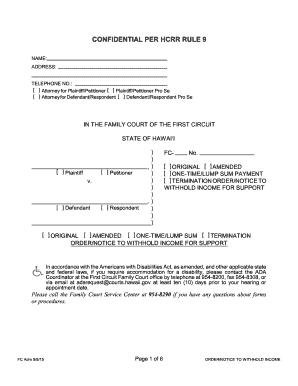

Rule 9 Hcrr Form

What is the Rule 9 Hcrr

The Rule 9 Hcrr is a legal form used primarily within the context of tax withholding and compliance. It is designed to assist individuals and businesses in reporting and managing their income withholding obligations accurately. This form plays a crucial role in ensuring that the correct amounts are withheld from payments made to employees or contractors, thereby helping to maintain compliance with federal and state tax regulations.

How to use the Rule 9 Hcrr

Using the Rule 9 Hcrr involves several key steps. First, gather all necessary information related to the income being reported, including the amounts and the recipients. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to review the information for accuracy before submission. Once completed, the form can be submitted to the appropriate tax authority, either electronically or via mail, depending on the specific requirements outlined by the IRS or state regulations.

Steps to complete the Rule 9 Hcrr

Completing the Rule 9 Hcrr requires careful attention to detail. Follow these steps:

- Collect necessary documentation, such as payment records and recipient information.

- Access the Rule 9 Hcrr form, available in both digital and printable formats.

- Fill in the required fields with accurate information, including names, addresses, and amounts.

- Review the completed form for any errors or omissions.

- Submit the form according to the guidelines provided by the relevant tax authority.

Legal use of the Rule 9 Hcrr

The legal use of the Rule 9 Hcrr is essential for maintaining compliance with tax laws. This form must be filled out correctly to ensure that withholding amounts are appropriate and that all parties involved are accurately represented. Failing to use the form properly can lead to penalties, including fines or additional scrutiny from tax authorities. It is advisable to consult legal or tax professionals if there are uncertainties regarding the form's use.

Key elements of the Rule 9 Hcrr

Several key elements define the Rule 9 Hcrr. These include:

- Recipient Information: Accurate details about the individual or entity receiving payments.

- Payment Amounts: Clear reporting of the total amounts subject to withholding.

- Withholding Rates: Specification of the applicable withholding rates based on current tax laws.

- Signature: Required signatures to validate the information provided on the form.

Form Submission Methods

The Rule 9 Hcrr can be submitted through various methods, catering to different preferences and requirements. These methods include:

- Online Submission: Many tax authorities allow electronic filing of the Rule 9 Hcrr, which can expedite processing times.

- Mail: The form can be printed and sent via postal service to the appropriate tax office.

- In-Person Submission: Some individuals may prefer to deliver the form directly to local tax offices, ensuring immediate receipt.

Quick guide on how to complete rule 9 hcrr

Accomplish Rule 9 Hcrr effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly and without delays. Handle Rule 9 Hcrr on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Rule 9 Hcrr without effort

- Find Rule 9 Hcrr and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and press the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Rule 9 Hcrr to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rule 9 hcrr

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the significance of rule 9 hcrr in document management?

The rule 9 hcrr plays a crucial role in outlining the electronic submission requirements for documents. Understanding this rule ensures compliance, which is vital for businesses that rely on digital document management systems, such as airSlate SignNow.

-

How does airSlate SignNow comply with rule 9 hcrr?

AirSlate SignNow complies with rule 9 hcrr by providing secure and accurate eSigning capabilities that meet legal standards. This compliance helps businesses avoid potential pitfalls and ensures that their electronic documents are recognized legally.

-

What features does airSlate SignNow offer to support rule 9 hcrr compliance?

AirSlate SignNow offers features such as audit trails, secure storage, and customizable workflows that support adherence to rule 9 hcrr. These features enable users to track changes, maintain document integrity, and ensure that all signatures are legally binding.

-

Is there a pricing plan that fits businesses needing to comply with rule 9 hcrr?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate various business needs, including those requiring compliance with rule 9 hcrr. By selecting a plan that fits your budget, you can access essential features for effective document management.

-

What benefits does airSlate SignNow provide for businesses working under rule 9 hcrr?

By using airSlate SignNow, businesses benefit from streamlined document workflows, enhanced security, and improved compliance under rule 9 hcrr. This leads to increased efficiency in handling documents while ensuring legal standards are met.

-

Can airSlate SignNow integrate with other tools to ensure compliance with rule 9 hcrr?

Absolutely! AirSlate SignNow integrates seamlessly with various software tools, providing a cohesive platform for document management to ensure compliance with rule 9 hcrr. This integration allows businesses to enhance their workflow and maintain high standards of documentation.

-

How can I get started with airSlate SignNow for rule 9 hcrr compliance?

Getting started with airSlate SignNow for rule 9 hcrr compliance is simple. You can sign up for a free trial to explore the features that help you meet legal requirements, and quickly implement the solution into your business processes.

Get more for Rule 9 Hcrr

- Casa cheque requisition form 1 casa casajmsb casajmsb

- Head office dynamic funds tower 1 adelaide st e form

- Income support application application for income support completed by applicants and given to alberta employment immigration form

- Date received stamp office use onlybach audiolog form

- Toronto fire services emergency patient care scenario form

- Www uslegalforms comform library479436 earlyearly childhood educator application renewal fill and

- C078 direct deposit request change for worker wcb form

- Lmc referral form fill online printable fillable blank

Find out other Rule 9 Hcrr

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast