Dtf 950 Form 2014

What is the Dtf 950 Form

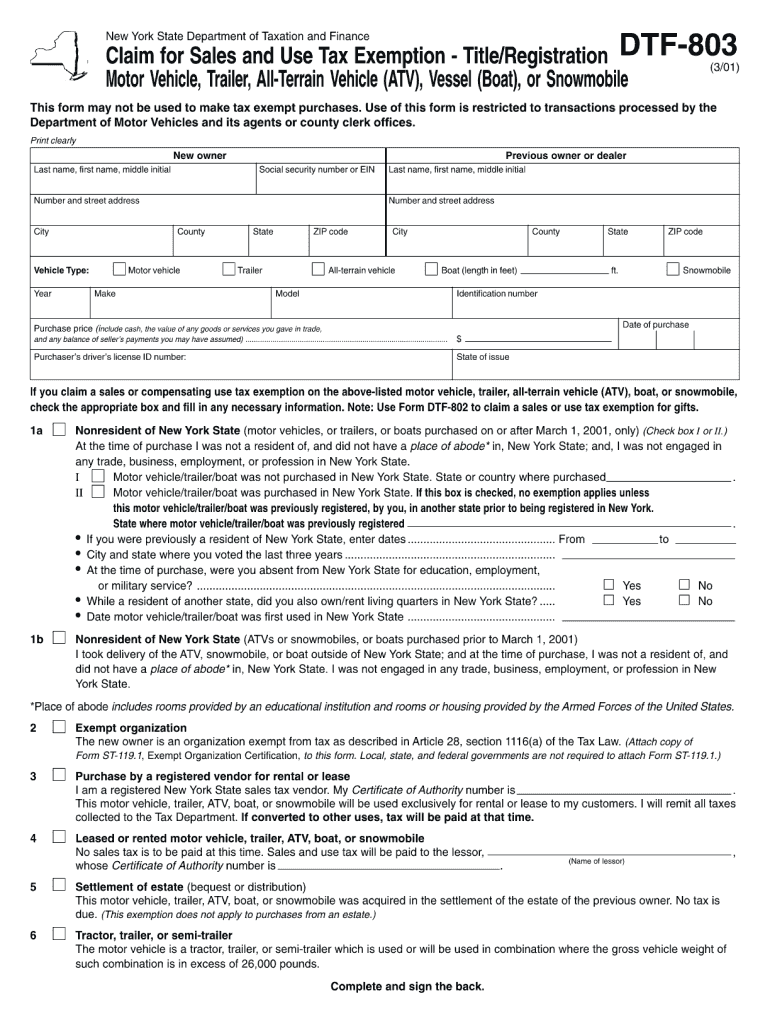

The Dtf 950 Form is a document utilized primarily for tax purposes in the state of New York. It is specifically designed for businesses and individuals to report certain transactions and activities related to sales and use tax. This form plays a crucial role in ensuring compliance with state tax regulations, allowing taxpayers to accurately report their tax obligations. Understanding the purpose of the Dtf 950 Form is essential for maintaining proper tax records and fulfilling legal requirements.

How to use the Dtf 950 Form

Using the Dtf 950 Form involves several key steps that ensure accurate completion and submission. First, gather all necessary information, including your business details, tax identification number, and transaction records. Next, fill out the form by following the provided instructions, ensuring that all sections are completed thoroughly. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority. Utilizing electronic methods for submission can streamline the process and enhance record-keeping.

Steps to complete the Dtf 950 Form

Completing the Dtf 950 Form requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather all relevant financial documents and transaction records.

- Access the Dtf 950 Form, available through the New York State Department of Taxation and Finance website.

- Fill in your business information, including name, address, and tax identification number.

- Provide details of the transactions being reported, ensuring accuracy in amounts and dates.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail to the designated tax authority.

Legal use of the Dtf 950 Form

The Dtf 950 Form is legally binding and must be completed in accordance with New York State tax laws. Proper use of this form ensures compliance with regulations governing sales and use tax reporting. Failure to accurately complete and submit the Dtf 950 Form can result in penalties and interest charges. It is essential for taxpayers to understand the legal implications of this form and to maintain accurate records to support their submissions.

Filing Deadlines / Important Dates

Timely filing of the Dtf 950 Form is critical for compliance with state tax regulations. The specific deadlines for submission may vary based on the reporting period and the nature of the transactions being reported. Generally, forms must be filed quarterly or annually, depending on the taxpayer's business activities. Taxpayers should consult the New York State Department of Taxation and Finance for the most current deadlines to avoid penalties.

Who Issues the Form

The Dtf 950 Form is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that taxpayers meet their obligations under state law. The department provides resources and guidance for completing the form, as well as information regarding filing procedures and deadlines.

Quick guide on how to complete dtf 950 2001 form

Effortlessly Complete Dtf 950 Form on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Dtf 950 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Alter and eSign Dtf 950 Form with Ease

- Locate Dtf 950 Form and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details using tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Dtf 950 Form to ensure optimal communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dtf 950 2001 form

Create this form in 5 minutes!

How to create an eSignature for the dtf 950 2001 form

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is a Dtf 950 Form?

The Dtf 950 Form is a tax-related document used to report specific tax information for various purposes. It is crucial for businesses to complete the form accurately to ensure compliance with tax regulations. Using airSlate SignNow, you can easily create, send, and eSign your Dtf 950 Form without hassle.

-

How can airSlate SignNow help me with the Dtf 950 Form?

airSlate SignNow streamlines the process of preparing and managing your Dtf 950 Form. With our easy-to-use platform, you can quickly fill out the form, send it for signatures, and securely track its status. This ensures that your documents are handled promptly and efficiently.

-

Is airSlate SignNow cost-effective for managing the Dtf 950 Form?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be budget-friendly for businesses of all sizes. Our solution provides signNow value by reducing the time and resources needed to manage your Dtf 950 Form. Explore our plans today to find the perfect fit for your needs.

-

What features does airSlate SignNow offer for the Dtf 950 Form?

airSlate SignNow provides various features to enhance your experience with the Dtf 950 Form. You can utilize templates, customize fields, and integrate with other software to simplify the signing process. Additionally, our advanced security measures ensure that your sensitive information remains protected.

-

Are there any integrations available for the Dtf 950 Form?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance the way you handle your Dtf 950 Form. This includes popular tools like Google Drive and Dropbox, ensuring that you can access your documents whenever you need them. These integrations help streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Dtf 950 Form?

Using airSlate SignNow for your Dtf 950 Form offers several benefits, including faster turnaround times and improved accuracy in document preparation. Our platform allows you to manage all your forms digitally, reducing paper waste and enhancing productivity. These features help save both time and money for your business.

-

How secure is the airSlate SignNow platform for the Dtf 950 Form?

security is a top priority at airSlate SignNow, especially for sensitive documents like the Dtf 950 Form. We employ industry-standard encryption and compliance measures to protect your information throughout the signing process. You can trust that your data is safe with us.

Get more for Dtf 950 Form

- Medcom forms 200685

- Map evaluation revised per tecom form

- Cyber branch questionnaire form

- Department of the air force 86th airlift wing form

- Machinery and mechanized equipment galveston district u s army form

- Fill out taxes form online for recruiting

- Fort hood form 7041 application for barraks assignment hood army

- Dcips defense govdcips home u s department of defense form

Find out other Dtf 950 Form

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word