185 Hmrc Certificate Form

What is the 185 HMRC Certificate

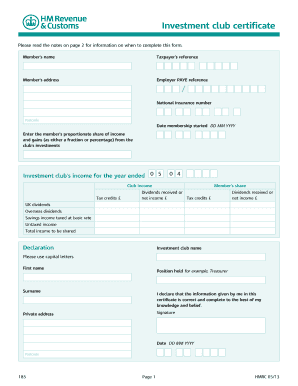

The 185 HMRC Certificate, also known as the HMRC investment club tax return form 185, is a crucial document for investment clubs in the United Kingdom. It serves as a self-certification form that allows these clubs to declare their income and gains to HM Revenue and Customs (HMRC). This certificate is essential for ensuring compliance with tax regulations and enables investment clubs to manage their tax obligations effectively. By completing this form, clubs can confirm their status and provide necessary information regarding their investments and earnings.

How to Obtain the 185 HMRC Certificate

To obtain the 185 HMRC Certificate, investment clubs must follow specific steps. First, they need to register their club with HMRC, which involves providing details about the club's structure and membership. Once registered, clubs can access the necessary forms through the HMRC website or contact HMRC directly for assistance. It is important to ensure that all required information is accurate and complete to prevent delays in processing. Clubs may also need to provide additional documentation, such as financial statements, to support their application.

Steps to Complete the 185 HMRC Certificate

Completing the 185 HMRC Certificate involves several key steps:

- Gather necessary information about the club's income, expenses, and investments.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to HMRC by the specified deadline.

It is advisable for clubs to keep a copy of the submitted form and any supporting documents for their records.

Legal Use of the 185 HMRC Certificate

The 185 HMRC Certificate is legally binding, provided it is completed and submitted according to HMRC regulations. This document must be used to declare the club's income and ensure compliance with tax laws. Failure to submit the certificate or providing false information can result in penalties or legal consequences. Therefore, it is essential for clubs to understand their obligations and ensure that they use the certificate correctly to avoid any issues with HMRC.

Key Elements of the 185 HMRC Certificate

Several key elements must be included in the 185 HMRC Certificate to ensure its validity:

- Club name and registration details.

- Details of all members, including their contributions and shareholdings.

- Income generated from investments and any associated expenses.

- Signature of an authorized member to validate the submission.

Including all these elements is critical for the form to be accepted by HMRC and to fulfill the club's tax obligations.

Filing Deadlines / Important Dates

Investment clubs must be aware of the filing deadlines associated with the 185 HMRC Certificate. Typically, the deadline for submitting the certificate aligns with the end of the tax year, which is April fifth in the UK. Clubs should ensure that they submit their forms on time to avoid penalties. It is also important to stay informed about any changes to deadlines or requirements that may arise from HMRC.

Quick guide on how to complete 185 hmrc certificate

Easily Prepare 185 Hmrc Certificate on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage 185 Hmrc Certificate on any device with airSlate SignNow apps for Android or iOS and simplify any document-driven task today.

The easiest way to modify and eSign 185 Hmrc Certificate effortlessly

- Locate 185 Hmrc Certificate and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 185 Hmrc Certificate and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 185 hmrc certificate

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is an HMRC investment club certificate?

An HMRC investment club certificate is an official document issued by HM Revenue and Customs that confirms the registration of an investment club with HMRC. This certificate is essential for investment clubs to benefit from tax exemptions on qualifying investments. By obtaining this certificate, clubs can ensure they comply with necessary tax regulations.

-

How can I obtain an HMRC investment club certificate?

To obtain an HMRC investment club certificate, your club must apply for registration with HMRC. You'll need to provide specific information about your club's structure and membership. After processing, HMRC will issue the certificate, allowing you to enjoy the benefits associated with official recognition.

-

What are the benefits of having an HMRC investment club certificate?

Having an HMRC investment club certificate enables your club to qualify for certain tax advantages, such as exemptions on capital gains and income tax. This can signNowly enhance your members' returns on investments. Additionally, it lends credibility and legitimacy to your investment club.

-

What features does airSlate SignNow offer for managing HMRC investment club certificates?

airSlate SignNow provides a user-friendly platform to create, send, and eSign documents related to your HMRC investment club certificate efficiently. You can track document statuses and securely store all relevant information in one place. These features streamline the management process and ensure compliance with HMRC requirements.

-

Is airSlate SignNow cost-effective for managing HMRC investment club certificates?

Yes, airSlate SignNow offers cost-effective plans tailored to suit the needs of investment clubs managing HMRC investment club certificates. By minimizing administrative costs and ensuring faster document processing, it proves to be a valuable investment for club members. Moreover, the platform's features help save time and effort in managing required documentation.

-

Can airSlate SignNow integrate with other platforms for HMRC investment club management?

Absolutely! airSlate SignNow can seamlessly integrate with various platforms and software that investment clubs might use to manage their operations, including CRM and financial management tools. This integration enhances your club's efficiency in handling HMRC investment club certificates and other related processes.

-

What should I do if my HMRC investment club certificate is lost?

If your HMRC investment club certificate is lost, you should contact HMRC directly to request a replacement. They may ask for specific details about your investment club and evidence of your registration. It's essential to resolve this quickly to maintain compliance and ensure your club benefits from its tax-exempt status.

Get more for 185 Hmrc Certificate

- Information in suit affecting the parent child relationship

- Real property tax audit report form nyc gov nycppf

- Job hazard analysis form template american society of concrete contractors job hazard analysis form template by american

- Form 3522 llc tax voucher ftb ca

- Athletic pre participation physical examination article form

- Form 8038 rev february information return for tax exempt private activity bond issues

- Form 8925 rev january report of employer owned life insurance contracts

- The csa compensation accrual fund form

Find out other 185 Hmrc Certificate

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death