as Tax Form 390 2018

What is the As Tax Form 390

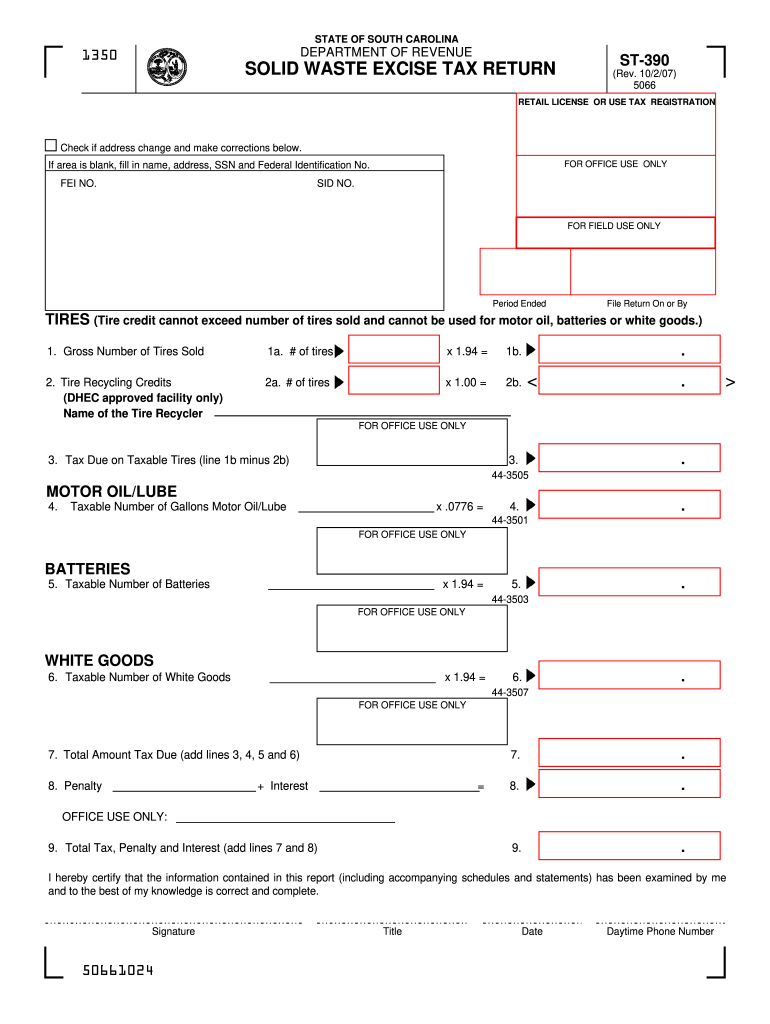

The As Tax Form 390 is a specific tax form used by certain taxpayers in the United States to report income, deductions, and other tax-related information. This form is particularly relevant for individuals and businesses that need to disclose specific financial details to the Internal Revenue Service (IRS). Understanding the purpose of this form is essential for accurate tax reporting and compliance with federal regulations.

How to use the As Tax Form 390

Using the As Tax Form 390 involves several steps to ensure that all required information is accurately reported. Taxpayers should start by gathering necessary financial documents, such as income statements and deduction records. Next, they should carefully fill out the form, ensuring that all sections are completed according to IRS guidelines. Once completed, the form can be submitted electronically or by mail, depending on the taxpayer's preference and the specific requirements of the IRS.

Steps to complete the As Tax Form 390

Completing the As Tax Form 390 requires attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income and deduction records.

- Download the As Tax Form 390 from the IRS website or access it through tax preparation software.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form electronically or by mail, as per IRS guidelines.

Legal use of the As Tax Form 390

The As Tax Form 390 is legally binding when completed and submitted according to IRS regulations. It is crucial for taxpayers to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be signed and dated by the taxpayer to validate its authenticity, which can also be accomplished through electronic signature solutions that comply with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the As Tax Form 390 vary depending on the taxpayer's specific situation, such as whether they are an individual or a business entity. Generally, the form must be filed by April 15 of the tax year. However, extensions may be available under certain circumstances. It is important for taxpayers to be aware of these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The As Tax Form 390 can be submitted through various methods. Taxpayers have the option to file online using approved tax software, which often streamlines the process and reduces the chance of errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is typically not available for this form, as most taxpayers complete their filings remotely.

Quick guide on how to complete as tax form 390 2007

Complete As Tax Form 390 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and eSign your documents quickly without delays. Manage As Tax Form 390 on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign As Tax Form 390 without effort

- Find As Tax Form 390 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign As Tax Form 390 and ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct as tax form 390 2007

Create this form in 5 minutes!

How to create an eSignature for the as tax form 390 2007

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is As Tax Form 390 and why is it important?

As Tax Form 390 is an official document required for certain tax filings, helping businesses ensure compliance with IRS regulations. Proper handling of this form is crucial to avoid penalties and delays in processing tax returns. airSlate SignNow streamlines the signing process, making it easy to manage As Tax Form 390 efficiently.

-

How can airSlate SignNow assist with As Tax Form 390?

airSlate SignNow provides a secure platform for sending, signing, and storing As Tax Form 390 electronically. With features like customizable templates and reminders, businesses can ensure timely completion of this important form. This simplifies the overall tax filing process, enhancing productivity and reducing stress.

-

What pricing options are available for using airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to fit different business needs, allowing you to choose the one that best accommodates your use of As Tax Form 390. Each plan provides access to features that enhance document management, such as eSigning, integrations, and cloud storage. You can start with a free trial to explore these capabilities at no cost.

-

Is airSlate SignNow compliant with legal regulations for As Tax Form 390?

Yes, airSlate SignNow complies with industry standards to ensure that your electronic signatures on As Tax Form 390 are legally binding. The platform adheres to eSignature laws, including the ESIGN Act and UETA, giving you peace of mind when managing sensitive tax documents. This compliance supports your business in meeting regulatory requirements.

-

What features does airSlate SignNow provide for signing As Tax Form 390?

airSlate SignNow includes features like customizable signing workflows, document templates, and real-time tracking to facilitate the signing of As Tax Form 390. Users can also add fields, annotate documents, and set up approval workflows, ensuring that all necessary signatures are captured efficiently. These tools enhance the overall experience and effectiveness in handling tax documents.

-

Can I integrate airSlate SignNow with other software for managing As Tax Form 390?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage As Tax Form 390. Popular integrations include CRM systems, cloud storage services, and accounting software, allowing for a streamlined workflow and improved productivity. This flexibility enables businesses to utilize existing tools more effectively.

-

How does airSlate SignNow enhance collaboration on As Tax Form 390?

With airSlate SignNow, teams can collaborate in real-time on As Tax Form 390, ensuring everyone involved has access to the most up-to-date information. The platform allows for comments, document sharing, and version control, which improves communication and reduces errors. This collaborative approach leads to more efficient document processing and timely filing.

Get more for As Tax Form 390

- Form 4 notice from tenant to landlord withholding rent

- Pdf download of ventures grade 6 new curriculum textbooks in zimbabwe form

- Route 33 crossfit liability waiver form

- Consultancy contract template form

- Consultant contract template form

- Sew contract template form

- Sew seamstress contract template form

- Shared ownership contract template form

Find out other As Tax Form 390

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer