Form F 1065 2016

What is the Form F 1065

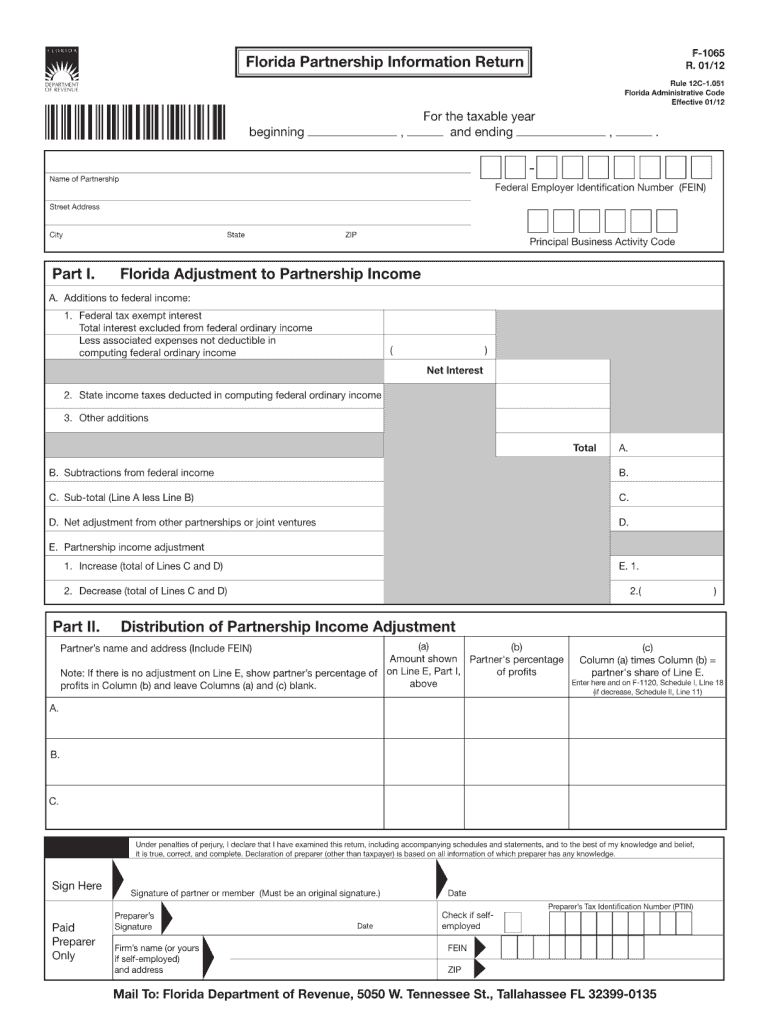

The Form F 1065 is a tax document used by partnerships to report income, deductions, gains, and losses from the partnership's operations. It is essential for partnerships to file this form annually with the Internal Revenue Service (IRS) to ensure compliance with federal tax regulations. The form provides a detailed overview of the partnership's financial activities and allocates income and deductions to each partner based on their ownership percentage. This information is crucial for partners to accurately report their share of the partnership's income on their individual tax returns.

How to use the Form F 1065

Using the Form F 1065 involves several steps to ensure accurate completion and compliance. First, gather all necessary financial records, including income statements, expense reports, and any other relevant documentation. Next, complete the form by entering the partnership's financial information, such as total income, deductions, and credits. It is important to accurately allocate income and deductions to each partner as per the partnership agreement. Once completed, the form must be signed by a partner or authorized representative before submission to the IRS.

Steps to complete the Form F 1065

Completing the Form F 1065 requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including income and expense records.

- Fill out the partnership's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report total income by including all sources of revenue generated by the partnership.

- Detail allowable deductions, including business expenses, salaries, and other costs.

- Calculate the partnership's net income or loss.

- Allocate the income or loss to each partner based on the partnership agreement.

- Review the form for accuracy and completeness before signing.

Legal use of the Form F 1065

The legal use of the Form F 1065 is governed by IRS regulations. It serves as an official record of the partnership's financial activities and must be filed annually. To ensure the form is legally binding, it is essential to comply with all IRS guidelines, including accurate reporting of income and deductions. Additionally, partners should maintain proper documentation to support the figures reported on the form. Non-compliance with filing requirements can result in penalties and interest charges, making it crucial to adhere to legal obligations.

Filing Deadlines / Important Dates

The filing deadline for the Form F 1065 is typically March 15th for partnerships operating on a calendar year basis. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships may file for an automatic six-month extension using Form 7004, which must be submitted by the original due date. It is important for partnerships to be aware of these deadlines to avoid late filing penalties and ensure timely compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form F 1065 can be submitted to the IRS through various methods. Partnerships may file electronically using IRS-approved e-filing software, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate IRS address based on the partnership's location. It is essential to ensure that the form is sent to the correct address to avoid delays in processing. In-person submissions are generally not accepted for this form, making electronic or mail filing the primary options.

Quick guide on how to complete form f 1065

Effortlessly Prepare Form F 1065 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle Form F 1065 on any device with the airSlate SignNow Android or iOS applications and enhance your document-related tasks today.

How to Edit and Electronically Sign Form F 1065 with Ease

- Locate Form F 1065 and then click Get Form to begin.

- Utilize our tools to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using specialized tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal authority as a traditional handwritten signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, time-consuming form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Form F 1065 while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form f 1065

Create this form in 5 minutes!

How to create an eSignature for the form f 1065

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form F 1065 and how does airSlate SignNow simplify the eSigning process?

Form F 1065 is a crucial tax document for partnerships. With airSlate SignNow, businesses can easily send, eSign, and manage Form F 1065 seamlessly, ensuring compliance and quick turnaround times.

-

How does airSlate SignNow ensure the security of my Form F 1065?

airSlate SignNow takes security seriously by employing advanced encryption methods to protect your Form F 1065 and other documents. We ensure that all data is stored securely, allowing you to focus on your business without worrying about sensitive information.

-

What are the pricing options for using airSlate SignNow for Form F 1065?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses, making it cost-effective to manage your Form F 1065. You can choose from monthly or annual subscriptions, allowing flexibility based on your document signing requirements.

-

Can airSlate SignNow integrate with accounting software for Form F 1065?

Yes, airSlate SignNow easily integrates with popular accounting software, enabling you to streamline the process of preparing and eSigning Form F 1065. This integration helps eliminate manual data entry and enhances productivity by keeping everything in one place.

-

What features does airSlate SignNow offer for managing Form F 1065?

airSlate SignNow offers various features for managing Form F 1065, including customizable templates, automated reminders, and real-time tracking. These features make it easier to handle multiple signers and ensure that deadlines are met.

-

Is it easy to eSign Form F 1065 using airSlate SignNow?

Absolutely! eSigning Form F 1065 with airSlate SignNow is incredibly easy. The user-friendly interface allows you to quickly add signatures, initials, and other required information, making the entire process efficient.

-

What are the benefits of using airSlate SignNow for Form F 1065 when preparing for tax season?

Using airSlate SignNow for Form F 1065 during tax season offers numerous benefits, such as expedited signing processes, enhanced compliance, and reduced paperwork. This helps you focus more on strategic tasks and less on administrative work.

Get more for Form F 1065

Find out other Form F 1065

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later