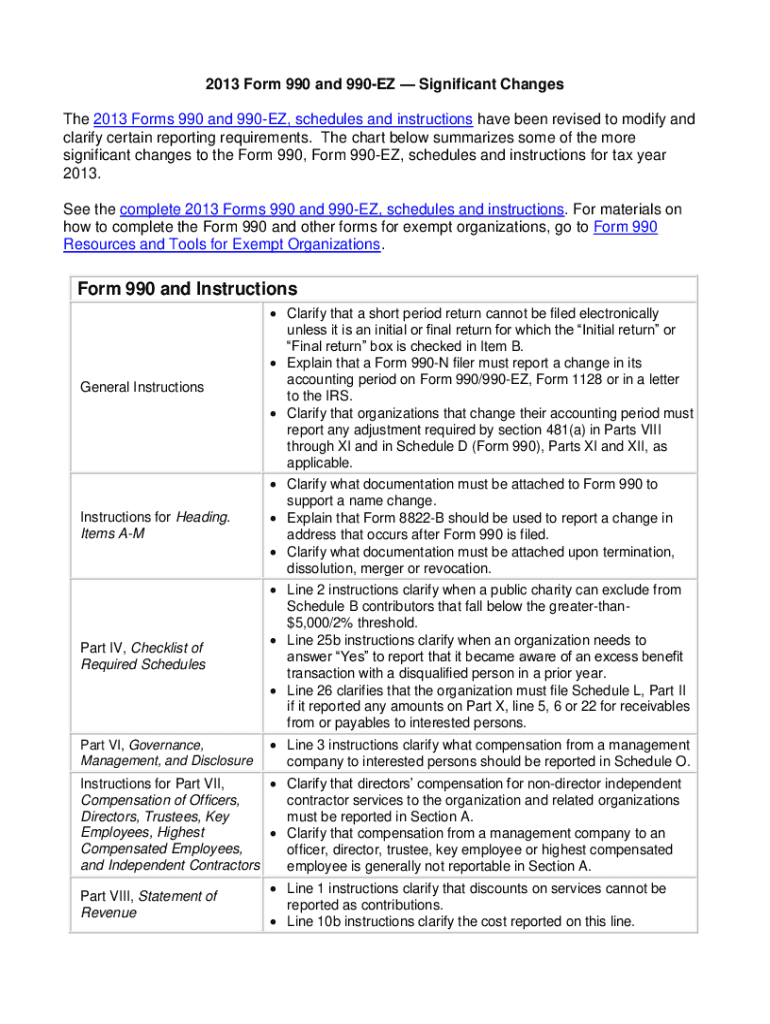

Irs Significant Form PDF 2013

What is the IRS 990 Schedule O?

The IRS 990 Schedule O is a supplementary document that provides additional information about an organization’s operations, governance, and financial activities. It is specifically designed for tax-exempt organizations that file Form 990 or 990-EZ. This schedule allows organizations to explain their mission, significant activities, and any changes in their programs or policies. By providing detailed insights, Schedule O helps the IRS and the public understand the organization’s purpose and how it fulfills its charitable mission.

Key Elements of the IRS 990 Schedule O

When completing the IRS 990 Schedule O, organizations should focus on several key elements:

- Mission Statement: A clear description of the organization’s purpose and goals.

- Significant Activities: Detailed explanations of major programs and services offered during the tax year.

- Changes in Operations: Information on any significant changes in the organization’s structure, programs, or policies.

- Financial Information: Insights into how funds are allocated and managed, including any notable financial challenges or achievements.

Steps to Complete the IRS 990 Schedule O

Completing the IRS 990 Schedule O involves several important steps:

- Gather Information: Collect all necessary documents, including the mission statement, program descriptions, and financial reports.

- Review Previous Filings: Look at past Schedule O submissions to ensure consistency and address any previous comments from the IRS.

- Draft Responses: Write clear and concise explanations for each section of the schedule, focusing on transparency and clarity.

- Consult with Stakeholders: Engage board members or key staff to review the draft and provide input.

- Finalize and Submit: Ensure all information is accurate, then submit the completed Schedule O along with the main Form 990 or 990-EZ.

Legal Use of the IRS 990 Schedule O

The IRS 990 Schedule O is legally required for tax-exempt organizations that file Form 990 or 990-EZ. It serves as an official document that provides transparency to the IRS and the public regarding the organization’s operations. Failure to complete and submit Schedule O can result in penalties or a loss of tax-exempt status. Organizations should ensure that the information provided is accurate and reflective of their current activities to maintain compliance with IRS regulations.

Filing Deadlines for the IRS 990 Schedule O

Organizations must adhere to specific filing deadlines for the IRS 990 Schedule O. Generally, the Form 990 and its schedules are due on the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December 31, the Form 990 and Schedule O would be due by May 15 of the following year. Organizations can apply for an extension, which may allow for an additional six months to file; however, this extension does not apply to any taxes owed.

Examples of Using the IRS 990 Schedule O

Organizations can utilize the IRS 990 Schedule O in various ways, including:

- Clarifying Program Impact: Providing detailed descriptions of how their programs have made a difference in the community.

- Addressing Changes: Explaining any shifts in operational focus or significant changes in governance.

- Enhancing Transparency: Building trust with donors and stakeholders by openly sharing financial and operational information.

Quick guide on how to complete irs significant form pdf

Effortlessly prepare Irs Significant Form Pdf on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Irs Significant Form Pdf on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related operation today.

How to edit and electronically sign Irs Significant Form Pdf with ease

- Obtain Irs Significant Form Pdf and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs Significant Form Pdf to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs significant form pdf

Create this form in 5 minutes!

How to create an eSignature for the irs significant form pdf

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is IRS Form 990 Schedule O?

IRS Form 990 Schedule O is used by organizations to provide additional information to the IRS regarding their tax-exempt status. Understanding what will IRS 990 Schedule O entails can help organizations present accurate information. This form is essential for transparency and can impact an organization's charitable status.

-

Why do I need to file IRS Form 990 Schedule O?

Filing IRS Form 990 Schedule O is crucial for nonprofit organizations to explain any changes in governance, financial practices, or policies. Understanding what will IRS 990 Schedule O require can help maintain compliance and inform stakeholders. It supports the organization's accountability to funders and the public.

-

How can airSlate SignNow assist with IRS 990 Schedule O documentation?

airSlate SignNow streamlines the signing and document management process, making it easier to prepare your IRS 990 Schedule O. By using airSlate SignNow, you can effortlessly gather signatures on your documentation, ensuring you meet all submission deadlines. Our platform is designed to help you save time and stay organized.

-

What features does airSlate SignNow offer for managing nonprofit documentation?

airSlate SignNow offers a range of features, including eSignature capabilities, document templates, and compliance tools tailored for nonprofits. These features are perfect for managing IRS-related documents like Schedule O. By utilizing our platform, organizations can efficiently handle all their crucial paperwork and save on administrative costs.

-

Is airSlate SignNow a cost-effective solution for nonprofits?

Yes, airSlate SignNow offers competitive pricing that is particularly beneficial for nonprofits. With various pricing plans, nonprofits can find a solution that fits their budget while still effectively managing IRS 990 Schedule O and other essential documents. This makes it a valuable investment for organizations focused on compliance and efficiency.

-

Can airSlate SignNow integrate with other nonprofit management tools?

Absolutely! airSlate SignNow seamlessly integrates with various nonprofit management tools and software, enhancing your workflow efficiency. This integration is vital if you need to manage IRS 990 Schedule O alongside other operational processes. By connecting tools, nonprofits can ensure a comprehensive approach to document management.

-

What are the benefits of using eSignatures for IRS 990 Schedule O?

Using eSignatures for IRS 990 Schedule O can signNowly expedite the filing process and ensure compliance. They provide a secure and easily trackable method for obtaining signatures. This digital approach aligns with modern practices and meets IRS requirements, making life easier for your organization.

Get more for Irs Significant Form Pdf

- Application for enrollment to practice before form

- Premarital intake form

- Expert witness engagement agreement form

- Receiving a tax refund form

- Car hire contract template form

- Military judge verification of record of trial form

- 009 077 fy 26 navsea standard item fy 26 item no form

- Form 511nr oklahoma tax commission

Find out other Irs Significant Form Pdf

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document