Florida Tax Exempt Form Department of Revenue MyFlorida Com 2020

What is the Florida Tax Exempt Form Department Of Revenue MyFlorida com

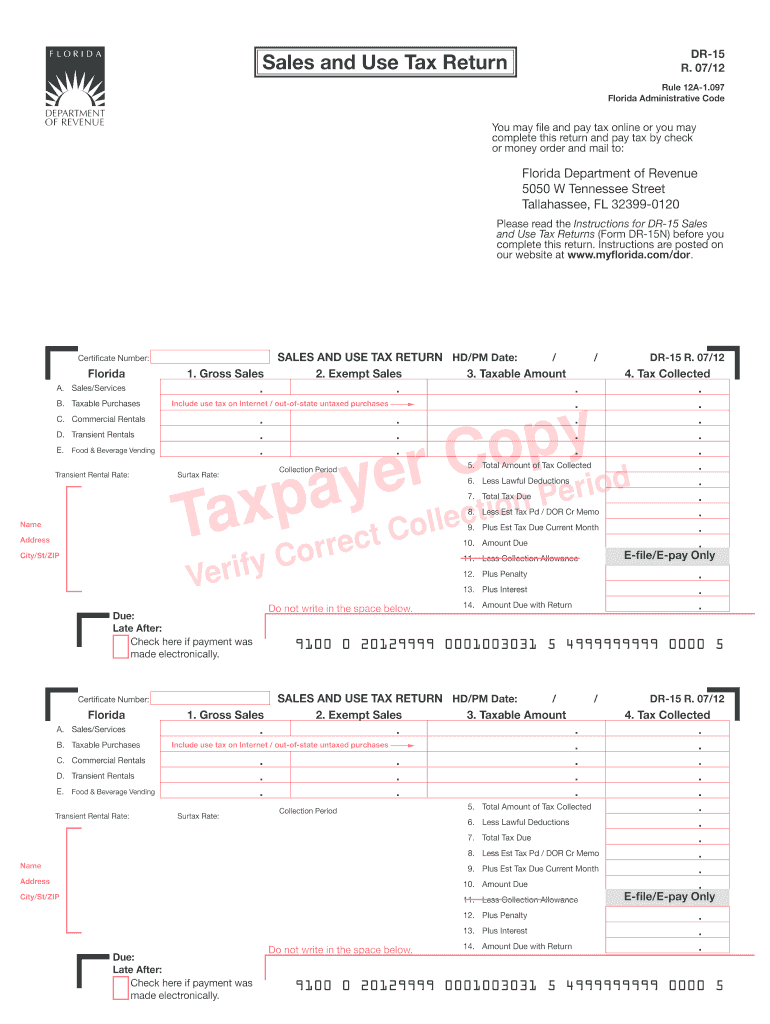

The Florida Tax Exempt Form, provided by the Department of Revenue, is a crucial document for individuals and businesses seeking to claim tax-exempt status in the state of Florida. This form allows eligible entities, such as nonprofit organizations, to purchase goods and services without paying sales tax. By submitting this form, the organization certifies its tax-exempt status, which is recognized by vendors and suppliers when making purchases. Understanding the purpose and implications of this form is essential for compliance with Florida tax laws.

How to use the Florida Tax Exempt Form Department Of Revenue MyFlorida com

Using the Florida Tax Exempt Form involves several steps to ensure proper completion and submission. First, gather all necessary information, including the organization’s name, address, and tax identification number. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it should be presented to vendors at the time of purchase. Vendors will retain a copy of the form for their records, which validates the tax-exempt status of the organization. Proper usage of this form helps prevent unnecessary tax charges on eligible purchases.

Steps to complete the Florida Tax Exempt Form Department Of Revenue MyFlorida com

Completing the Florida Tax Exempt Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Florida Department of Revenue website.

- Fill in the organization’s name, address, and tax identification number in the designated fields.

- Indicate the type of exempt organization, such as a charitable or educational entity.

- Provide a brief description of the organization's purpose and activities.

- Review the completed form for accuracy and completeness.

- Sign and date the form to certify the information provided is true.

Legal use of the Florida Tax Exempt Form Department Of Revenue MyFlorida com

The legal use of the Florida Tax Exempt Form is governed by state tax laws. Organizations must ensure they meet the eligibility criteria for tax exemption to use this form legitimately. Misuse of the form can result in penalties, including the obligation to pay back taxes and potential fines. It is essential for organizations to maintain proper documentation and records related to their tax-exempt status to defend their claims if audited by the Florida Department of Revenue.

Key elements of the Florida Tax Exempt Form Department Of Revenue MyFlorida com

Key elements of the Florida Tax Exempt Form include:

- Organization Information: Name, address, and tax identification number.

- Type of Exemption: Classification of the organization, such as nonprofit or government entity.

- Signature: Authorized representative’s signature to validate the form.

- Purpose Statement: A brief description of the organization’s mission and activities.

Eligibility Criteria

To qualify for tax-exempt status using the Florida Tax Exempt Form, organizations must meet specific criteria set by the state. Generally, eligible entities include charitable organizations, educational institutions, and certain government agencies. Organizations must provide proof of their exempt status, such as IRS determination letters or other relevant documentation. Understanding these criteria is vital for organizations to ensure compliance and avoid potential tax liabilities.

Quick guide on how to complete florida tax exempt form department of revenue myfloridacom

Complete Florida Tax Exempt Form Department Of Revenue MyFlorida com effortlessly on any device

Online document management has become widely used by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Florida Tax Exempt Form Department Of Revenue MyFlorida com on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Florida Tax Exempt Form Department Of Revenue MyFlorida com without effort

- Find Florida Tax Exempt Form Department Of Revenue MyFlorida com and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in a few clicks from any device you prefer. Modify and eSign Florida Tax Exempt Form Department Of Revenue MyFlorida com and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida tax exempt form department of revenue myfloridacom

Create this form in 5 minutes!

How to create an eSignature for the florida tax exempt form department of revenue myfloridacom

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Florida Tax Exempt Form Department Of Revenue MyFlorida com?

The Florida Tax Exempt Form Department Of Revenue MyFlorida com is a document that allows eligible businesses to claim tax-exempt status on purchases. This form is essential for organizations that qualify under Florida tax regulations to avoid sales tax on specific purchases. Understanding and utilizing this form is crucial for compliance and can save your business money.

-

How can airSlate SignNow help with filling out the Florida Tax Exempt Form Department Of Revenue MyFlorida com?

airSlate SignNow streamlines the process of completing the Florida Tax Exempt Form Department Of Revenue MyFlorida com by providing an easy-to-use digital platform. Users can fill out the form quickly, ensuring all necessary information is included without the hassle of paper documents. This not only saves time but also reduces errors, helping you stay compliant.

-

What features does airSlate SignNow offer for managing tax exemption forms?

airSlate SignNow includes several powerful features for managing tax exemption forms, including document templates, e-signature capabilities, and secure cloud storage. These features make it simple to create, send, and store the Florida Tax Exempt Form Department Of Revenue MyFlorida com and other essential documents. Moreover, our software allows for real-time collaboration among team members.

-

Is airSlate SignNow cost-effective for businesses needing tax exemption documentation?

Yes, airSlate SignNow offers a cost-effective solution for businesses requiring the Florida Tax Exempt Form Department Of Revenue MyFlorida com. Our pricing plans are designed to fit various business sizes and needs, ensuring you get maximum value for your investment. The savings from efficient document handling can easily offset the subscription costs.

-

Can I integrate airSlate SignNow with other software for my tax exemption processing?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for processing the Florida Tax Exempt Form Department Of Revenue MyFlorida com and related documents. Whether you use CRM systems or accounting software, our integration capabilities facilitate smoother operations and save time.

-

What are the benefits of using airSlate SignNow for tax exemption forms compared to traditional methods?

Using airSlate SignNow for the Florida Tax Exempt Form Department Of Revenue MyFlorida com offers numerous benefits over traditional paper methods. Digital signatures are legally binding and secure, reducing the time spent on mailing and printing documents. Additionally, our solution ensures easier access to your forms and improves organization across your business.

-

Is the Florida Tax Exempt Form Department Of Revenue MyFlorida com valid if sent electronically?

Yes, the Florida Tax Exempt Form Department Of Revenue MyFlorida com is valid when sent electronically via airSlate SignNow, as we comply with all relevant e-signature laws. Electronic submissions are legally recognized and can enhance efficiency within your business operations. Just ensure all required fields are completed accurately before submission.

Get more for Florida Tax Exempt Form Department Of Revenue MyFlorida com

- Lakewood development review board city of lakewood california form

- Certificate of acceptance nrca env 02 a fenestration energy ca form

- Revised forms for pdf

- Mah shooters reg maharashtra rifle association maharifle form

- Bank guarantee caa coastal aquaculture authority caa gov form

- Pcl indemnity bond punjab state power corporation limited form

- Policy benefit payout form hdfc life

- No claim certificate kribhco form

Find out other Florida Tax Exempt Form Department Of Revenue MyFlorida com

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free