it 114 2016-2026

What is the IT-114?

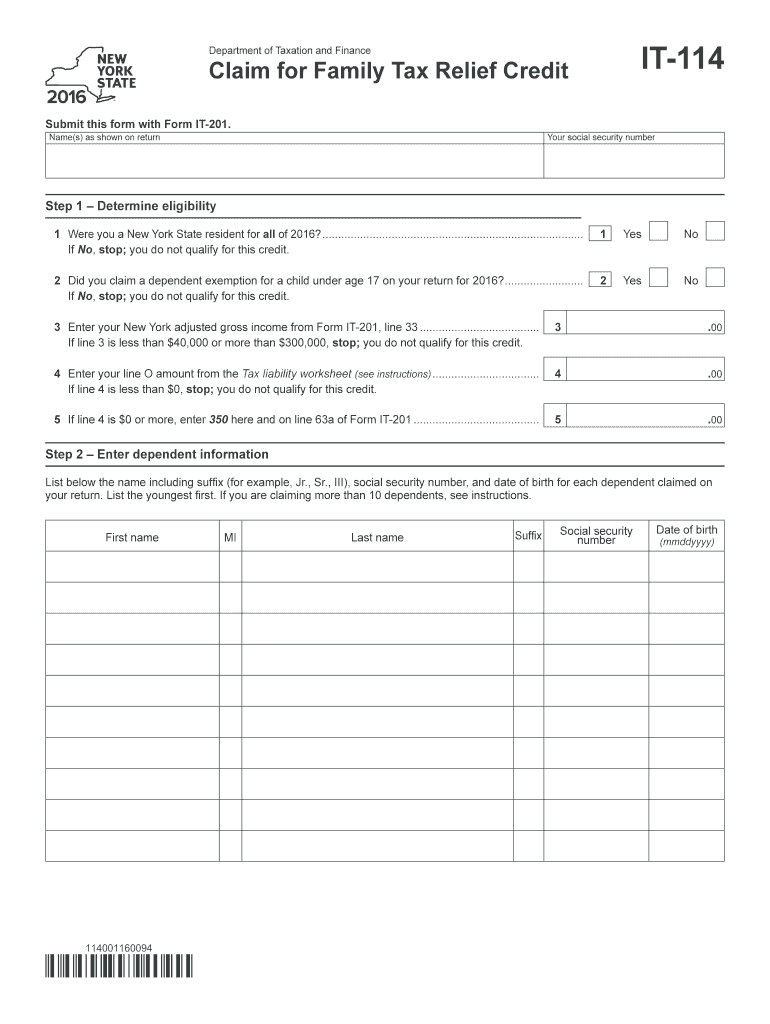

The IT-114 is a tax form used in New York State for claiming certain tax credits, specifically related to the 2016 relief credit. This form is essential for eligible taxpayers who wish to receive financial relief based on their circumstances. The IT-114 helps streamline the process of claiming these credits, ensuring that taxpayers can accurately report their income and expenses while maximizing their potential refunds.

How to Use the IT-114

Using the IT-114 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary documentation, including income statements and any relevant deductions. Once the necessary information is compiled, individuals can fill out the form, providing details such as personal information, income, and the specific credits being claimed. After completing the form, it should be reviewed for accuracy before submission.

Steps to Complete the IT-114

Completing the IT-114 requires careful attention to detail. Here are the key steps:

- Gather all required documents, including W-2s and 1099s.

- Fill in personal information, such as name, address, and Social Security number.

- Report total income and any adjustments that apply.

- Indicate the specific relief credits being claimed.

- Review the completed form for accuracy.

- Submit the form by the designated deadline.

Legal Use of the IT-114

The IT-114 must be used in accordance with New York State tax regulations. This includes ensuring that all information provided is truthful and accurate. Failure to comply with these legal requirements can result in penalties, including fines or disqualification from receiving credits. Taxpayers are encouraged to familiarize themselves with relevant laws and guidelines to ensure proper use of the form.

Filing Deadlines / Important Dates

Filing deadlines for the IT-114 are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the tax filing deadline for the respective year. For the 2016 relief credit, the deadline aligns with the general tax filing date, which is usually April 15. It is important to check for any extensions or changes to deadlines that may occur due to special circumstances.

Required Documents

To successfully complete the IT-114, certain documents are required. These include:

- Income statements such as W-2 forms and 1099 forms.

- Proof of residency in New York State.

- Any documentation supporting the claims for credits.

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods

The IT-114 can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online using approved e-filing services, or they may opt to mail the completed form to the appropriate tax office. In-person submissions may also be possible at designated locations. Each method has its own set of instructions and deadlines that must be followed.

Quick guide on how to complete it 114

Effortlessly prepare It 114 on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional paper documents, allowing you to obtain the necessary forms and securely keep them online. airSlate SignNow provides all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle It 114 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

The easiest method to modify and electronically sign It 114 without stress

- Obtain It 114 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign It 114 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 114

Create this form in 5 minutes!

How to create an eSignature for the it 114

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 114 claim form and how does it work?

The 114 claim form is a crucial document used for submitting claims for reimbursements in various scenarios. With airSlate SignNow, you can easily prepare, send, and eSign the 114 claim form online, ensuring a seamless process from submission to approval.

-

How much does airSlate SignNow cost for managing 114 claim forms?

airSlate SignNow offers competitive pricing tailored to your business needs when dealing with the 114 claim form. Our plans provide cost-effective solutions that allow you to manage multiple documents and signatures efficiently.

-

What features does airSlate SignNow provide for 114 claim form management?

airSlate SignNow includes a variety of features designed for the efficient management of the 114 claim form. Key features include easy document creation, customizable templates, secure eSigning, and real-time tracking of your claims.

-

How can airSlate SignNow benefit my business when using the 114 claim form?

Using airSlate SignNow to manage the 114 claim form can signNowly streamline your document workflow. With enhanced efficiency, reduced processing time, and improved accuracy, your business can focus more on its core functions and less on paperwork.

-

Is it easy to integrate airSlate SignNow with other applications for the 114 claim form?

Yes, airSlate SignNow offers seamless integration with various third-party applications, making it easy to incorporate the 114 claim form into your existing workflows. This flexibility ensures that your documentation process remains streamlined and efficient across multiple platforms.

-

Can I track the status of an eSigned 114 claim form?

Absolutely! airSlate SignNow provides real-time tracking for the status of eSigned 114 claim forms. You'll receive notifications when a form is signed, ensuring you are always updated on your claims' progress.

-

What security measures does airSlate SignNow have for the 114 claim form?

Security is a top priority at airSlate SignNow. When managing the 114 claim form, all documents are protected with robust encryption protocols, ensuring that your sensitive information is safe and secure throughout the signing process.

Get more for It 114

Find out other It 114

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online