Delaware Form W1a9301 2018-2026

What is the Delaware Form W1A9301?

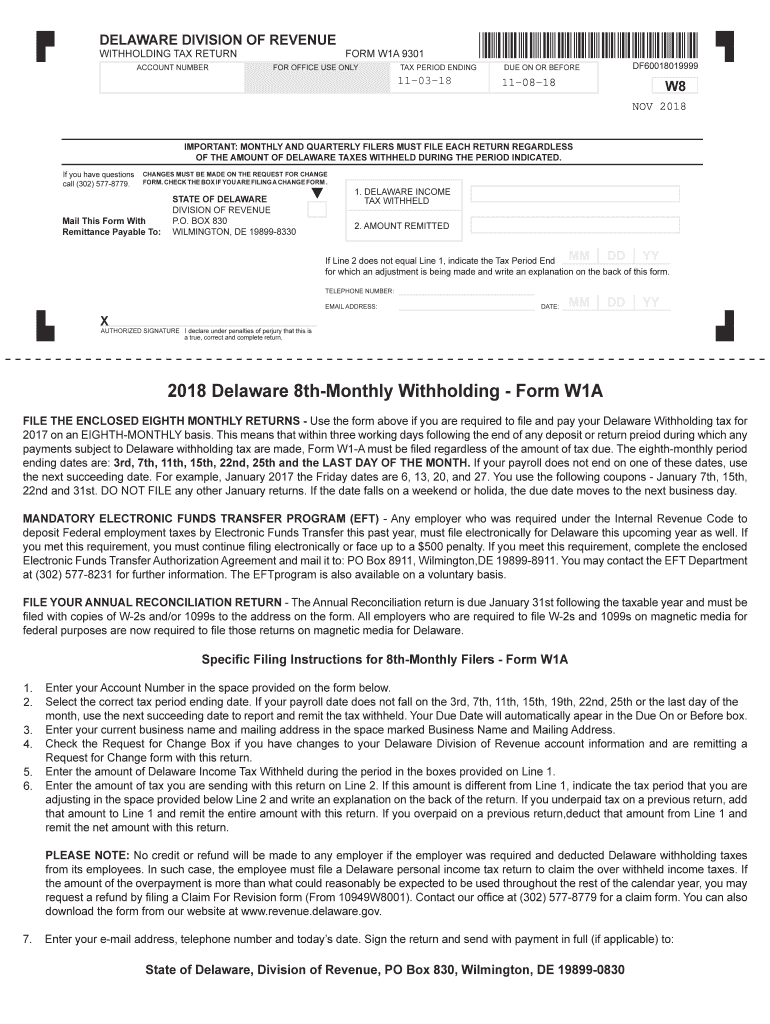

The Delaware Form W1A9301 is a withholding tax return form used by employers in the state of Delaware. It is specifically designed to report and remit income tax withheld from employees' wages. This form is essential for compliance with Delaware tax laws and ensures that employers fulfill their tax obligations accurately and on time. The W1A9301 form is typically used for reporting income tax withheld during the tax year, making it a crucial document for both employers and employees.

Steps to Complete the Delaware Form W1A9301

Completing the Delaware Form W1A9301 involves several key steps:

- Gather necessary information, including employer identification details and employee wage data.

- Fill out the form accurately, ensuring that all required fields are completed, such as employee names, social security numbers, and the amounts withheld.

- Review the form for any errors or omissions to avoid potential penalties.

- Submit the completed form to the Delaware Division of Revenue by the specified deadline.

Each step is crucial to ensure compliance and avoid delays in processing.

How to Obtain the Delaware Form W1A9301

The Delaware Form W1A9301 can be obtained directly from the Delaware Division of Revenue's website. It is available in a fillable format, allowing employers to complete it electronically. Additionally, physical copies can be requested through the Division of Revenue's office if needed. It is advisable to ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Legal Use of the Delaware Form W1A9301

The Delaware Form W1A9301 is legally binding when completed and submitted according to state regulations. Employers must ensure that the information provided is accurate and reflects the correct amounts withheld from employee wages. Failure to comply with the legal requirements associated with this form can result in penalties, including fines or interest on unpaid taxes. Therefore, understanding the legal implications of the form is essential for all employers operating in Delaware.

Form Submission Methods

The Delaware Form W1A9301 can be submitted through various methods:

- Online: Employers can file the form electronically through the Delaware Division of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Division of Revenue.

- In-Person: Employers may also submit the form in person at designated Division of Revenue offices.

Choosing the right submission method can help ensure timely processing and compliance with Delaware tax laws.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Delaware Form W1A9301. Typically, the form is due quarterly, with deadlines falling on the last day of the month following the end of each quarter. For example, the first quarter's filing would be due by April 30. It is essential to stay informed about these deadlines to avoid late fees and penalties.

Quick guide on how to complete delaware form w1a9301

Effortlessly create Delaware Form W1a9301 on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents quickly without delays. Manage Delaware Form W1a9301 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Truly the easiest way to edit and eSign Delaware Form W1a9301 seamlessly

- Obtain Delaware Form W1a9301 and then click Get Form to begin.

- Make use of the tools available to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal importance as a conventional ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Delaware Form W1a9301 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware form w1a9301

Create this form in 5 minutes!

How to create an eSignature for the delaware form w1a9301

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the form w1a 9301 2020 w8 and how can it be used?

The form w1a 9301 2020 w8 is a tax document used by foreign individuals or entities to signNow their status for tax withholding purposes. It ensures compliance with U.S. tax regulations and can be easily filled out and submitted using airSlate SignNow's intuitive platform.

-

How much does it cost to use airSlate SignNow for the form w1a 9301 2020 w8?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose from monthly or yearly subscriptions, making it a cost-effective solution for managing documents like the form w1a 9301 2020 w8 without hidden fees.

-

Can I integrate airSlate SignNow with other applications to manage the form w1a 9301 2020 w8?

Yes, airSlate SignNow supports numerous integrations with popular applications such as Google Drive, Salesforce, and more. This capability allows you to easily manage your workflow involving the form w1a 9301 2020 w8 alongside other tools you use.

-

What features does airSlate SignNow offer for managing the form w1a 9301 2020 w8?

airSlate SignNow provides a range of features including electronic signatures, templates, and document tracking for the form w1a 9301 2020 w8. These tools streamline the signing process and enhance organizational efficiency.

-

Is it safe to sign the form w1a 9301 2020 w8 using airSlate SignNow?

Absolutely, airSlate SignNow employs advanced security measures, including AES-256 bit encryption, to ensure that your documents, including the form w1a 9301 2020 w8, are protected. You can confidently sign and send documents knowing your data is secure.

-

How can airSlate SignNow simplify the process of filling out the form w1a 9301 2020 w8?

With airSlate SignNow, you can easily create and store templates for the form w1a 9301 2020 w8, minimizing the time spent on repetitious tasks. The platform's user-centric design makes it straightforward to fill out and save forms, enhancing your productivity.

-

What benefits can businesses gain from using airSlate SignNow for the form w1a 9301 2020 w8?

By using airSlate SignNow for the form w1a 9301 2020 w8, businesses can expedite document turnaround times, reduce paper usage, and improve overall efficiency. The ease of use and accessibility of the platform help ensure timely compliance with tax requirements.

Get more for Delaware Form W1a9301

- Equipment repair form

- Borang gcr terkini form

- Optavia health assessment form

- Optumrx medicare prior authorization form

- Ohio bmv form 4428

- Bbbee sworn affidavit small enterprise form

- Application for an encroachment license indianapolis indygov form

- Discretionary housing payment application form calderdale

Find out other Delaware Form W1a9301

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement