Tax Alaska 2020

What is the Tax Alaska

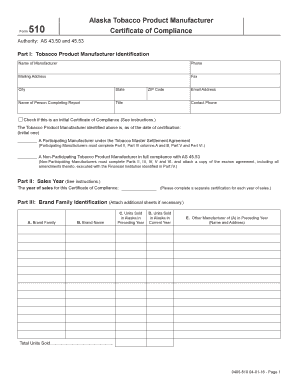

The Tax Alaska form is a specific document used for tax-related purposes within the state of Alaska. It serves as a means for individuals and businesses to report their income, deductions, and credits to the state tax authorities. Understanding the purpose of this form is crucial for compliance with state tax regulations and ensuring accurate reporting of financial information.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Next, fill out the form accurately, ensuring that all information is complete and correct. Once completed, review the form for any errors before submitting it to the appropriate state tax agency. It is also advisable to keep a copy for your records.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- List eligible deductions and credits.

- Calculate your total tax liability.

- Sign and date the form before submission.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws. To ensure that your submission is legally binding, it is essential to comply with all requirements outlined by the Alaska Department of Revenue. This includes using the most current version of the form, providing accurate information, and submitting it by the designated deadlines. Failure to adhere to these regulations can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline. It is important to check for any specific state extensions or changes that may affect your filing date. Mark these dates on your calendar to ensure timely submission.

Required Documents

To complete the Tax Alaska form, certain documents are required. These may include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Documentation for any tax credits claimed.

Having these documents ready will streamline the process and help ensure accuracy in your tax filing.

Quick guide on how to complete tax alaska 6967177

Complete Tax Alaska effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents rapidly without delays. Manage Tax Alaska on any device using the airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to modify and eSign Tax Alaska with ease

- Find Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal authority as a traditional ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Alaska and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967177

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967177

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is a user-friendly eSigning platform that empowers businesses to send and electronically sign documents efficiently. For individuals dealing with Tax Alaska, this tool simplifies the process of handling tax documents, ensuring they are signed and sent in a timely manner.

-

How does airSlate SignNow help with managing Tax Alaska documents?

With airSlate SignNow, managing Tax Alaska documents becomes seamless. The platform offers features such as document templates, cloud storage, and real-time tracking, making it easier to handle tax-related paperwork effortlessly.

-

What are the pricing options for airSlate SignNow for Tax Alaska users?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, including those focused on Tax Alaska. Whether you're a solo taxpayer or part of a large organization, there's a plan that provides access to the critical features for efficiently managing tax documents.

-

Can I integrate airSlate SignNow with other tools for Tax Alaska management?

Yes, airSlate SignNow supports integrations with various applications, making it easy to manage Tax Alaska documents alongside your existing tools. This integration capability helps streamline workflows and enhance productivity when handling tax-related tasks.

-

What security features does airSlate SignNow provide for Tax Alaska documents?

airSlate SignNow prioritizes the security of your documents, especially those related to Tax Alaska. The platform employs advanced encryption and complies with industry standards to ensure that sensitive tax information is protected at all times.

-

Is airSlate SignNow user-friendly for Tax Alaska documentation processes?

Absolutely! airSlate SignNow is designed to be intuitive, making it easy for users to navigate the platform for Tax Alaska documentation processes. With a straightforward interface, even those with limited technical skills can send and sign tax documents without hassle.

-

What are the benefits of using airSlate SignNow for Tax Alaska submissions?

Using airSlate SignNow for Tax Alaska submissions streamlines your document management process signNowly. Benefits include quicker turnaround times for signatures, reduced paper usage, and enhanced organization of your tax records, all of which lead to a more efficient tax preparation experience.

Get more for Tax Alaska

- Mvp health care form

- Frysvisa form

- Download as pdf bank of america form

- Letter of intent for deceased patron evergreen fs form

- Dnr wisconsin govtopicdrinkingwaterinformation for public water system owners wisconsin dnr

- Www citywd org vertical sitespark and recreation facility rental application form

- Fet consent forms dallas ivf fill out ampamp sign online

- Childrens developmental services agency in winston form

Find out other Tax Alaska

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now