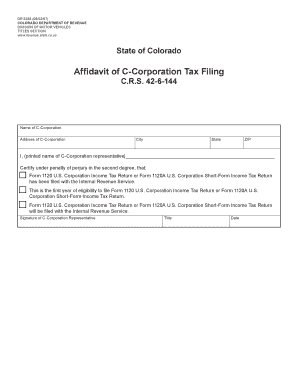

Affidavit of C Corporation Tax Filing Colorado Gov Colorado Form

What is the Affidavit of C Corporation Tax Filing in Colorado?

The Affidavit of C Corporation Tax Filing in Colorado is a legal document required for C corporations to affirm their compliance with state tax regulations. This affidavit serves to confirm that the corporation has accurately reported its income and paid the necessary taxes. It is essential for maintaining good standing with the Colorado Department of Revenue and ensuring that all tax obligations are met. The affidavit may also be used as part of the documentation needed for various business operations, including securing loans or contracts.

Steps to Complete the Affidavit of C Corporation Tax Filing

Completing the Affidavit of C Corporation Tax Filing involves several important steps:

- Gather necessary information, including your corporation's tax ID number, financial statements, and previous tax filings.

- Access the affidavit form, which can typically be found on the Colorado Department of Revenue's website.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the affidavit for any errors or omissions before submitting it.

- Sign the affidavit electronically or in ink, depending on submission requirements.

- Submit the completed affidavit to the appropriate state office, either online or by mail.

Legal Use of the Affidavit of C Corporation Tax Filing

The Affidavit of C Corporation Tax Filing has legal significance as it verifies the corporation's adherence to tax laws. It may be used in legal proceedings to demonstrate compliance or to contest any disputes regarding tax obligations. Properly executed affidavits can protect the corporation from penalties and legal issues related to tax filings. It is crucial to ensure that the affidavit is completed in accordance with state laws to maintain its legal validity.

State-Specific Rules for the Affidavit of C Corporation Tax Filing

Each state may have unique requirements for the Affidavit of C Corporation Tax Filing. In Colorado, it is important to be aware of specific filing deadlines, required documentation, and any additional forms that may need to be submitted alongside the affidavit. Familiarizing yourself with these rules can help ensure compliance and avoid potential penalties. It's advisable to consult the Colorado Department of Revenue or a tax professional for the most current regulations.

Required Documents for the Affidavit of C Corporation Tax Filing

To complete the Affidavit of C Corporation Tax Filing, certain documents are typically required:

- Tax identification number of the corporation.

- Financial statements for the relevant tax year.

- Previous tax returns filed by the corporation.

- Any additional documentation requested by the Colorado Department of Revenue.

Filing Deadlines for the Affidavit of C Corporation Tax Filing

Timely filing of the Affidavit of C Corporation Tax Filing is crucial to avoid penalties. In Colorado, the affidavit must be submitted by the designated deadline, which is typically aligned with the corporation's tax return due date. Corporations should be aware of their specific filing schedule and any extensions that may apply. Keeping track of these deadlines ensures compliance with state tax laws.

Quick guide on how to complete affidavit of c corporation tax filing coloradogov colorado

Effortlessly prepare Affidavit Of C Corporation Tax Filing Colorado gov Colorado on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Affidavit Of C Corporation Tax Filing Colorado gov Colorado on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Affidavit Of C Corporation Tax Filing Colorado gov Colorado with ease

- Obtain Affidavit Of C Corporation Tax Filing Colorado gov Colorado and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Affidavit Of C Corporation Tax Filing Colorado gov Colorado and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit of c corporation tax filing coloradogov colorado

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is a Colorado affidavit tax filing?

A Colorado affidavit tax filing is a legal document that verifies information related to tax submissions in the state of Colorado. It is essential for ensuring compliance with state regulations and can help prevent issues with your tax filings. Using platforms like airSlate SignNow can simplify the process of creating and submitting these affidavits.

-

How does airSlate SignNow assist with Colorado affidavit tax filing?

airSlate SignNow provides an efficient and user-friendly platform to eSign and manage your Colorado affidavit tax filing documents. With easy document templates and the ability to track your filings, you can streamline the process and focus on other essential business tasks. This simplifies compliance and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Colorado affidavit tax filing?

Yes, airSlate SignNow offers different pricing plans tailored to cater to businesses of various sizes. The cost is competitive and reflects the features offered, including unlimited document signing and custom workflows for your Colorado affidavit tax filing. A free trial is available, allowing you to test the service before committing.

-

Can I integrate airSlate SignNow with other software for Colorado affidavit tax filing?

Absolutely! airSlate SignNow seamlessly integrates with various business applications like CRM systems and accounting software to enhance your Colorado affidavit tax filing process. Integrations help ensure that all necessary data and documentation are correlated efficiently, saving time and effort.

-

What features does airSlate SignNow offer for streamlining Colorado affidavit tax filing?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and real-time tracking for your Colorado affidavit tax filing documents. These features make it easy to manage your filings, reduce paper usage, and ensure every aspect of the submission process is covered efficiently.

-

How secure is the Colorado affidavit tax filing process with airSlate SignNow?

The security of your documents is a top priority for airSlate SignNow. We utilize advanced encryption and security measures to protect your Colorado affidavit tax filing and personal information. You can trust that your data will remain secure and confidential throughout the entire process.

-

Can airSlate SignNow help with remote teams managing Colorado affidavit tax filing?

Yes, airSlate SignNow is designed for remote collaboration, making it easy for teams to manage Colorado affidavit tax filing from anywhere. Team members can access documents, eSign, and make necessary changes in real-time, ensuring that everyone stays aligned regardless of their location.

Get more for Affidavit Of C Corporation Tax Filing Colorado gov Colorado

- Reporting guide for laser light shows and displays form

- Answer jd hm 5 ct eviction guide for renters form

- Name of person or organisation you are paying form

- Rehearing request illinois unemployment insurance act ibis form

- Santander for intermediaries home form

- Lincoln fire amp rescue form

- Letter of phlebotomy experience for california certification 476770030 form

- Telephone 209 468 6818 form

Find out other Affidavit Of C Corporation Tax Filing Colorado gov Colorado

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors