishment and ensure proper financial planning.

-

How do I access the 2024 garnishment printable worksheet?

You can easily access the 2024 garnishment printable worksheet directly from the airSlate SignNow website. Simply visit our resources section, where you'll find the downloadable format available for printing. This user-friendly access ensures you have the worksheet ready whenever you need it.

-

Is the 2024 garnishment printable worksheet free?

Yes, the 2024 garnishment printable worksheet is available for free on the airSlate SignNow platform. We believe in empowering users with essential financial tools without any cost barriers. Download it easily to start utilizing it for your garnishment calculations.

-

Can I customize the 2024 garnishment printable worksheet?

Our 2024 garnishment printable worksheet is designed to be user-friendly, but customization options depend on the format you choose. You can fill in your specific financial details and make notes as needed. This personalization ensures that the worksheet serves your unique financial situation effectively.

-

How can the 2024 garnishment printable worksheet benefit my business?

The 2024 garnishment printable worksheet can greatly benefit your business by ensuring compliance with garnishment laws and preventing costly legal issues. By using this worksheet, you can accurately calculate garnishment amounts for employees, maintaining transparent and fair payroll practices. This proactive approach can enhance employee satisfaction and trust.

-

Does the 2024 garnishment printable worksheet integrate with any software?

The 2024 garnishment printable worksheet can be easily integrated with various payroll and accounting software by exporting the calculations you complete. While it’s a standalone resource, aligning it with your finance systems streamlines your processes. Our platform ensures that all information is accessible and easy to manage.

-

What features are included in the 2024 garnishment printable worksheet?

The 2024 garnishment printable worksheet includes fields for income calculation, deductions, and other essential variables necessary for accurate garnishment computations. It’s structured for clarity and ease of use, ensuring that you can find the information you need quickly. This functionality supports both individuals and businesses in maintaining compliance.

Get more for Wisconsin Garnishment Exemption Worksheet

Find out other Wisconsin Garnishment Exemption Worksheet

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast