Reset Form 538 Certificate of Use Non Government 2021-2026

IRS Guidelines

IRS Publication 535 provides essential guidelines for businesses regarding the deductibility of various expenses. This publication clarifies what constitutes a business expense and how to properly categorize these expenses on tax returns. It is crucial for taxpayers to understand the difference between capital expenses and ordinary business expenses to ensure compliance with IRS regulations.

Included in the publication are detailed explanations of allowable deductions, such as those related to business use of a vehicle, home office deductions, and depreciation of assets. Familiarizing oneself with these guidelines helps in maximizing deductions while minimizing the risk of audits.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with IRS Publication 535 is vital for timely compliance. Typically, businesses must file their tax returns by April fifteenth, unless an extension is requested. It is also important to note that specific deadlines may vary based on the business structure, such as sole proprietorships or corporations.

Taxpayers should keep track of estimated tax payment deadlines, which occur quarterly, as these are also influenced by the deductions outlined in Publication 535. Missing these deadlines can result in penalties and interest charges.

Required Documents

To effectively utilize IRS Publication 535, businesses must gather various documents that support their expense claims. Key documents include receipts, invoices, and bank statements that detail business transactions. Additionally, records of asset purchases and sales are necessary for calculating depreciation and other deductions.

Maintaining organized documentation not only aids in accurately completing tax returns but also serves as crucial evidence in case of an IRS audit. Businesses should keep these records for at least three years from the date of filing.

Taxpayer Scenarios

IRS Publication 535 is particularly useful for different taxpayer scenarios, such as self-employed individuals, small business owners, and freelancers. Each of these groups may have unique deductions available to them, which are thoroughly outlined in the publication.

For instance, self-employed individuals can deduct expenses related to their home office, while small business owners can take advantage of deductions for employee wages and benefits. Understanding these nuances helps taxpayers maximize their deductions based on their specific circumstances.

Eligibility Criteria

Eligibility for deductions outlined in IRS Publication 535 is determined by several factors, including the nature of the expense and the taxpayer's business structure. Generally, to qualify as a deductible business expense, the cost must be both ordinary and necessary for the business operations.

Taxpayers should assess their eligibility based on the specific guidelines provided in the publication, as certain expenses may be limited or disallowed depending on the business type and structure.

Application Process & Approval Time

While IRS Publication 535 does not require a formal application process, understanding how to apply the guidelines effectively is crucial for accurate tax reporting. Taxpayers must systematically categorize their expenses according to the publication's instructions and ensure that all necessary documentation is in order.

Approval time for deductions is not applicable in the traditional sense, as the IRS does not pre-approve deductions. Instead, taxpayers must ensure compliance when filing their returns to avoid issues during audits.

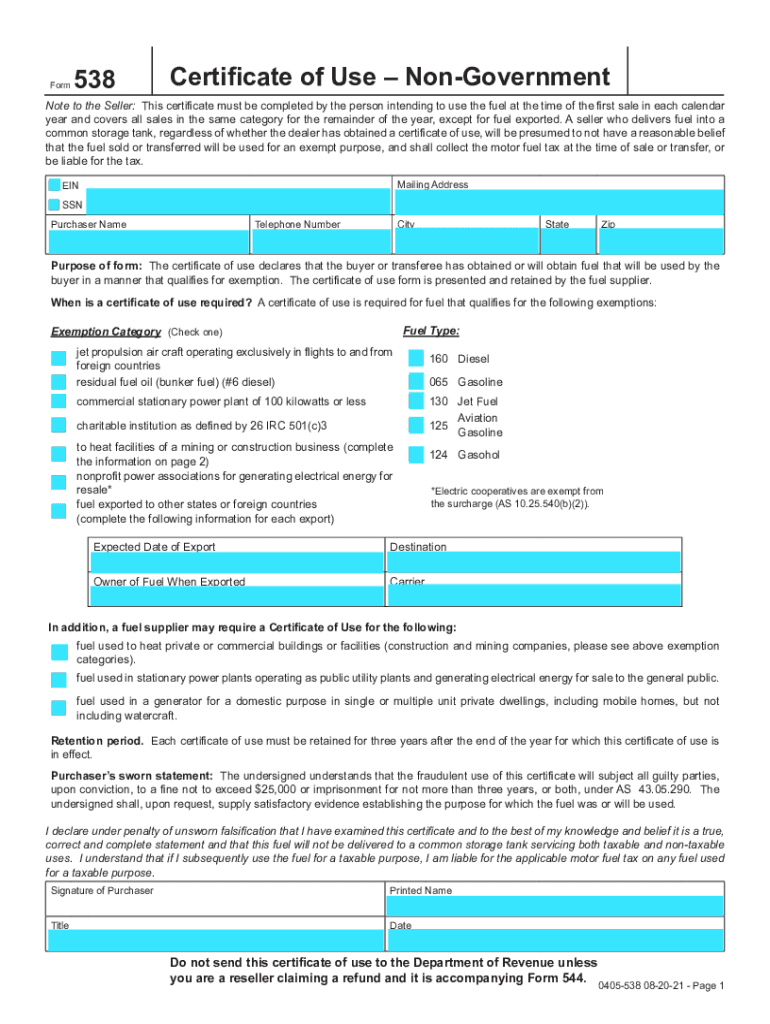

Quick guide on how to complete reset form 538 certificate of use non government

Complete Reset Form 538 Certificate Of Use Non Government effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Handle Reset Form 538 Certificate Of Use Non Government on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and electronically sign Reset Form 538 Certificate Of Use Non Government with ease

- Find Reset Form 538 Certificate Of Use Non Government and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Reset Form 538 Certificate Of Use Non Government and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reset form 538 certificate of use non government

Create this form in 5 minutes!

How to create an eSignature for the reset form 538 certificate of use non government

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Publication 535, and why is it important for businesses?

IRS Publication 535 provides guidelines on business expenses and deductibles. Understanding this publication is crucial for businesses to optimize their tax strategy and ensure compliance. By having a clear grasp of IRS Publication 535, businesses can make informed financial decisions and maximize their allowable deductions.

-

How can airSlate SignNow help with documents related to IRS Publication 535?

airSlate SignNow allows businesses to create, send, and eSign documents that might be necessary for tax reporting per IRS Publication 535. By streamlining the document management process, you ensure that all your expense records and necessary signatures are secured and compliant with IRS guidelines. This efficiency can save you valuable time, especially during tax season.

-

Are there any costs associated with accessing IRS Publication 535 through airSlate SignNow?

Accessing IRS Publication 535 doesn't have a direct cost through airSlate SignNow, but using our eSigning solution comes with various pricing plans tailored for your business needs. Our platform provides a cost-effective way to manage documents related to tax reporting and compliance with IRS regulations. Check out our pricing page for more details.

-

What features does airSlate SignNow provide for tax-related documents?

airSlate SignNow offers a range of features ideal for handling tax-related documents, such as secure eSignature, document templates, and real-time tracking. Using our platform, you can ensure that documents linked to IRS Publication 535 are signed and filed appropriately. This functionality aids in maintaining an organized and compliant document trail for your business.

-

Can I integrate airSlate SignNow with other tools to manage IRS Publication 535 documents?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and applications, enhancing your document management experience, especially for IRS Publication 535-related tasks. Whether it's accounting software or project management tools, our platform allows you to sync your workflow, ensuring that all tax-related documentation is handled efficiently.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers numerous benefits, including streamlined workflows, enhanced security, and reduced processing times. By ensuring compliance with IRS guidelines, including those outlined in IRS Publication 535, you can focus more on your business operations rather than paperwork. Our platform is designed to facilitate easier audit trails and documentation.

-

Is airSlate SignNow compliant with IRS regulations related to IRS Publication 535?

Yes, airSlate SignNow is designed to comply with IRS regulations, including those relevant to IRS Publication 535. Our electronic signatures meet legal requirements, ensuring that your documents are valid and secure during tax audits or inspections. This compliance helps businesses reduce the risk associated with tax-related documentation.

Get more for Reset Form 538 Certificate Of Use Non Government

- Personal income statement 486925447 form

- Modulo di richiesta recesso sim acquistata da web postemobile form

- Sales tax form st 3

- Form 1914 txdot

- Dgs termination of domestic partnership dgs pass form

- Avinhospi form

- Megs security authorization form megs security authorization form

- General consult contract template form

Find out other Reset Form 538 Certificate Of Use Non Government

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement