Form 1040N MIL Nebraska Department of Revenue Nebraska Gov 2020

What is the Form 1040N MIL Nebraska Department Of Revenue Nebraska gov

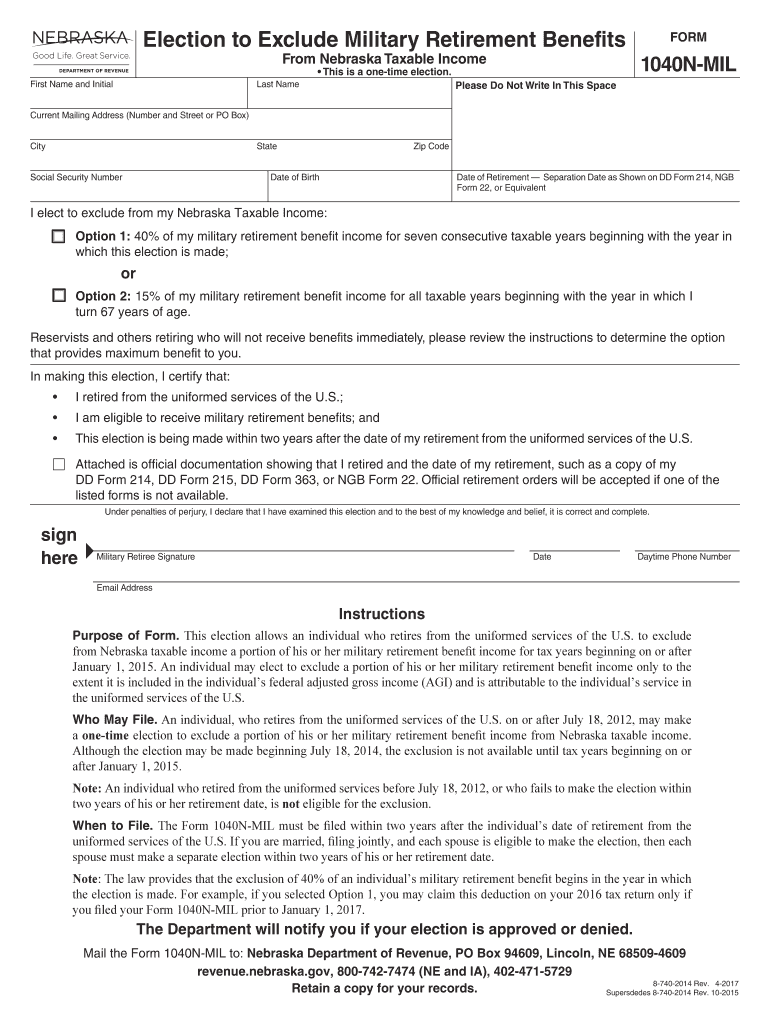

The Form 1040N MIL is a specific tax form utilized by residents of Nebraska to report their income and calculate state taxes owed. This form is essential for individuals who are required to file a Nebraska income tax return. It is designed to capture various income sources, deductions, and credits applicable to Nebraska taxpayers. Understanding the purpose and requirements of this form is crucial for compliance with state tax laws.

Steps to complete the Form 1040N MIL Nebraska Department Of Revenue Nebraska gov

Completing the Form 1040N MIL involves several key steps to ensure accurate reporting of income and tax liability. Begin by gathering all necessary documentation, including W-2 forms, 1099s, and records of any other income. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income in the designated sections, ensuring you include all applicable sources. After calculating your total income, apply any deductions and credits you qualify for. Finally, review the form for accuracy before signing and submitting it.

Legal use of the Form 1040N MIL Nebraska Department Of Revenue Nebraska gov

The Form 1040N MIL holds legal significance as it serves as an official document for reporting income to the Nebraska Department of Revenue. Proper completion and submission of this form are essential for fulfilling state tax obligations. E-signatures on this form are recognized as legally binding, provided they meet specific regulatory standards. It is important to ensure that all information is accurate and truthful to avoid potential legal repercussions, such as penalties or audits.

How to obtain the Form 1040N MIL Nebraska Department Of Revenue Nebraska gov

The Form 1040N MIL can be obtained through the Nebraska Department of Revenue's official website. It is available for download in a printable format, allowing taxpayers to complete it manually. Additionally, many tax preparation software programs include this form, enabling users to fill it out electronically. For those who prefer physical copies, the form can also be requested directly from the Nebraska Department of Revenue's offices.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040N MIL are critical for compliance with state tax laws. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. However, it is advisable to check for any updates or changes to the deadline each tax year. Filing on time helps avoid penalties and interest on any taxes owed.

Required Documents

To accurately complete the Form 1040N MIL, several documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and any other documentation related to income sources. Additionally, records of deductions, such as mortgage interest statements or medical expenses, should be collected. Having these documents on hand streamlines the completion process and ensures accurate reporting.

Quick guide on how to complete form 1040n mil nebraska department of revenue nebraskagov

Complete Form 1040N MIL Nebraska Department Of Revenue Nebraska gov effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 1040N MIL Nebraska Department Of Revenue Nebraska gov on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The easiest method to alter and electronically sign Form 1040N MIL Nebraska Department Of Revenue Nebraska gov without hassle

- Find Form 1040N MIL Nebraska Department Of Revenue Nebraska gov and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 1040N MIL Nebraska Department Of Revenue Nebraska gov and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040n mil nebraska department of revenue nebraskagov

Create this form in 5 minutes!

How to create an eSignature for the form 1040n mil nebraska department of revenue nebraskagov

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form 1040N MIL Nebraska Department Of Revenue Nebraska gov?

Form 1040N MIL is a tax form provided by the Nebraska Department of Revenue used for filing individual income tax returns in Nebraska. This form allows taxpayers to report their income and calculate their tax liability efficiently. By using airSlate SignNow, you can easily eSign and submit your Form 1040N MIL Nebraska Department Of Revenue Nebraska gov online.

-

How does airSlate SignNow help with eSigning Form 1040N MIL Nebraska Department Of Revenue Nebraska gov?

airSlate SignNow offers a seamless eSigning solution that allows you to electronically sign your Form 1040N MIL Nebraska Department Of Revenue Nebraska gov with just a few clicks. This platform is user-friendly, ensuring that you complete your tax form signing process quickly and securely. By simplifying eSigning, airSlate SignNow helps you stay compliant with state regulations.

-

What are the pricing options for using airSlate SignNow in relation to Form 1040N MIL Nebraska Department Of Revenue Nebraska gov?

airSlate SignNow provides various pricing plans to accommodate different business needs, including options for individuals and large enterprises. Each plan includes features that support the signing and management of documents like the Form 1040N MIL Nebraska Department Of Revenue Nebraska gov. You can choose a plan that best fits your budget and signing frequency.

-

Can I store my signed Form 1040N MIL Nebraska Department Of Revenue Nebraska gov documents securely?

Yes, airSlate SignNow offers secure storage for all your signed documents, including Form 1040N MIL Nebraska Department Of Revenue Nebraska gov. Your documents are protected with advanced encryption and are accessible anytime you need them. This secure storage is essential for maintaining your tax records.

-

What features does airSlate SignNow provide for managing Form 1040N MIL Nebraska Department Of Revenue Nebraska gov?

With airSlate SignNow, you can track the status of your Form 1040N MIL Nebraska Department Of Revenue Nebraska gov, set reminders, and manage your signing process efficiently. The platform offers robust workflow tools that enhance collaboration for tax preparation among multiple signers. These features ensure that your tax documents are handled efficiently and accurately.

-

Are there any integrations available with airSlate SignNow for Form 1040N MIL Nebraska Department Of Revenue Nebraska gov?

Absolutely! airSlate SignNow integrates seamlessly with various applications that can assist you while preparing your Form 1040N MIL Nebraska Department Of Revenue Nebraska gov. You can connect popular tools like Google Drive, Dropbox, and other cloud services, allowing for easy document import and management. These integrations streamline your tax filing process.

-

What benefits does airSlate SignNow offer for businesses regarding Form 1040N MIL Nebraska Department Of Revenue Nebraska gov?

For businesses, airSlate SignNow enhances efficiency by simplifying the signing process for essential forms like Form 1040N MIL Nebraska Department Of Revenue Nebraska gov. With automated workflows, reduced printing costs, and improved turnaround times, your business can focus more on core activities rather than paperwork. This cost-effective solution supports a modern approach to tax documentation.

Get more for Form 1040N MIL Nebraska Department Of Revenue Nebraska gov

- Cyber branch questionnaire form

- Department of the air force 86th airlift wing form

- Machinery and mechanized equipment galveston district u s army form

- Fill out taxes form online for recruiting

- Fort hood form 7041 application for barraks assignment hood army

- Dcips defense govdcips home u s department of defense form

- Risk management worksheet civil air patrol form

- Certificate of destruction mynavyexchange com form

Find out other Form 1040N MIL Nebraska Department Of Revenue Nebraska gov

- How To Edit Electronic signature PPT

- Convert Electronic signature PDF Online

- Convert Electronic signature PDF Free

- How To Convert Electronic signature PDF

- Convert Electronic signature Form Safe

- Convert Electronic signature Form Mac

- Convert Electronic signature Presentation Simple

- Print Electronic signature Document Simple

- How To Convert Electronic signature Presentation

- How To Print Electronic signature PDF

- How To Print Electronic signature Word

- How Can I Print Electronic signature Document

- Print Electronic signature Form Mobile

- Download Electronic signature PDF Free

- Download Electronic signature Word Free

- How To Download Electronic signature Document

- Download Electronic signature Document Now

- Download Electronic signature Document Free

- Download Electronic signature PPT Free

- Download Electronic signature Form Free