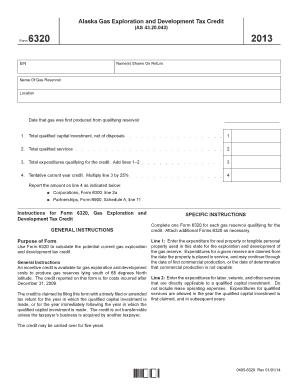

Tax Alaska 2013

What is the Tax Alaska

The Tax Alaska form is a crucial document for individuals and businesses operating in Alaska, designed to facilitate the reporting of income and other tax-related information to the state tax authorities. This form is essential for ensuring compliance with Alaska's tax regulations and helps taxpayers accurately calculate their tax obligations. The form may vary based on specific taxpayer scenarios, such as self-employed individuals, corporations, or partnerships.

How to use the Tax Alaska

Using the Tax Alaska form involves several key steps. First, gather all necessary financial information, including income statements, deductions, and credits applicable to your situation. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to review the form for any potential errors before submission. Once completed, the form can be submitted online, by mail, or in person, depending on your preference and the requirements set by the state tax authority.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach:

- Collect relevant financial documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Access the Tax Alaska form from the official state tax website or authorized sources.

- Fill out the form, ensuring to follow the instructions carefully for each section.

- Double-check all entries for accuracy, including names, Social Security numbers, and financial figures.

- Submit the form through your chosen method, ensuring to keep a copy for your records.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. To be considered valid, the form must be filled out accurately and submitted by the designated deadlines. Compliance with these laws ensures that the form is recognized by the state tax authority and can be used to determine tax liabilities. Additionally, using a reliable platform for electronic submission can enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are typically aligned with federal tax deadlines, but it is essential to verify specific dates with the Alaska Department of Revenue. Generally, individual taxpayers must file their forms by April 15 of each year. Businesses may have different deadlines based on their fiscal year and tax classification. Late submissions may incur penalties, so staying informed about these dates is crucial for compliance.

Required Documents

To complete the Tax Alaska form, several documents are typically required, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses

- Records of any other income sources

- Previous year's tax return for reference

Examples of using the Tax Alaska

Examples of using the Tax Alaska form include various taxpayer scenarios:

- A self-employed individual reporting income from freelance work.

- A business owner filing taxes for an LLC or corporation.

- A retired individual declaring pension income and Social Security benefits.

Each scenario may have specific requirements and considerations, making it important to understand how the form applies to your unique situation.

Quick guide on how to complete tax alaska 6967208

Effortlessly prepare Tax Alaska on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Tax Alaska on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Tax Alaska with ease

- Find Tax Alaska and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Tax Alaska and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967208

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967208

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how can it help with Tax Alaska forms?

airSlate SignNow is a user-friendly eSignature platform that simplifies the process of signing and managing documents. For Tax Alaska forms, it enables businesses to sign documents electronically, ensuring compliance and efficiency. With airSlate SignNow, you can streamline your tax submission process in Alaska, saving time and resources.

-

How does airSlate SignNow handle security for Tax Alaska documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Tax Alaska forms. The platform employs industry-standard encryption and adheres to rigorous data protection regulations. You can trust that your Tax Alaska documents are securely signed and stored.

-

What pricing plans are available for using airSlate SignNow for Tax Alaska?

airSlate SignNow offers flexible pricing plans designed to meet various business needs for handling Tax Alaska forms. Whether you are a small business or a large enterprise, there is an affordable plan that allows you to leverage the benefits of electronic signatures. Visit our website for detailed pricing information tailored for Tax Alaska processing.

-

Can I automate my Tax Alaska document workflows using airSlate SignNow?

Absolutely! airSlate SignNow provides automation tools that enable you to streamline workflows for Tax Alaska documentation. You can create templates, set reminders, and automate the signing process, which saves time and reduces the chances of human error in your tax-related activities.

-

What types of integrations does airSlate SignNow offer for Tax Alaska?

airSlate SignNow can easily integrate with various applications and platforms, enhancing your ability to manage Tax Alaska documents. Popular integrations include CRM systems, cloud storage solutions, and productivity tools, allowing you to sync data and improve efficiency across your business operations.

-

How can airSlate SignNow improve efficiency for Tax Alaska document management?

Using airSlate SignNow for Tax Alaska document management signNowly boosts efficiency by reducing the time spent on paperwork. The platform allows multiple stakeholders to sign documents instantly, eliminating the need for printouts and physical meetings. This streamlined process accelerates tax compliance and supports quicker decision-making.

-

Can I track the status of my Tax Alaska documents in airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking features for your Tax Alaska documents. You can easily monitor who has viewed or signed your documents, and receive notifications when actions are completed. This transparency helps ensure that all necessary steps in the Tax Alaska filing process are completed on time.

Get more for Tax Alaska

- Emergency supplies checklist be prepared form

- Vision form claimsecure

- Commercial proforma 1 invoice number and date 2 dpd

- Citi announces agreement to sell its consumer form

- Australia membership application form

- Dear sir madam letter sample form

- Qml pathology request form pdf fill online printable

- Vehicle escort driver application form

Find out other Tax Alaska

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy