FORM 4848 1974 ANNUAL EMPLOYERS RETURN for EMPLOYEES' PENSION or PROFIT SHARING PLANS 1974-2026

Understanding the 4848 Annual Employers Return

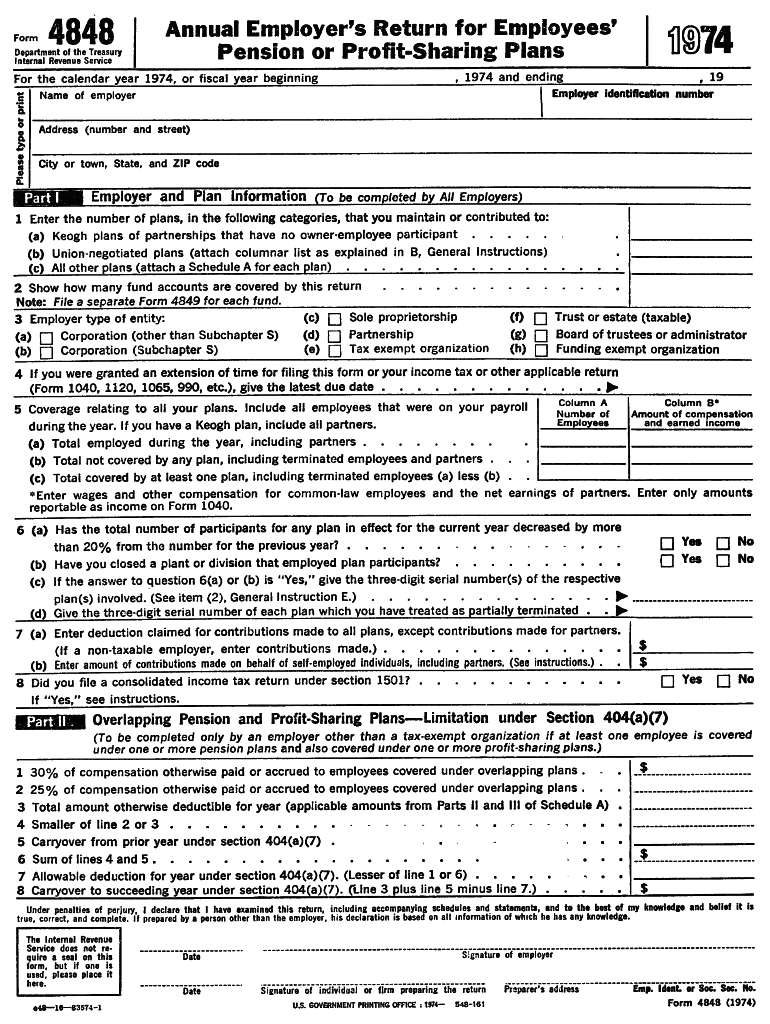

The 4848 Annual Employers Return for Employees' Pension or Profit Sharing Plans is a crucial document for employers managing retirement plans. This form, established by the IRS, ensures compliance with federal regulations regarding pension and profit-sharing contributions. It provides a detailed account of contributions made on behalf of employees and is essential for maintaining the tax-deferred status of these plans.

Steps to Complete the 4848 Annual Employers Return

Completing the 4848 form requires careful attention to detail. Here are the steps:

- Gather necessary information: Collect all relevant data regarding employee contributions, plan details, and financial records.

- Fill out the form: Input the required information accurately, ensuring all sections are completed.

- Review for accuracy: Double-check all entries for mistakes or omissions to avoid potential penalties.

- Submit the form: Choose your submission method—online, by mail, or in-person—and ensure it is sent before the deadline.

Legal Use of the 4848 Annual Employers Return

The legal validity of the 4848 form hinges on compliance with IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Electronic signatures are acceptable, provided they meet the standards set by the ESIGN Act and UETA. Employers should maintain records of submissions and correspondence with the IRS to safeguard against disputes.

IRS Guidelines for the 4848 Annual Employers Return

The IRS provides specific guidelines for completing and submitting the 4848 form. These guidelines include:

- Filing deadlines: Employers must adhere to strict deadlines to avoid penalties.

- Required documentation: Supporting documents must accompany the form to validate the information provided.

- Submission methods: The IRS accepts electronic submissions, which can expedite processing times.

Key Elements of the 4848 Annual Employers Return

Several key elements must be included in the 4848 form to ensure completeness:

- Employer information: Name, address, and identification number.

- Plan details: Type of plan, number of participants, and contribution amounts.

- Signature: An authorized representative must sign the form to validate it.

Filing Deadlines and Important Dates

It is essential for employers to be aware of the filing deadlines associated with the 4848 form. Typically, the form must be submitted by the last day of the seventh month after the end of the plan year. Late submissions can incur penalties, making it crucial to plan ahead and ensure timely filing.

Quick guide on how to complete form 4848 1974 annual employers return for employees pension or profit sharing plans

Effortlessly Prepare FORM 4848 1974 ANNUAL EMPLOYERS RETURN FOR EMPLOYEES' PENSION OR PROFIT SHARING PLANS on Any Gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage FORM 4848 1974 ANNUAL EMPLOYERS RETURN FOR EMPLOYEES' PENSION OR PROFIT SHARING PLANS on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign FORM 4848 1974 ANNUAL EMPLOYERS RETURN FOR EMPLOYEES' PENSION OR PROFIT SHARING PLANS with Ease

- Find FORM 4848 1974 ANNUAL EMPLOYERS RETURN FOR EMPLOYEES' PENSION OR PROFIT SHARING PLANS and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to retain your modifications.

- Select how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign FORM 4848 1974 ANNUAL EMPLOYERS RETURN FOR EMPLOYEES' PENSION OR PROFIT SHARING PLANS and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4848 1974 annual employers return for employees pension or profit sharing plans

Create this form in 5 minutes!

How to create an eSignature for the form 4848 1974 annual employers return for employees pension or profit sharing plans

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the IRS 4848 form and how is it used?

The IRS 4848 form, also known as the 'Power of Attorney and Declaration of Representative,' is used to authorize an individual to represent you before the IRS. This form allows your representative to conduct business related to your tax matters, ensuring that they have the legal right to act on your behalf.

-

How can airSlate SignNow help with the IRS 4848 form?

airSlate SignNow streamlines the process of completing and submitting the IRS 4848 form by providing a user-friendly interface for eSigning documents. This saves time and reduces the risk of errors, allowing you to focus on your tax matters with confidence.

-

Is there a cost associated with using airSlate SignNow for the IRS 4848 form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose a plan that suits your budget and gain access to all features necessary for efficiently managing your IRS 4848 form and other documents.

-

What features does airSlate SignNow offer for managing the IRS 4848 form?

With airSlate SignNow, you can easily create, edit, and eSign the IRS 4848 form online. Key features include templates for quick access, status tracking for submissions, and secure storage options to keep your documents safe.

-

Can I integrate airSlate SignNow with other applications for processing the IRS 4848 form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and CRM systems to simplify the management of your IRS 4848 form. These integrations allow for seamless document sharing and collaboration between platforms.

-

What are the benefits of using airSlate SignNow for the IRS 4848 form over paper methods?

Using airSlate SignNow for the IRS 4848 form eliminates the hassles of paper-based processes, such as printing, signing, scanning, and mailing. The electronic signing process is faster, more efficient, and environmentally friendly, allowing you to manage your tax documents effortlessly.

-

How secure is airSlate SignNow for handling the IRS 4848 form?

Security is a top priority for airSlate SignNow. When managing the IRS 4848 form, your data is protected with high-level encryption and access controls, ensuring that your sensitive information remains confidential and secure.

Get more for FORM 4848 1974 ANNUAL EMPLOYERS RETURN FOR EMPLOYEES' PENSION OR PROFIT SHARING PLANS

- Publication 16 rev 8 form

- Car installment payment contract template form

- 433rd airlift wing hi res stock photography and images form

- Enclosure 2 united states naval academy self assessment form

- Rappel master off post training information

- Cpf ig hotline complaint form pdf

- Dd form 137 quotsecondary dependency applicationquot

- Dd form 3160 ampquotnon temporary storage nts release formampquot

Find out other FORM 4848 1974 ANNUAL EMPLOYERS RETURN FOR EMPLOYEES' PENSION OR PROFIT SHARING PLANS

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT