Nc 3 Form 2018-2026

What is the NC-3 Form?

The NC-3 form, officially known as the North Carolina Annual Withholding Reconciliation, is a crucial document for employers in North Carolina. It is used to report the state income tax withheld from employees' wages throughout the year. This form consolidates the total amount of withholding and ensures compliance with state tax laws. By accurately completing the NC-3 form, employers can fulfill their legal obligations and provide necessary information to the North Carolina Department of Revenue.

Steps to Complete the NC-3 Form

Completing the NC-3 form involves several key steps to ensure accuracy and compliance. First, gather all relevant payroll records for the year, including total wages paid and the amount of state income tax withheld. Next, fill in the employer information section, including the employer's name, address, and identification number. Then, report the total wages and the total withholding amounts in the designated fields. Finally, review the completed form for any errors before submitting it to the North Carolina Department of Revenue.

How to Obtain the NC-3 Form

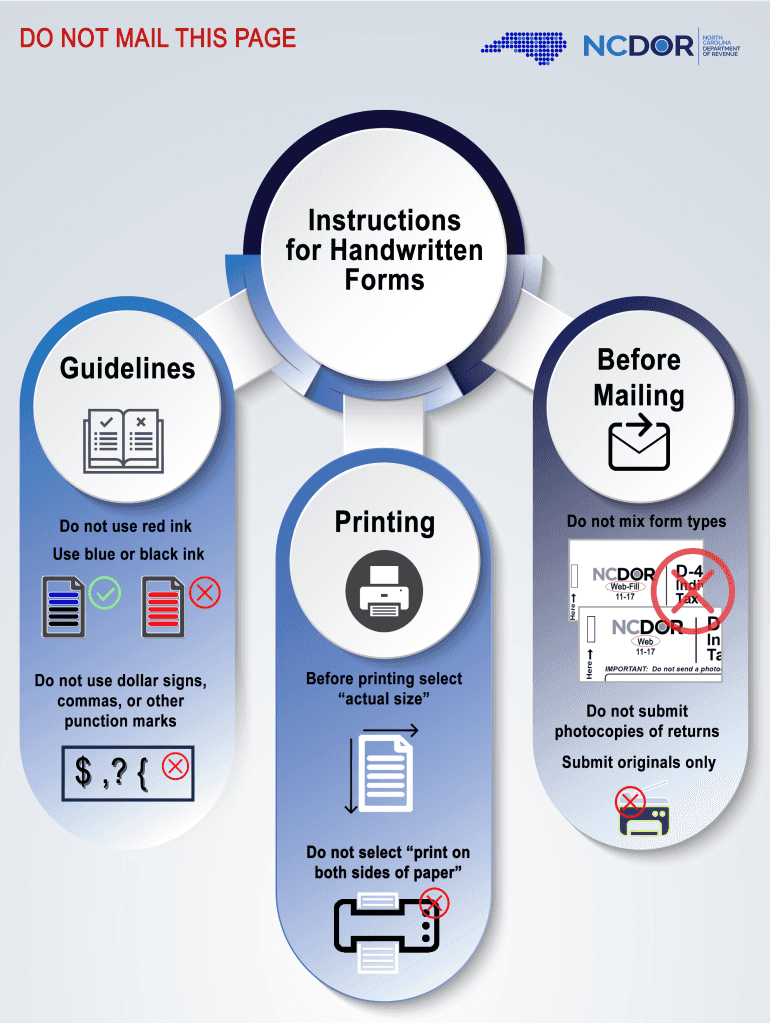

The NC-3 form can be easily obtained from the North Carolina Department of Revenue's official website. It is available as a downloadable PDF, which can be printed and filled out by hand, or it can be completed electronically using compatible software. Employers may also request a physical copy through mail or visit their local revenue office to pick up a form in person. Ensuring you have the correct version of the form is essential for compliance with current tax regulations.

Filing Deadlines / Important Dates

Employers must be aware of important deadlines related to the NC-3 form to avoid penalties. The form is typically due by January 31 of the following year for the previous calendar year's withholding. It is essential to submit the NC-3 form along with any accompanying payment to ensure compliance with state tax laws. Employers should also keep track of any changes in deadlines that may occur due to state regulations or special circumstances.

Required Documents

To complete the NC-3 form accurately, employers need to gather specific documents. These include payroll records for the entire year, which detail employee wages and the amounts withheld for state income tax. Additionally, employers should have their Employer Identification Number (EIN) readily available, as it is required on the form. Keeping organized records will facilitate a smoother filing process and help ensure compliance with North Carolina tax regulations.

Legal Use of the NC-3 Form

The NC-3 form serves a legal purpose by ensuring that employers report their withholding accurately to the state. It is a requirement under North Carolina law for all employers who withhold state income tax from their employees' wages. Failure to file the NC-3 form or submitting inaccurate information can result in penalties and interest charges. Therefore, understanding the legal implications of this form is essential for all employers operating in North Carolina.

Digital vs. Paper Version

Employers have the option to submit the NC-3 form either digitally or via paper. The digital version allows for easier completion and submission, often through compatible tax software that can streamline the process. This method can reduce errors and save time. Conversely, the paper version may be preferred by those who are less comfortable with technology. Regardless of the method chosen, it is important to ensure that the form is completed accurately and submitted by the deadline.

Quick guide on how to complete nc 3 fillable form 2018 2019

Your assistance manual on how to prepare your Nc 3 Form

If you’re looking to discover how to generate and submit your Nc 3 Form, here are some concise guidelines on how to simplify tax submissions.

Initially, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to modify, create, and finalize your income tax paperwork with ease. Utilizing its editor, you can navigate between text, checkboxes, and electronic signatures, and return to adjust responses when necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing features.

Follow the instructions below to finalize your Nc 3 Form in just a few minutes:

- Establish your account and start editing PDFs within moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your Nc 3 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper submissions can lead to increased return errors and delayed reimbursements. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nc 3 fillable form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Actually I want to fill out my JEE Advanced application form and I belong to OBC-NCL, but my NCL certificate is applicable only until 31st of March 2018. What should I do now?

u can quickly get new one by showing old one and request them to do as soon as possible

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the nc 3 fillable form 2018 2019

How to generate an eSignature for your Nc 3 Fillable Form 2018 2019 online

How to generate an electronic signature for the Nc 3 Fillable Form 2018 2019 in Chrome

How to make an electronic signature for signing the Nc 3 Fillable Form 2018 2019 in Gmail

How to create an eSignature for the Nc 3 Fillable Form 2018 2019 from your smart phone

How to create an eSignature for the Nc 3 Fillable Form 2018 2019 on iOS

How to create an eSignature for the Nc 3 Fillable Form 2018 2019 on Android

People also ask

-

What is the NC 3 Form and how is it used?

The NC 3 Form is a crucial document used for reporting certain tax-related information in North Carolina. With airSlate SignNow, you can easily fill out, sign, and send the NC 3 Form electronically, streamlining your filing process and ensuring compliance.

-

How does airSlate SignNow simplify the process of completing the NC 3 Form?

AirSlate SignNow provides an intuitive interface that makes it easy to complete the NC 3 Form quickly. Our platform allows users to fill out fields, add electronic signatures, and securely send documents, all in one place, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the NC 3 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that best fits your requirements for managing the NC 3 Form and other documents, ensuring you get cost-effective solutions without compromising on features.

-

What features does airSlate SignNow offer for managing the NC 3 Form?

AirSlate SignNow includes features such as templates for the NC 3 Form, customizable fields, and secure storage. Additionally, you can track the status of your documents in real-time, making it easy to manage your filings efficiently.

-

Can I integrate airSlate SignNow with other applications while using the NC 3 Form?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This functionality enhances your workflow by allowing you to access and manage the NC 3 Form alongside your other business tools.

-

What are the benefits of using airSlate SignNow for the NC 3 Form?

Using airSlate SignNow for the NC 3 Form provides several benefits, including faster processing times, reduced errors, and improved document security. Our electronic signing solution ensures that your tax documents are handled efficiently and securely.

-

Is airSlate SignNow compliant with regulations for the NC 3 Form?

Yes, airSlate SignNow is designed to comply with relevant regulations, ensuring that your use of the NC 3 Form meets all legal requirements. Our platform employs advanced security measures to protect your sensitive information throughout the signing process.

Get more for Nc 3 Form

- Opt out form

- Cancel transfer of names in ration card southgoa gov form

- Simclaim case 1 2 form

- Iht416 form

- Ia 1041 fiduciary return form

- Anti steering loan options disclosure interbank form

- Dbpr ddc 227 florida department of business and professional form

- City of daytona beach shores building permit application form

Find out other Nc 3 Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement