How to Fill in Form Iht422 2010

What is the How To Fill In Form Iht422

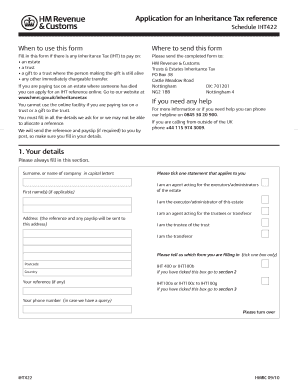

The How To Fill In Form Iht422 is a document used in the United States for reporting and calculating inheritance tax. This form is crucial for individuals who are responsible for settling the estate of a deceased person. It helps to determine the tax liability based on the value of the estate and the applicable deductions. Understanding this form is essential for compliance with tax regulations and ensuring that the estate is settled correctly.

Steps to complete the How To Fill In Form Iht422

Completing the How To Fill In Form Iht422 involves several steps to ensure accuracy and compliance. Begin by gathering all necessary information about the deceased's estate, including assets, debts, and any applicable deductions. Next, follow these steps:

- Identify the decedent's full name and date of death.

- List all assets owned by the decedent, including real estate, bank accounts, and personal property.

- Document any debts or liabilities that the estate must pay.

- Calculate the total value of the estate by subtracting liabilities from assets.

- Complete the form by entering the calculated values in the appropriate sections.

- Review the form for accuracy and completeness before submission.

Legal use of the How To Fill In Form Iht422

The How To Fill In Form Iht422 must be completed and submitted in accordance with U.S. tax laws. It serves as a legal declaration of the estate's value and tax obligations. Properly filling out this form ensures that the estate complies with inheritance tax regulations, avoiding potential penalties. It is essential to maintain accurate records and documentation to support the information provided in the form.

Required Documents

When filling out the How To Fill In Form Iht422, specific documents are required to support the information provided. These documents may include:

- The death certificate of the deceased.

- Documents proving ownership of assets, such as titles or deeds.

- Statements from financial institutions regarding account balances.

- Records of any debts or liabilities incurred by the deceased.

- Tax returns from the previous years, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The How To Fill In Form Iht422 can be submitted through various methods, depending on the specific requirements of the jurisdiction. Common submission methods include:

- Online submission through designated tax authority websites.

- Mailing the completed form to the appropriate tax office.

- In-person submission at local tax offices or estate administration offices.

Filing Deadlines / Important Dates

Filing the How To Fill In Form Iht422 is subject to specific deadlines, which vary by state. It is important to be aware of these dates to avoid penalties. Generally, the form should be filed within nine months of the decedent's date of death. Extensions may be available, but they must be requested in advance. Keeping track of these important dates ensures compliance with tax obligations.

Quick guide on how to complete how to fill in form iht422

Effortlessly Prepare How To Fill In Form Iht422 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage How To Fill In Form Iht422 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and eSign How To Fill In Form Iht422 with Ease

- Obtain How To Fill In Form Iht422 and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing out new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign How To Fill In Form Iht422 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to fill in form iht422

Create this form in 5 minutes!

How to create an eSignature for the how to fill in form iht422

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is Form IHT422, and why is it important?

Form IHT422 is a crucial document used in the UK for reporting inheritance tax liabilities after someone's death. Understanding how to fill in Form IHT422 accurately is essential to ensure compliance with tax regulations and to avoid potential penalties.

-

How can airSlate SignNow assist in filling out Form IHT422?

airSlate SignNow provides a user-friendly platform that simplifies the document completion process, allowing users to fill in Form IHT422 efficiently. With its intuitive features, you can easily input necessary information and ensure that your form is completed correctly.

-

Is there a cost associated with using airSlate SignNow for Form IHT422?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While you'll need to select a plan to access its features, the cost-effective solution ensures that you can complete important documents like Form IHT422 without breaking the bank.

-

Can I save my progress while filling in Form IHT422 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your progress while filling in Form IHT422. This feature enables you to return and complete your document at your convenience, ensuring that you never lose any data.

-

Are there templates available for Form IHT422?

Yes, airSlate SignNow provides templates that can help you get started with Form IHT422. These templates streamline the filling process and ensure that you include all necessary information to avoid delays and complications.

-

Can I electronically sign Form IHT422 with airSlate SignNow?

Yes, airSlate SignNow allows you to eSign Form IHT422 securely and conveniently. This feature eliminates the need for printing and scanning, making the process faster and more efficient.

-

What integrations does airSlate SignNow offer for Form IHT422?

airSlate SignNow integrates seamlessly with various applications that can enhance your document management workflow. This means you can easily connect with CRM systems, email applications, and storage solutions while filling in Form IHT422.

Get more for How To Fill In Form Iht422

- Cg 25 03 05 09 form

- Simpsite form

- End user declaration letter 412843619 form

- Sample request form w 9 legacy oca

- Medical report omers total disability benefits form 147

- Form w 2gu guam wage and tax statement

- Ca dmv license renewal form pdf fill out ampamp sign online

- Transfer authorization for registered investments hsbc canada form

Find out other How To Fill In Form Iht422

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast