Do Not File Form CT 8857 with Your Tax Return Ct

Understanding the Penalty Code 11c and N11c

The penalty code 11c, often referred to as n11c, is a specific designation used in the context of tax payments in the United States. This code is associated with penalties for late filing or payment of taxes, particularly in relation to TDS returns. Understanding the implications of the 11c and n11c codes is crucial for individuals and businesses to ensure compliance with tax regulations and avoid unnecessary penalties.

Legal Validity of the 11c and N11c Forms

When dealing with the 11c for tax payment, it is essential to recognize that electronic documents can be legally binding if they meet specific criteria. The use of reliable digital tools, such as signNow, ensures that the execution of these forms adheres to legal standards. Compliance with the ESIGN Act and UETA is vital for the legitimacy of electronic signatures, making it important to choose a platform that guarantees these legal protections.

Steps to Complete the N11c Form Online

Completing the n11c form online involves several straightforward steps to ensure accuracy and compliance:

- Access the n11c form through a secure digital platform.

- Fill in the required information, ensuring all fields are accurately completed.

- Review the form for any errors or omissions before submission.

- Utilize electronic signature features to sign the document securely.

- Submit the completed form as directed by the platform or regulatory body.

Key Elements of the N11c Penalty Code

The n11c penalty code encompasses several key elements that taxpayers should be aware of:

- It specifies the penalties associated with late filings or payments.

- It outlines the conditions under which these penalties apply.

- It provides guidelines for taxpayers on how to address potential penalties.

Penalties for Non-Compliance with the N11c Code

Failure to comply with the n11c penalty code can result in significant consequences, including financial penalties and interest on overdue amounts. Understanding the potential ramifications of non-compliance is essential for taxpayers to avoid costly mistakes. It is advisable to stay informed about deadlines and requirements to ensure timely submissions and avoid penalties.

IRS Guidelines for the N11c Form

The IRS provides specific guidelines regarding the use of the n11c form, emphasizing the importance of accurate reporting and timely submissions. Taxpayers should familiarize themselves with these guidelines to ensure compliance and minimize the risk of penalties. Staying updated on IRS regulations can aid in effective tax planning and management.

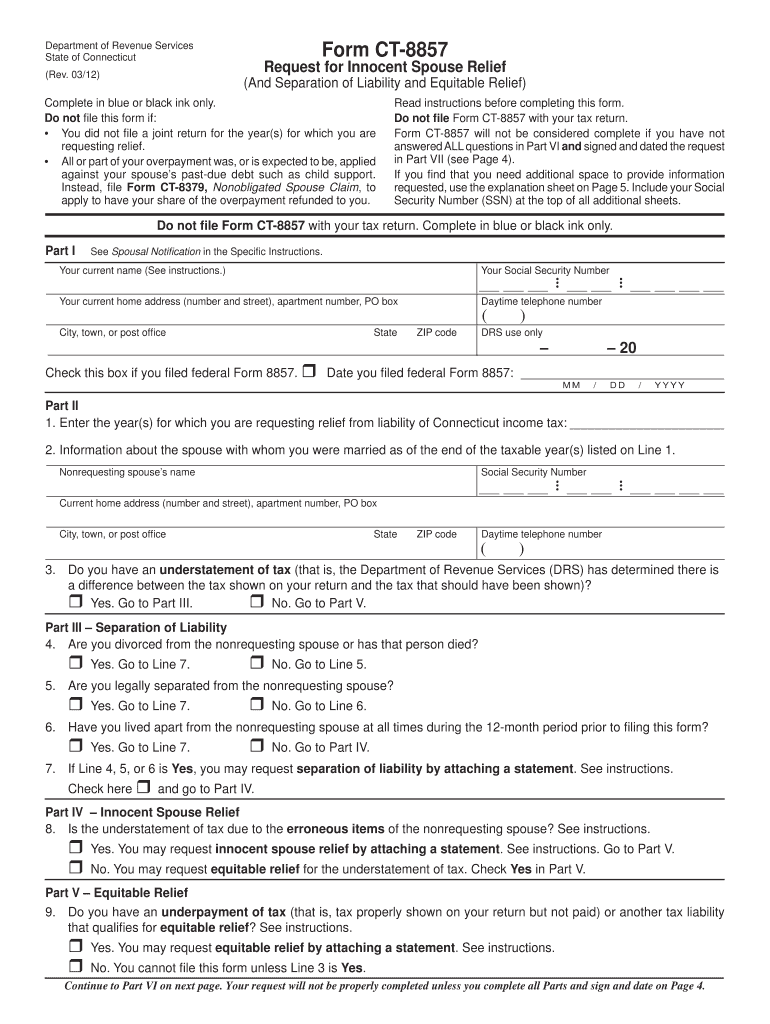

Quick guide on how to complete do not file form ct 8857 with your tax return ct

Complete Do Not File Form CT 8857 With Your Tax Return Ct effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documentation, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents swiftly without delays. Manage Do Not File Form CT 8857 With Your Tax Return Ct on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Do Not File Form CT 8857 With Your Tax Return Ct with ease

- Find Do Not File Form CT 8857 With Your Tax Return Ct and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from your preferred device. Modify and eSign Do Not File Form CT 8857 With Your Tax Return Ct and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do you know where to file your tax return forms?

The proposed GST (goods and services tax) regime is likely to provide for monthly filing of returns for business to business dealings through a set of eight forms for different categories of transactions.The joint committee on Business Process for GST in relation to GST Return has suggested filing of a periodic e-return for Central GST, State GST and Integrated GST.According to the proposal, the returns can be filed on a specific date of a month, like on 10th of next month for outward supplies, 15th for inward supplies and 20th in case of monthly returns.The Committee suggested that in the GST regime there should be eight forms for filing of returns by tax payers.There will also be provision for filing of GST returns by non-resident tax payers in form GSTR-5. Non-resident tax payers could include taxi aggregators like Uber.The report also said there will be a defaulters list of those who will be failing to file returns periodically and such details would be forwarded to GST authorities for necessary action.The Joint Committee also suggested that the GST law should provide for automatic imposition of late fees for non-filers and late filers of returns.In case the return is filed without full payment of taxes, the report said they should be rendered invalid. There will, however, no provision for revision of GST returns.The Finance Ministry had earlier put up three reports of the Empowered Committee, pertaining to registration, payment process and refunds in the GST regime in the public domain for stakeholder comments.The proposed GST envisages taxation of the same taxable event — supply of goods and services, simultaneously by both the Centre and the states.GST seeks to subsume many indirect taxes at the Central and state levels.Although the government had planned to roll out the GST — touted as the most comprehensive indirect tax reform since the independence — from April 1, it seems difficult as the Constitution Amendment Bill is stuck in the Rajya Sabha where the ruling NDA does not have a majority.The government, however, is going ahead with the preparatory work necessary for smooth implementation of the GST, which will subsume various levies like excise, service tax, sales tax, octroi, etc, and will ensure a single indirect tax regime for the entire country.

-

While paying eTax and filling out a tax return file, it asked me to put a code for 11c or N11c. What should I do with this option?

Hello Sir,In my opinonCode 11c: for Penalty in the normal proceedings, where the order is issued after giving proper noticeCode N11c: Penalty under IDS can be classified in this code, since the Form 2 can be treated as order [ so that it can be interpreted as order other than under Sec 271(1)(c) ]If you have nothing to do with these, you can ignore and fill the remaining and submit.

-

How do I file the Income Tax return (ITR) in India if my employer has not provided me with Form 16?

Ideally, an employer should provide form 16 to their employees. However, in case you have not been provided with the same, the first thing you need to do is to verify if the taxes deducted from your salary have been deposited by the company or not. For this, register for an account with the income tax e-filing website. You will have the option to view Form 26AS or tax credit form. This form will have the details of all TDS that has been deposited against your PAN, included taxes deducted by your bank, if any.If everything is in order, then pick up your salary slips and tabulate them line by line in any spreadsheet. Tabulate it will full break up as there are certain exemptions and deductions.The common exemption and deduction from salary income are:House rent allowanceConveyance allowance (not available after AY 2018–19)Medical reimbursement (not available after AY 2018–19)Food couponsTelephone reimbursementProfessional taxProvident fundIf you have any of these components in your salary, check their treatment for tax purposes (refer cleartax website or other answers here on Quora). Remember to add the interest income from your bank deposits and capital gains from bonds, mutual funds, and stocks, if any. Calculate your total income taking all these into account.Now fill out the return form using this spreadsheet.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

What do I do now, that I did not sent the ITR-V form along with the supporting documents to the specified address, when I filed the income tax return for year 2014-15 on 05-Aug-2014?

You do not need to send any documents along with ITR V. You have 120 days from the date of return filling to send it. Your time expired on 3rd or 4th December.Your best option now is to send ITR V immediately and drop a mail to IT dept. You may have received reminders in your email. Check your email for any possible extensions they may have given. You can also call their helpline number and enquire about possible recourse. Income tax dept. is not very strict with salaried individuals, especially if you have paid your taxes. So you do not need to worry much. But resolve this as soon as possible and be more careful in future.

Create this form in 5 minutes!

How to create an eSignature for the do not file form ct 8857 with your tax return ct

How to generate an electronic signature for your Do Not File Form Ct 8857 With Your Tax Return Ct in the online mode

How to make an electronic signature for your Do Not File Form Ct 8857 With Your Tax Return Ct in Chrome

How to create an eSignature for signing the Do Not File Form Ct 8857 With Your Tax Return Ct in Gmail

How to make an electronic signature for the Do Not File Form Ct 8857 With Your Tax Return Ct from your smartphone

How to create an eSignature for the Do Not File Form Ct 8857 With Your Tax Return Ct on iOS

How to make an eSignature for the Do Not File Form Ct 8857 With Your Tax Return Ct on Android OS

People also ask

-

What does penalty code 11c or n11c refer to?

The penalty code 11c or n11c generally refers to specific charges in legal documentation, often associated with certain violations. Understanding this code is important when navigating legal scenarios, particularly when using platforms like airSlate SignNow to manage your documents.

-

How can airSlate SignNow help with documents related to penalty code 11c or n11c?

airSlate SignNow provides a straightforward way to send and eSign documents that may include details related to penalty code 11c or n11c. Utilizing our platform allows businesses to efficiently manage and sign documents while ensuring legal compliance.

-

What features does airSlate SignNow offer for managing penalty code 11c or n11c documents?

airSlate SignNow offers several features, including customizable templates, automated workflows, and robust security options, tailored specifically for documents involving penalty code 11c or n11c. These features ensure that your documents are professional, secure, and compliant.

-

Are there any pricing plans for airSlate SignNow that cater to penalty code 11c or n11c documentation needs?

Yes, airSlate SignNow offers flexible pricing plans that are suitable for organizations dealing with penalty code 11c or n11c documentation. Our affordable solutions are designed to meet the varying needs of businesses, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other tools for handling penalty code 11c or n11c related tasks?

Absolutely! airSlate SignNow integrates seamlessly with numerous business applications, enhancing your workflow for documents related to penalty code 11c or n11c. These integrations allow for streamlined processes and improved efficiency in managing your paperwork.

-

What are the benefits of using airSlate SignNow for penalty code 11c or n11c documentation?

Using airSlate SignNow for penalty code 11c or n11c documentation provides multiple benefits, including faster turnaround times, reduced errors in documentation, and increased security. These advantages make managing legal documents easier and more reliable for businesses.

-

Is there any customer support available for queries related to penalty code 11c or n11c?

Yes, airSlate SignNow offers robust customer support to assist with any queries related to penalty code 11c or n11c. Whether you need help with technical issues or advice on best practices, our dedicated support team is here to help.

Get more for Do Not File Form CT 8857 With Your Tax Return Ct

Find out other Do Not File Form CT 8857 With Your Tax Return Ct

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document