Nc3 Form 2018

What is the NC-3 Form

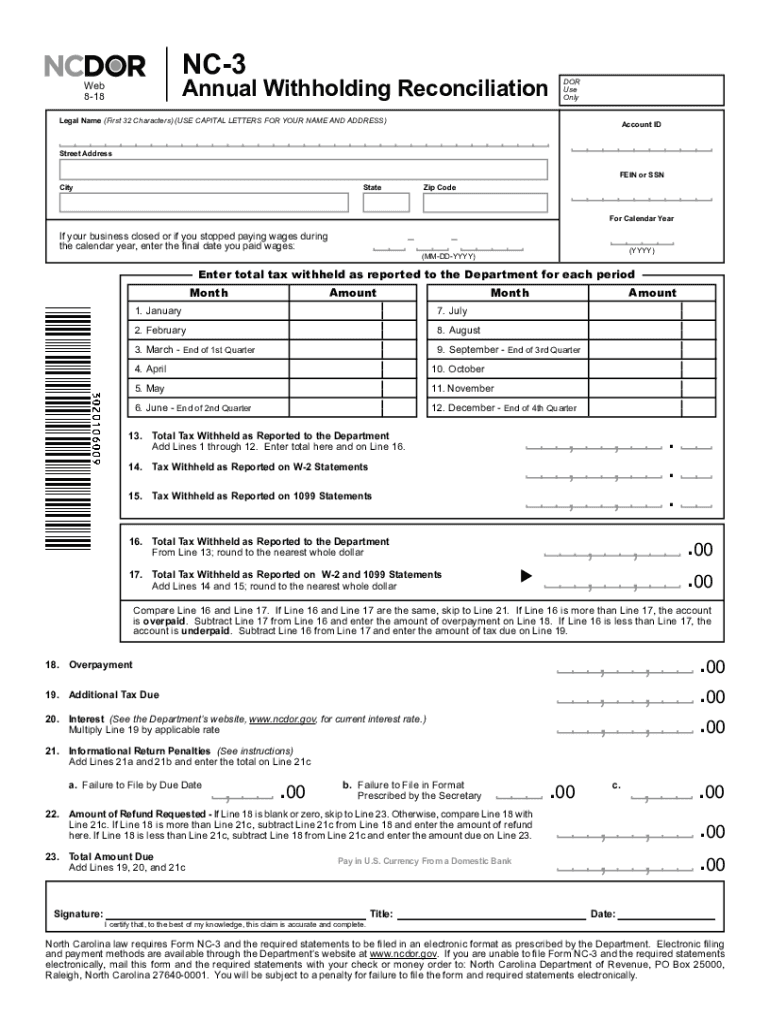

The NC-3 form, officially known as the NC Annual Withholding Reconciliation Form, is a document used by employers in North Carolina to report and reconcile the state income tax withheld from employees' wages throughout the year. This form is essential for ensuring compliance with state tax regulations and provides a summary of the total amount withheld, which is then submitted to the North Carolina Department of Revenue.

How to use the NC-3 Form

To effectively use the NC-3 form, employers must gather all relevant payroll data for the calendar year. This includes the total wages paid, the total amount of state income tax withheld, and the number of employees. The form serves as a summary that consolidates this information, allowing employers to report their withholding accurately. After completing the form, it must be submitted along with any required payments to the North Carolina Department of Revenue.

Steps to complete the NC-3 Form

Completing the NC-3 form involves several key steps:

- Gather payroll records for the year, including total wages and withholding amounts.

- Fill out the NC-3 form with the required information, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the NC-3 form electronically or via mail to the North Carolina Department of Revenue by the specified deadline.

Legal use of the NC-3 Form

The NC-3 form is legally binding when completed and submitted according to North Carolina tax laws. Employers must ensure that the information provided is accurate and reflects the withholding amounts reported on individual employee W-2 forms. Failure to comply with the legal requirements associated with this form can result in penalties and interest charges from the state.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the NC-3 form to avoid penalties. Typically, the form is due by January 31 of the following year after the tax year ends. It is important to check for any updates or changes to deadlines that may occur due to legislative changes or state announcements.

Form Submission Methods (Online / Mail / In-Person)

The NC-3 form can be submitted through various methods, providing flexibility for employers. The options include:

- Online Submission: Employers can file the form electronically through the North Carolina Department of Revenue’s online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Employers may also choose to deliver the form in person at designated Department of Revenue offices.

Quick guide on how to complete nc3 form

Effortlessly Complete Nc3 Form on Any Device

Digital document management has become increasingly favored among organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Nc3 Form from any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Nc3 Form Effortlessly

- Find Nc3 Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the document or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Nc3 Form while ensuring clear communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc3 form

Create this form in 5 minutes!

How to create an eSignature for the nc3 form

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the NC annual withholding reconciliation form?

The NC annual withholding reconciliation form is a document used to report and reconcile payroll withholding tax information for North Carolina employers. This form helps ensure accurate tax reporting and compliance with state laws. Proper completion of this form can prevent penalties and ensure that your business maintains good standing with the state.

-

How can airSlate SignNow help with the NC annual withholding reconciliation form?

airSlate SignNow simplifies the process of completing and submitting the NC annual withholding reconciliation form. With our easy-to-use eSigning solution, users can quickly fill out and send this form securely, ensuring timely compliance. This not only saves time but also reduces the risk of errors that can occur with manual processing.

-

Is there a cost for using airSlate SignNow for the NC annual withholding reconciliation form?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes looking to manage their NC annual withholding reconciliation form efficiently. Our subscription model ensures you only pay for what you need, making it a cost-effective solution for eSigning and document management. Visit our pricing page to find the plan that suits your needs.

-

What features does airSlate SignNow offer for managing forms like the NC annual withholding reconciliation form?

airSlate SignNow includes features such as template management, secure document storage, and advanced eSignature options that can streamline the handling of the NC annual withholding reconciliation form. Our platform also allows for easy collaboration among team members, ensuring everyone involved can access and review necessary information. These features enhance efficiency and accuracy in your document workflows.

-

Can I integrate airSlate SignNow with other software for managing the NC annual withholding reconciliation form?

Yes, airSlate SignNow offers seamless integrations with a variety of software applications that can enhance your workflow related to the NC annual withholding reconciliation form. Whether you use accounting software, customer relationship management (CRM) systems, or other business tools, our platform can be connected for streamlined document management. Check our integrations page for a list of compatible applications.

-

How does airSlate SignNow ensure the security of my NC annual withholding reconciliation form?

airSlate SignNow prioritizes the security of your documents, including the NC annual withholding reconciliation form, with encryption methods and secure storage. We adhere to industry-standard security protocols to protect sensitive information from unauthorized access. With our platform, you can confidently sign and share documents while knowing that your data is safeguarded.

-

What are the benefits of using airSlate SignNow for the NC annual withholding reconciliation form?

Using airSlate SignNow for the NC annual withholding reconciliation form offers numerous benefits, including faster processing times, enhanced accuracy, and reduced paper consumption. Our digital solution allows for real-time tracking of document status, ensuring you stay informed throughout the submission process. Overall, it leads to increased efficiency for your business operations.

Get more for Nc3 Form

- Courts ohio form

- Court of common pleas franklin county ohio form

- Court of common pleas hamilton co org form

- 021 waiver of notice of probate of will butler county probate court butlercountyprobatecourt form

- Cuyahoga probate court form

- 49 and sup form

- Ohio traffic tickets ampamp violationsdmv org form

- Motor vehicle services us armed forces affidavit form

Find out other Nc3 Form

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile