Tax Ny 2015

What is the Tax Ny

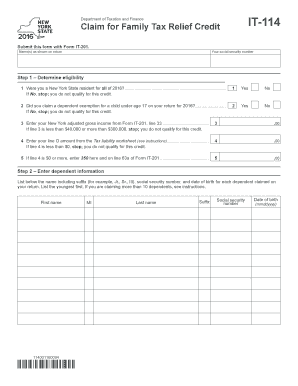

The Tax Ny form is a specific document used for tax purposes in the state of New York. It serves various functions, including reporting income, claiming deductions, and ensuring compliance with state tax regulations. Understanding the purpose and requirements of the Tax Ny form is essential for individuals and businesses operating within New York. This form is crucial for maintaining accurate records and fulfilling tax obligations in accordance with state laws.

How to use the Tax Ny

Using the Tax Ny form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form carefully, ensuring that all information is correct and complete. After completing the form, review it for any errors before submitting it to the appropriate state tax authority. Utilizing digital tools can streamline this process, making it easier to fill out and eSign the document securely.

Steps to complete the Tax Ny

Completing the Tax Ny form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Gather all necessary documents, including income statements and proof of deductions.

- Access the Tax Ny form through the official state tax website or a trusted digital platform.

- Fill out the form, providing accurate information in each section.

- Review the completed form for accuracy, checking for any missing information.

- Submit the form electronically or by mail, depending on your preference and state guidelines.

Legal use of the Tax Ny

The Tax Ny form must be used in compliance with state tax laws to ensure its legal validity. This includes adhering to deadlines for submission and maintaining accurate records of all financial transactions reported on the form. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential to understand the legal framework surrounding the use of the Tax Ny form to avoid any issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Ny form vary depending on the type of taxpayer and the specific tax year. Generally, individual taxpayers must file their forms by April 15 each year. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to ensure timely submission and avoid late fees or penalties. Keeping a calendar of important tax dates can help in managing these deadlines effectively.

Required Documents

To complete the Tax Ny form accurately, several documents are typically required. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Gathering these documents in advance can facilitate a smoother filing process and ensure that all necessary information is included in the Tax Ny form.

Form Submission Methods (Online / Mail / In-Person)

The Tax Ny form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the state tax website or authorized digital platforms.

- Mailing a printed copy of the completed form to the designated tax office.

- In-person submission at local tax offices for those who prefer direct interaction.

Choosing the method that best suits your needs can help ensure a smooth filing experience.

Quick guide on how to complete tax ny 100723393

Complete Tax Ny effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage Tax Ny on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Tax Ny with ease

- Obtain Tax Ny and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Ny while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax ny 100723393

Create this form in 5 minutes!

How to create an eSignature for the tax ny 100723393

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Ny?

airSlate SignNow is a digital solution that enables businesses to send and eSign important documents efficiently. For companies dealing with Tax Ny., having a secure and reliable electronic signature solution can streamline tax document management and ensure compliance with local regulations.

-

How can airSlate SignNow help with Tax Ny. document management?

With airSlate SignNow, you can easily manage, store, and eSign Tax Ny. documents in one centralized platform. This reduces the risk of errors and provides a comprehensive audit trail, allowing users to maintain compliance and organize their tax-related paperwork efficiently.

-

What are the pricing options for airSlate SignNow concerning Tax Ny. needs?

airSlate SignNow offers several pricing plans tailored to various business needs, including those focused on Tax Ny. The plans are designed to be cost-effective, ensuring that businesses of all sizes can access essential features for document signing and management without overextending their budgets.

-

Is airSlate SignNow secure for handling Tax Ny. documents?

Yes, airSlate SignNow prioritizes security, implementing encryption and compliance with legal standards to protect your Tax Ny. documents. This commitment to security helps businesses safeguard sensitive information while ensuring legality and integrity in electronic transactions.

-

Can airSlate SignNow integrate with other platforms for Tax Ny. compliance?

Absolutely! airSlate SignNow can seamlessly integrate with various platforms, enhancing your workflow while managing Tax Ny. duties. These integrations help ensure that your eSigning process aligns with other business operations, creating a more streamlined approach to compliance.

-

What features of airSlate SignNow are beneficial for Tax Ny. filings?

Key features of airSlate SignNow beneficial for Tax Ny. filings include templates, automated workflows, and bulk sending options. These functionalities not only save time but also help ensure that all necessary tax documents are completed accurately and on time according to local regulations.

-

How does airSlate SignNow enhance collaboration for Tax Ny. teams?

airSlate SignNow fosters collaboration by allowing multiple users to eSign and review Tax Ny. documents simultaneously. This capability ensures that teams can work together efficiently, reducing bottlenecks and expediting the document processing needed for tax-related tasks.

Get more for Tax Ny

Find out other Tax Ny

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself