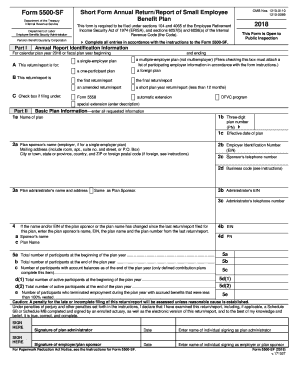

Internal Revenue Service 5500sf Form

What is the Internal Revenue Service 5500sf?

The Internal Revenue Service 5500sf form is a crucial document for certain employee benefit plans in the United States. It is primarily used to report information about the financial condition, investments, and operations of these plans. The 5500sf form is a simplified version of the standard Form 5500, designed for smaller plans that meet specific criteria. By filing this form, plan administrators comply with the Employee Retirement Income Security Act (ERISA) and Internal Revenue Code requirements, ensuring transparency and accountability in managing employee benefits.

Steps to Complete the Internal Revenue Service 5500sf

Completing the Internal Revenue Service 5500sf form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information regarding the benefit plan, including assets, liabilities, and plan operations. Next, fill out each section of the form accurately, paying close attention to the instructions provided by the IRS. It is essential to review the completed form for any errors or omissions before submission. Finally, submit the form electronically through the IRS e-file system or by mail, ensuring it is sent by the required deadline to avoid penalties.

Legal Use of the Internal Revenue Service 5500sf

The legal use of the Internal Revenue Service 5500sf form is governed by federal regulations that mandate its submission for certain employee benefit plans. Filing this form is not only a legal requirement but also serves to protect the rights of plan participants by providing transparency about the plan's financial status. To ensure compliance, it is crucial to adhere to the guidelines set forth by the IRS and ERISA, as failure to do so can result in penalties and increased scrutiny from regulatory agencies.

Filing Deadlines / Important Dates

Timely filing of the Internal Revenue Service 5500sf form is essential to avoid penalties. The standard deadline for filing is the last day of the seventh month after the plan year ends. For plans operating on a calendar year, this means the form is due by July 31. If additional time is needed, plan administrators can apply for an extension, which must be filed before the original deadline. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS announcements.

Required Documents

To accurately complete the Internal Revenue Service 5500sf form, several documents are required. These typically include financial statements, participant count, and information regarding plan assets and liabilities. Additionally, any amendments to the plan or changes in plan operations must be documented. Having these documents readily available will facilitate a smoother filing process and help ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Internal Revenue Service 5500sf form can be submitted through various methods, providing flexibility for plan administrators. The preferred method is electronic filing through the IRS e-file system, which allows for immediate processing and confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address, though this method may result in longer processing times. In-person submissions are generally not accepted for this form, making electronic filing the most efficient option.

Penalties for Non-Compliance

Failure to file the Internal Revenue Service 5500sf form by the deadline can result in significant penalties. The IRS imposes fines for late filings, which can accumulate daily until the form is submitted. Additionally, non-compliance may lead to increased scrutiny from regulatory agencies and potential legal repercussions. It is essential for plan administrators to understand these penalties and prioritize timely submission to avoid unnecessary costs and complications.

Quick guide on how to complete internal revenue service 5500sf

Complete Internal Revenue Service 5500sf seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents swiftly and efficiently. Handle Internal Revenue Service 5500sf on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Internal Revenue Service 5500sf effortlessly

- Obtain Internal Revenue Service 5500sf and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Internal Revenue Service 5500sf and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service 5500sf

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2018 5500 sf form?

The 2018 5500 sf form is an important document used for reporting information about employee benefit plans. It provides detailed insights into a plan's financial status, which is essential for compliance with federal regulations. Completing this form accurately ensures that you meet your legal obligations and helps you maintain transparency with participants.

-

How can I fill out the 2018 5500 sf form using airSlate SignNow?

Filling out the 2018 5500 sf form with airSlate SignNow is streamlined and user-friendly. You can easily upload the form, fill in the required fields, and sign it electronically. Our platform simplifies the entire process, ensuring that your document is completed accurately and efficiently.

-

What are the costs associated with using airSlate SignNow for the 2018 5500 sf form?

Our pricing for airSlate SignNow is competitive and offers cost-effective solutions tailored for businesses of all sizes. While basic plans start at an affordable rate, we also offer premium features that enhance your experience with the 2018 5500 sf form. You can choose a plan that best suits your document management needs.

-

Are there any key features of airSlate SignNow that aid in processing the 2018 5500 sf form?

Yes, airSlate SignNow offers a range of features that greatly assist in processing the 2018 5500 sf form. These include customizable templates, real-time tracking of document status, and automated reminders for signing. Such features streamline the workflow, making it easier to manage crucial documents.

-

Can airSlate SignNow integrate with other software to manage the 2018 5500 sf form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to efficiently manage the 2018 5500 sf form alongside your other business tools. Whether you use CRM systems or accounting software, our platform can enhance your productivity through these integrations.

-

What are the advantages of using airSlate SignNow for the 2018 5500 sf form?

Using airSlate SignNow for the 2018 5500 sf form has numerous advantages, including enhanced security for your documents and a user-friendly interface. This platform also saves time through its automated features, ensuring that your submissions are processed quickly. Moreover, the eSignature capability ensures compliance without compromising the speed of your operations.

-

Is it easy to track the status of my 2018 5500 sf form with airSlate SignNow?

Yes, tracking the status of your 2018 5500 sf form in airSlate SignNow is straightforward and efficient. Our platform provides real-time notifications and status updates, allowing you to monitor who has signed your document and when. This enhances your ability to manage deadlines and follow up as necessary.

Get more for Internal Revenue Service 5500sf

- Bhc tenancy application eras application instructi form

- Employee set up form hr 101 health service executivehr 101 c 19 health service executive1600 human resources hr form

- Assessment of professional competence apc mark sheet photo scsi form

- Application form nonsocial welfare servicespteo 1p

- Www hse ierequest to hire forms guidelinesrequest to hire forms ampamp guidelines hse ie

- Uas flight in controlled airspace application form

- Pregnancy at work risk assessment template form

- Application form for apprenticeship

Find out other Internal Revenue Service 5500sf

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple