Simplified Method Worksheet 2017-2026

What is the Simplified Method Worksheet

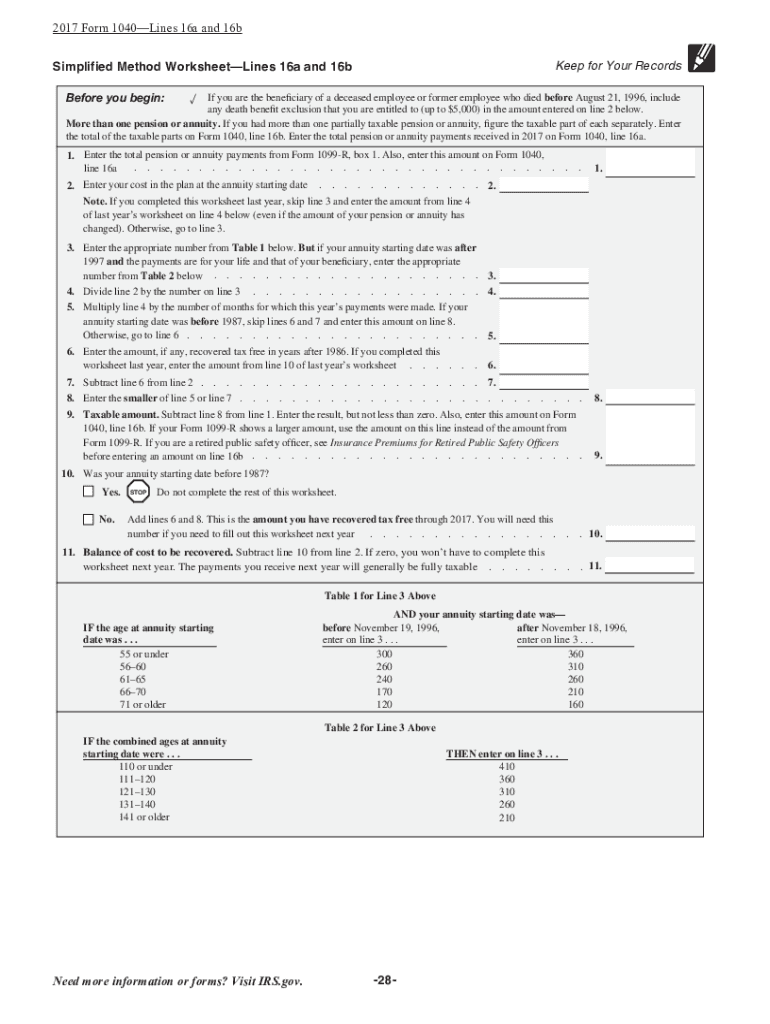

The Simplified Method Worksheet is a tool used primarily by taxpayers to determine the taxable portion of annuity payments received. This worksheet is particularly relevant for individuals who have received distributions from retirement accounts or annuities, as it provides a streamlined approach to calculating how much of the annuity payment is subject to income tax. The worksheet is designed to simplify the process, making it easier for taxpayers to comply with IRS regulations while ensuring accurate reporting of taxable income.

How to use the Simplified Method Worksheet

To effectively use the Simplified Method Worksheet, taxpayers should first gather relevant information, including the total amount of annuity payments received and the investment in the contract. The worksheet guides users through a series of calculations, helping them determine the exclusion ratio, which indicates the portion of each payment that is not taxable. By following the step-by-step instructions, individuals can accurately report their income on their tax returns, ensuring compliance with IRS guidelines.

Steps to complete the Simplified Method Worksheet

Completing the Simplified Method Worksheet involves several key steps:

- Gather necessary documents, including Form 1099-R, which reports distributions from retirement plans.

- Identify the total amount of annuity payments received during the tax year.

- Determine the total investment in the annuity contract, which is crucial for calculating the exclusion ratio.

- Follow the worksheet's instructions to calculate the exclusion ratio and the taxable amount of each payment.

- Record the results on your tax return, ensuring that the taxable portion is accurately reported.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Simplified Method Worksheet. Taxpayers must adhere to these guidelines to ensure compliance and avoid potential penalties. The IRS outlines the eligibility criteria for using this worksheet, including the types of annuities that qualify and the circumstances under which taxpayers can use the simplified approach. Familiarizing oneself with these guidelines is essential for accurate tax reporting and to maximize potential tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for tax returns are critical for taxpayers using the Simplified Method Worksheet. Generally, individual income tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure that they submit their forms on time to avoid late fees or penalties.

Required Documents

To complete the Simplified Method Worksheet accurately, several documents are required. Key documents include:

- Form 1099-R: This form reports distributions from pensions, annuities, retirement plans, and IRAs.

- Records of the total investment in the annuity contract, which is necessary for calculating the taxable portion.

- Any additional documentation related to other income sources that may affect tax calculations.

Eligibility Criteria

Eligibility to use the Simplified Method Worksheet is determined by specific criteria set forth by the IRS. Generally, taxpayers must have received annuity payments from a qualified retirement plan or contract. Additionally, the taxpayer must have a defined investment in the annuity, which is essential for determining the exclusion ratio. Understanding these criteria helps taxpayers determine if they can utilize the simplified approach for reporting their annuity income.

Quick guide on how to complete simplified method worksheet 2018

Effortlessly Prepare Simplified Method Worksheet on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files promptly and without complications. Manage Simplified Method Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Edit and eSign Simplified Method Worksheet Effortlessly

- Locate Simplified Method Worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details with specialized tools offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form – via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Simplified Method Worksheet while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct simplified method worksheet 2018

Create this form in 5 minutes!

How to create an eSignature for the simplified method worksheet 2018

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is a simplified method worksheet?

A simplified method worksheet is a tool designed to ease the process of managing and signing documents electronically. It allows users to streamline their document workflows efficiently, reducing time spent on manual tasks.

-

How does airSlate SignNow utilize the simplified method worksheet?

AirSlate SignNow incorporates the simplified method worksheet to enhance the user experience by allowing users to create, send, and eSign documents seamlessly. This feature aids in simplifying complex document processes, ensuring quicker turnaround times.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. Each plan includes access to the simplified method worksheet feature, allowing businesses to choose the option that fits their budget while enjoying essential functionality.

-

What features does the simplified method worksheet offer?

The simplified method worksheet includes features such as document editing, real-time collaboration, and automated reminders. These functionalities ensure that users can efficiently handle their electronic signing processes with minimal hassle.

-

Can the simplified method worksheet integrate with other software?

Yes, the simplified method worksheet can easily integrate with various third-party applications, enhancing your document management capabilities. This integration allows users to synchronize their workflows across different platforms without any interruptions.

-

What benefits does using a simplified method worksheet provide?

Using a simplified method worksheet can signNowly reduce the time spent on document management, allowing businesses to focus on core activities. Additionally, it improves accuracy and compliance in document handling, resulting in a more efficient workflow.

-

Is the simplified method worksheet user-friendly?

Absolutely! The simplified method worksheet is designed with user-friendliness in mind, ensuring that individuals of all skill levels can navigate and utilize its features without difficulty. Its intuitive layout promotes an effortless signing experience.

Get more for Simplified Method Worksheet

- Personal care home supplement form

- Evaluation formlayout 1 cod

- Tree diagram worksheet with answers pdf form

- 3 4 puzzle time answers form

- Excise tax application for abatement somervillema form

- Step 2 ptr functional behavior assessment summary table form

- Amended vcp application form and instructions texas tceq texas

- Stolen vehicle affidavit form

Find out other Simplified Method Worksheet

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract