Colorado Dept of Revenue Dr0511 Form 2007

What is the Colorado Dept Of Revenue Dr0511 Form

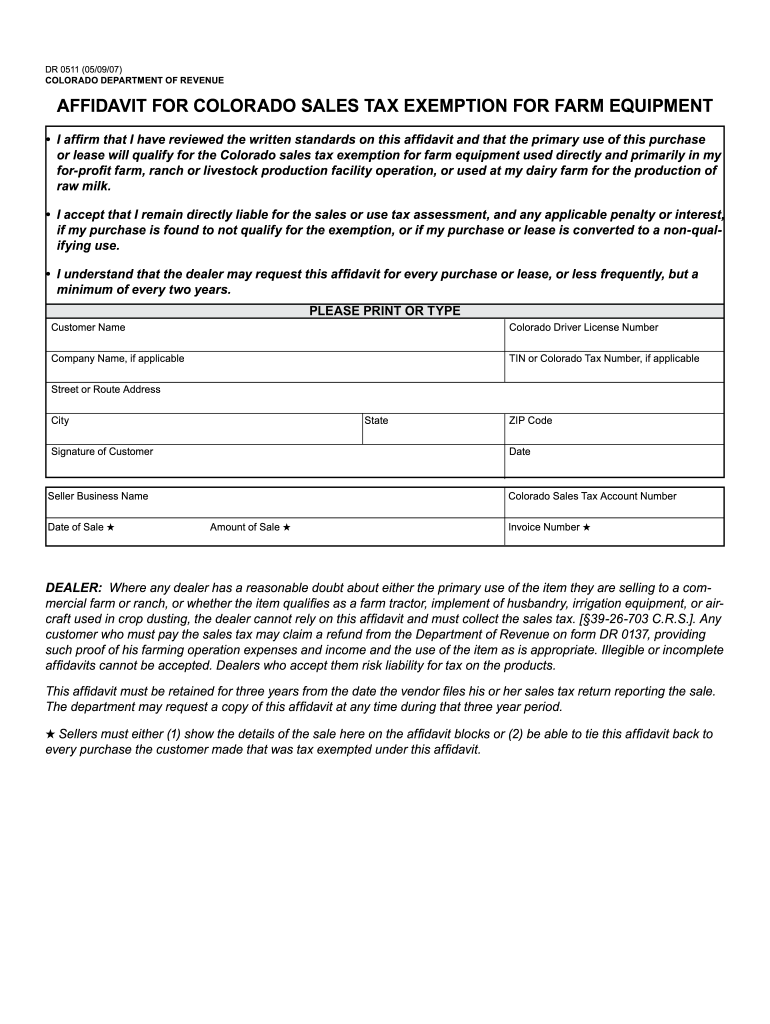

The Colorado Dept Of Revenue Dr0511 Form is a crucial document used for reporting specific tax information to the state of Colorado. This form is primarily utilized by individuals and businesses to ensure compliance with state tax regulations. It serves as a means to communicate financial data necessary for accurate tax assessment and collection. Understanding the purpose and requirements of this form is essential for anyone looking to fulfill their tax obligations in Colorado.

How to use the Colorado Dept Of Revenue Dr0511 Form

Using the Colorado Dept Of Revenue Dr0511 Form involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from the Colorado Department of Revenue's official website. Next, gather all necessary financial documents and information required to complete the form accurately. Once you have filled out the form, it can be submitted electronically or via traditional mail, depending on your preference. Familiarizing yourself with the specific instructions provided with the form will help streamline the process.

Steps to complete the Colorado Dept Of Revenue Dr0511 Form

Completing the Colorado Dept Of Revenue Dr0511 Form involves a series of steps to ensure accuracy and compliance. Begin by downloading the form from the Colorado Department of Revenue website. Next, carefully read the instructions accompanying the form. Fill in your personal information, including your name, address, and Social Security number. Input your financial data as required, ensuring all figures are accurate. After completing the form, review it for any errors before signing it. Finally, submit the form electronically or by mail, following the guidelines provided.

Key elements of the Colorado Dept Of Revenue Dr0511 Form

The Colorado Dept Of Revenue Dr0511 Form contains several key elements that are critical for proper completion. These include sections for personal identification, income reporting, deductions, and credits. Each section must be filled out accurately to reflect your financial situation. Additionally, the form may require supporting documentation, such as W-2s or 1099s, to substantiate the information provided. Understanding these elements is vital for ensuring that your submission is complete and compliant with state requirements.

Form Submission Methods (Online / Mail / In-Person)

The Colorado Dept Of Revenue Dr0511 Form can be submitted through various methods, offering flexibility to taxpayers. Online submission is available through the Colorado Department of Revenue's e-filing system, which is a convenient option for many. Alternatively, taxpayers can print the completed form and mail it to the designated address provided in the instructions. For those who prefer a personal touch, in-person submission is also an option at local tax offices. Each method has its own advantages, so choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to comply with the requirements of the Colorado Dept Of Revenue Dr0511 Form can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential to file the form accurately and on time to avoid these consequences. Taxpayers should be aware of the deadlines associated with the form and ensure that all information is complete to mitigate the risk of non-compliance penalties.

Quick guide on how to complete colorado dept of revenue dr0511 2007 form

Your assistance manual on how to prepare your Colorado Dept Of Revenue Dr0511 Form

If you’re interested in discovering how to generate and submit your Colorado Dept Of Revenue Dr0511 Form, here are a few straightforward guidelines on how to simplify tax processing.

To start, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, create, and finalize your income tax papers effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and revert to modify details as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow these steps to complete your Colorado Dept Of Revenue Dr0511 Form in no time:

- Sign up for your account and start working on PDFs shortly.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Hit Get form to access your Colorado Dept Of Revenue Dr0511 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to include your legally-binding eSignature (if needed).

- Review your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper can lead to increased return mistakes and delay refunds. It goes without saying, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct colorado dept of revenue dr0511 2007 form

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

Create this form in 5 minutes!

How to create an eSignature for the colorado dept of revenue dr0511 2007 form

How to make an eSignature for your Colorado Dept Of Revenue Dr0511 2007 Form online

How to make an electronic signature for your Colorado Dept Of Revenue Dr0511 2007 Form in Chrome

How to make an electronic signature for signing the Colorado Dept Of Revenue Dr0511 2007 Form in Gmail

How to create an electronic signature for the Colorado Dept Of Revenue Dr0511 2007 Form from your mobile device

How to create an eSignature for the Colorado Dept Of Revenue Dr0511 2007 Form on iOS devices

How to create an eSignature for the Colorado Dept Of Revenue Dr0511 2007 Form on Android

People also ask

-

What is the Colorado Dept Of Revenue Dr0511 Form?

The Colorado Dept Of Revenue Dr0511 Form is a tax form used by businesses in Colorado to report and pay their taxes. This form is essential for ensuring compliance with state tax regulations. By accurately completing the Colorado Dept Of Revenue Dr0511 Form, businesses can avoid penalties and maintain good standing with the state.

-

How can airSlate SignNow help with the Colorado Dept Of Revenue Dr0511 Form?

airSlate SignNow streamlines the process of completing and signing the Colorado Dept Of Revenue Dr0511 Form. With our intuitive eSignature solution, you can easily fill out, sign, and send the form electronically, saving time and reducing paperwork. This ensures a hassle-free experience for businesses filing their taxes.

-

Is there a cost associated with using airSlate SignNow for the Colorado Dept Of Revenue Dr0511 Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for those specifically needing to manage the Colorado Dept Of Revenue Dr0511 Form. Our cost-effective solutions provide excellent value, enabling you to eSign and manage documents without breaking the bank. You can choose a plan that best suits your usage requirements.

-

What features does airSlate SignNow offer for the Colorado Dept Of Revenue Dr0511 Form?

airSlate SignNow provides a range of features designed to simplify the management of the Colorado Dept Of Revenue Dr0511 Form. These include customizable templates, automated workflows, and real-time tracking of document status. These features enhance efficiency and ensure that your tax forms are handled promptly and securely.

-

Can airSlate SignNow integrate with other software for managing the Colorado Dept Of Revenue Dr0511 Form?

Absolutely! airSlate SignNow seamlessly integrates with popular business applications, allowing you to manage the Colorado Dept Of Revenue Dr0511 Form alongside your existing tools. Whether you use CRM systems or accounting software, our integrations enhance your workflow and improve efficiency.

-

How secure is airSlate SignNow when handling the Colorado Dept Of Revenue Dr0511 Form?

Security is a top priority at airSlate SignNow. When handling the Colorado Dept Of Revenue Dr0511 Form, your documents are protected with industry-standard encryption and security protocols. This ensures that sensitive tax information remains confidential and secure during the eSigning process.

-

What are the benefits of using airSlate SignNow for the Colorado Dept Of Revenue Dr0511 Form?

Using airSlate SignNow for the Colorado Dept Of Revenue Dr0511 Form offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our user-friendly platform allows you to quickly complete and submit tax documents, reducing the risk of errors and ensuring timely filing. Overall, it simplifies the tax process for businesses.

Get more for Colorado Dept Of Revenue Dr0511 Form

- Cpy document los angeles county form

- Download form dr 514 formupack

- Uniform policies and procedures manual for value adjustment boards 6967032

- Xml us government publishing office 6967066 form

- Form f 1065

- F 1120a r 01 14 finalpdf florida administrative weekly form

- Physicians certification of total and permanent disability form in new york

- Dr 416 form

Find out other Colorado Dept Of Revenue Dr0511 Form

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online