Iht422 2017-2026

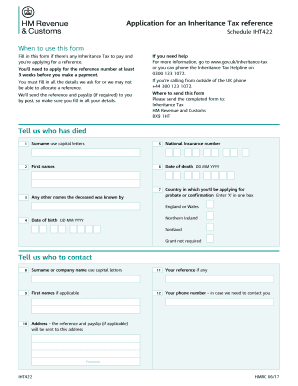

What is the IHT422?

The IHT422 form is a crucial document used in the United Kingdom for inheritance tax purposes. It serves as a request for an inheritance tax reference number, which is necessary when dealing with the HM Revenue and Customs (HMRC) inheritance tax. This form is particularly important for individuals who are managing estates or are beneficiaries of an estate. The IHT422 helps streamline the process of applying for an inheritance tax reference, ensuring that all necessary information is submitted correctly to the relevant authorities.

How to Use the IHT422

Using the IHT422 form involves several steps to ensure that the application for an inheritance tax reference number is completed accurately. First, gather all relevant information regarding the estate, including details about the deceased and the value of the estate. Next, fill out the IHT422 form with accurate and complete information. Once completed, submit the form to HMRC either online or through traditional mail. It is essential to keep a copy of the submitted form for your records, as this will be useful for future reference or if any queries arise.

Steps to Complete the IHT422

Completing the IHT422 form requires careful attention to detail. Here are the steps to follow:

- Collect all necessary information about the deceased, including their full name, date of birth, and date of death.

- Determine the total value of the estate, including assets and liabilities.

- Fill out the IHT422 form accurately, ensuring that all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to HMRC via the preferred method, either online or by mail.

Legal Use of the IHT422

The IHT422 form is legally recognized as a valid request for an inheritance tax reference number. It is essential to use this form correctly to comply with UK tax laws. Submitting the form ensures that the estate is properly registered with HMRC, which is a critical step in the inheritance tax process. Failure to use the IHT422 appropriately may lead to delays or complications in the estate settlement process.

Required Documents

When completing the IHT422 form, certain documents are typically required to support the application. These may include:

- A copy of the death certificate of the deceased.

- Documentation detailing the assets and liabilities of the estate.

- Any previous correspondence with HMRC regarding the estate.

Having these documents ready will facilitate a smoother application process and help ensure that all necessary information is provided to HMRC.

Form Submission Methods

The IHT422 form can be submitted through various methods, catering to different preferences and needs. The primary submission methods include:

- Online Submission: This method allows for quick and efficient processing of the form through the HMRC website.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to HMRC.

Choosing the appropriate submission method depends on individual circumstances and preferences, but online submission is often faster and more convenient.

Quick guide on how to complete iht422

Complete Iht422 seamlessly on any device

Online document management has become favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Iht422 on any platform with the airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to edit and eSign Iht422 with ease

- Obtain Iht422 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Iht422 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iht422

Create this form in 5 minutes!

How to create an eSignature for the iht422

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is iht422 online, and how can it benefit my business?

IHT422 online is an essential digital tool that streamlines the process of sending and signing documents securely. By adopting this solution, businesses can improve efficiency, reduce paper waste, and speed up workflows, ultimately saving time and resources.

-

How does airSlate SignNow ensure the security of my documents when using iht422 online?

When utilizing the iht422 online feature of airSlate SignNow, your documents are protected with industry-standard encryption and secure authentication processes. This ensures that sensitive information remains private and accessible only to authorized parties.

-

What are the pricing options for iht422 online?

airSlate SignNow offers flexible pricing plans for its iht422 online services, catering to various business needs. You can choose between monthly and annual subscriptions, and discounts are available for larger teams or extended commitments.

-

Can I integrate iht422 online with other software tools?

Yes, airSlate SignNow allows seamless integration with a variety of popular applications when using iht422 online. This integration capability enhances your existing workflows and improves overall productivity across different platforms.

-

Is iht422 online suitable for small businesses?

Absolutely! IHT422 online is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses looking to streamline their document signing processes. It helps save time and facilitates improved collaboration among team members.

-

What features are included with iht422 online?

With iht422 online, users gain access to a range of features including customizable templates, automated reminders, and real-time tracking of signed documents. These tools empower businesses to manage their document workflows more efficiently.

-

How can I get started with iht422 online?

Getting started with iht422 online is easy! Simply visit the airSlate SignNow website, sign up for an account, and follow the setup instructions to begin sending and signing documents digitally within minutes.

Get more for Iht422

Find out other Iht422

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile