Schedule a Gc 400a4 Receipts Rent Form

What is the Schedule A GC 400A4 Receipts Rent

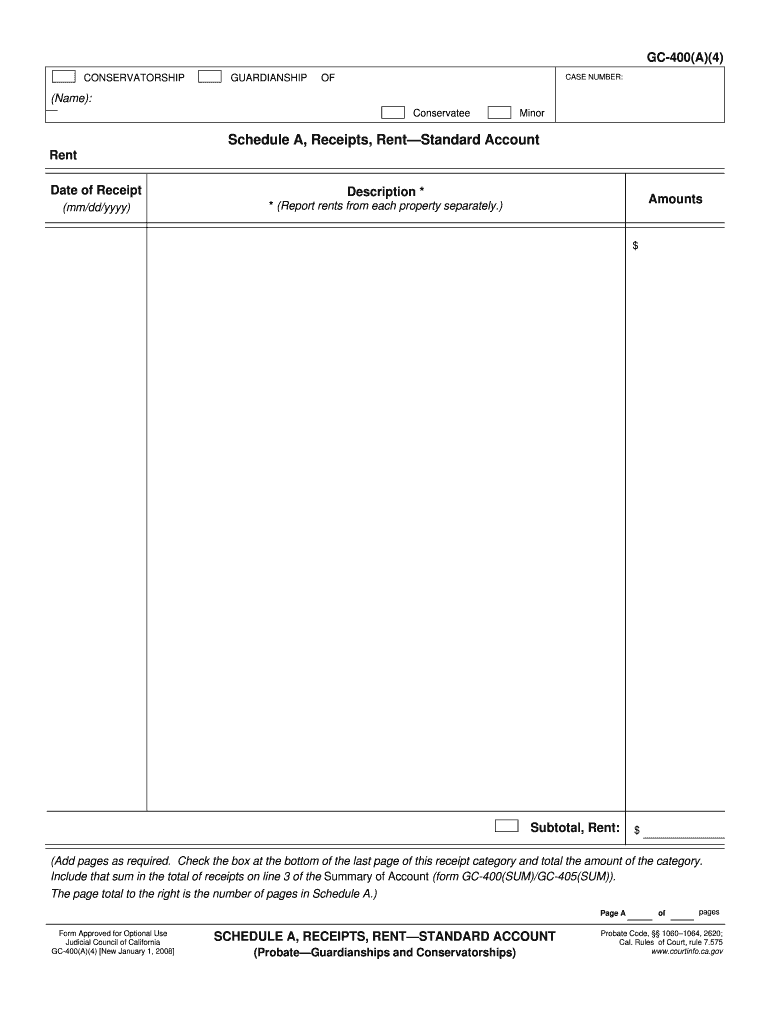

The Schedule A GC 400A4 Receipts Rent is a tax form used in the United States to report rental income and expenses. This form is essential for landlords and property owners who need to document their rental activities for tax purposes. It provides a structured way to list income received from tenants and any related expenses incurred during the rental period. Completing this form accurately is crucial for ensuring compliance with IRS regulations and for maximizing potential deductions.

How to Use the Schedule A GC 400A4 Receipts Rent

Using the Schedule A GC 400A4 Receipts Rent involves several steps. First, gather all relevant documentation, including rental agreements and receipts for expenses. Next, fill out the form by entering your rental income in the designated sections. You should also include any deductible expenses, such as maintenance costs, property management fees, and utilities. Once completed, this form can be submitted along with your tax return to the IRS.

Steps to Complete the Schedule A GC 400A4 Receipts Rent

Completing the Schedule A GC 400A4 Receipts Rent requires careful attention to detail. Follow these steps for accurate completion:

- Collect all necessary documents, such as lease agreements and receipts.

- Enter your total rental income for the year in the appropriate section.

- List all allowable expenses related to your rental property.

- Calculate your net rental income by subtracting expenses from income.

- Review the form for accuracy before submission.

Legal Use of the Schedule A GC 400A4 Receipts Rent

The Schedule A GC 400A4 Receipts Rent is legally recognized for reporting rental income to the IRS. To ensure its legal standing, it must be filled out completely and accurately. This form must be filed along with your annual tax return, and it should reflect true and honest reporting of your rental activities. Failure to comply with IRS regulations can result in penalties or audits.

Key Elements of the Schedule A GC 400A4 Receipts Rent

Understanding the key elements of the Schedule A GC 400A4 Receipts Rent is vital for effective use. The form typically includes sections for:

- Total rental income received.

- Detailed listing of deductible expenses.

- Net income calculation.

- Signature and date for verification.

Each section must be completed with accurate figures to ensure compliance and to maximize potential deductions.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines for the Schedule A GC 400A4 Receipts Rent. Typically, this form must be submitted by the tax return due date, which is usually April 15 for individual taxpayers. If you require additional time, you may file for an extension, but be mindful that any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete schedule a gc 400a4 receipts rent

Complete Schedule A Gc 400a4 Receipts Rent effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Schedule A Gc 400a4 Receipts Rent on any device with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The simplest way to alter and electronically sign Schedule A Gc 400a4 Receipts Rent without hassle

- Find Schedule A Gc 400a4 Receipts Rent and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate producing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Schedule A Gc 400a4 Receipts Rent and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule a gc 400a4 receipts rent

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is a receipts rents account pdf?

A receipts rents account pdf is a digital document that records rent payments and other transactions associated with a rental property. It provides both landlords and tenants with a clear overview of rent history and is essential for maintaining accurate financial records. By utilizing airSlate SignNow, you can create, manage, and eSign these receipts conveniently.

-

How can airSlate SignNow help me with receipts rents account pdf?

With airSlate SignNow, you can easily create and send a receipts rents account pdf for your rental transactions. The platform allows you to eSign documents quickly, ensuring that all parties have an official record of payments. This feature streamlines the management of rental agreements and financial documentation.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to fit various business needs. Whether you're a solo landlord or managing multiple properties, you can find a plan that includes features like creating a receipts rents account pdf. Pricing is competitive and ensures you get a cost-effective solution for all your eSigning needs.

-

What features does airSlate SignNow provide for managing receipts?

AirSlate SignNow offers a user-friendly interface for managing receipts, including the ability to create a receipts rents account pdf easily. Features such as templates, automated reminders, and tracking of eSigned documents enhance your workflow. These tools ensure all your rental documents are organized and accessible.

-

Can I integrate airSlate SignNow with other tools for managing rental payments?

Yes, airSlate SignNow seamlessly integrates with various property management and accounting tools, enhancing your ability to manage rental payments. By integrating these systems, you can automatically generate a receipts rents account pdf, ensuring that all transactions are recorded accurately. This integration simplifies your workflow signNowly.

-

Is it secure to eSign a receipts rents account pdf with airSlate SignNow?

Absolutely! AirSlate SignNow prioritizes security and compliance, ensuring that your eSignatures on a receipts rents account pdf are legally binding and safe. With encryption and secure storage, you can trust that your documents are protected from unauthorized access.

-

How can I access my receipts rents account pdf after eSigning?

After eSigning a receipts rents account pdf in airSlate SignNow, you can access your document anytime through your account dashboard. The platform allows for easy retrieval, sharing, and downloading of your signed receipts, ensuring that you have permanent records of your rental transactions.

Get more for Schedule A Gc 400a4 Receipts Rent

- Criminal record abuse history verificationdocx eriecountygov form

- Colorado uniform consumer credit code colorado attorney general coloradoattorneygeneral

- Studentska zamolba sveuili te u zagrebu uiteljski fakultet ufzg ufzg unizg form

- Form 3099

- University clearance form

- Proxy signature example form

- Permits royse city tx form

- Property owners agent authorization form bernalillo county

Find out other Schedule A Gc 400a4 Receipts Rent

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF