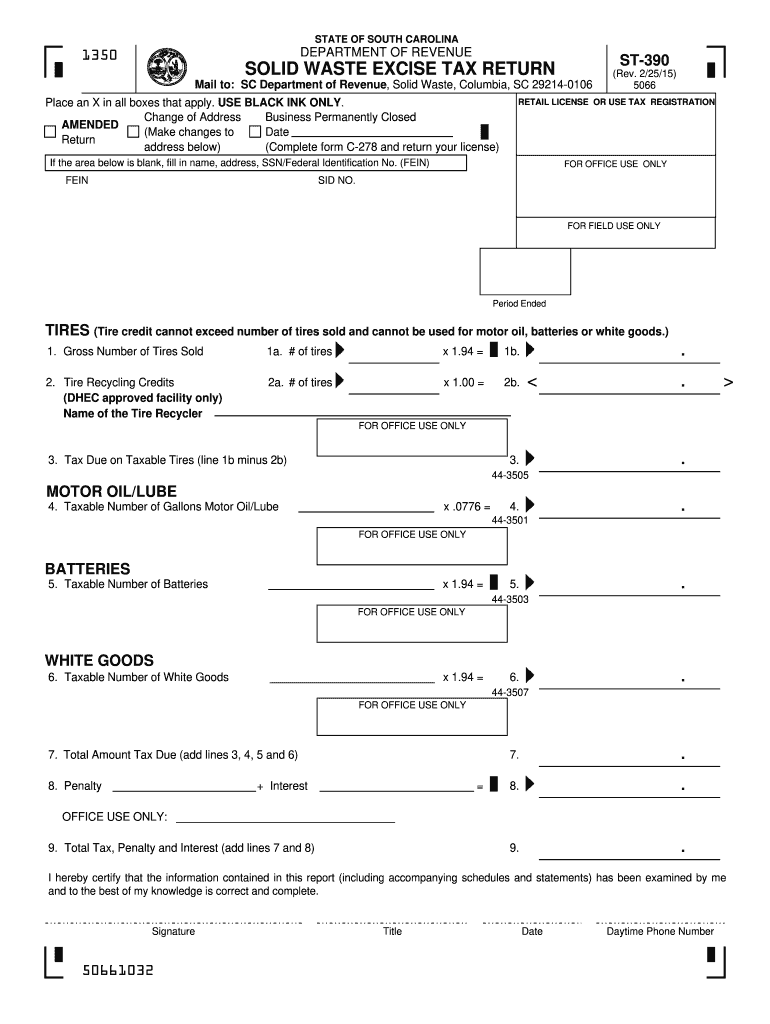

Form 390 2015

What is the Form 390

The Form 390 is a tax document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to disclose certain types of income or deductions. It serves as a formal declaration of financial activities during the tax year, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of Form 390 is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form 390

Using Form 390 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and deduction records. Next, fill out the form by entering the relevant data in the designated fields. It is important to review the completed form for accuracy before submission. Once verified, the form can be filed electronically or sent via mail to the appropriate IRS office. Utilizing a reliable eSignature solution can streamline this process, making it easier to complete and submit the form securely.

Steps to complete the Form 390

Completing Form 390 requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions.

- Access the Form 390 template, either online or through tax preparation software.

- Fill in personal information, including your name, address, and Social Security number.

- Enter income details and any applicable deductions in the appropriate sections.

- Review the form for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form to the IRS by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 390. These guidelines include instructions on what information must be reported, how to calculate income and deductions, and the importance of adhering to filing deadlines. It is essential to familiarize yourself with these guidelines to ensure compliance and avoid errors that could lead to audits or penalties. The IRS website offers detailed resources and FAQs to assist taxpayers in understanding their obligations related to Form 390.

Filing Deadlines / Important Dates

Filing deadlines for Form 390 are critical to avoid penalties. Generally, the form must be submitted by April fifteenth of the tax year following the reporting period. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes in tax law that may affect filing dates. Additionally, taxpayers may request an extension if more time is needed to complete their tax return, but this does not extend the deadline for any taxes owed.

Penalties for Non-Compliance

Failure to file Form 390 or inaccuracies in reporting can result in significant penalties. The IRS imposes fines for late submissions, which can increase the longer the form remains unfiled. Additionally, inaccuracies may lead to audits, further fines, or even legal action in severe cases. It is crucial for taxpayers to ensure that all information reported on Form 390 is accurate and submitted on time to avoid these potential consequences.

Quick guide on how to complete form 390 2015

Your assistance manual for preparing your Form 390

If you’re curious about how to finalize and submit your Form 390, here are a few brief instructions to simplify the tax filing process.

First, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and efficient document solution that enables you to edit, create, and finalize your tax documents with ease. With its editor, you can toggle between text, check boxes, and electronic signatures and revisit to update information as necessary. Enhance your tax management through advanced PDF editing, electronic signing, and intuitive sharing.

Follow the instructions below to finalize your Form 390 in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Select Obtain form to access your Form 390 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to insert your legally-recognized electronic signature (if necessary).

- Review your document and correct any inaccuracies.

- Save changes, print a copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Please remember that filing on paper may lead to return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 390 2015

Create this form in 5 minutes!

How to create an eSignature for the form 390 2015

How to create an electronic signature for the Form 390 2015 online

How to create an eSignature for your Form 390 2015 in Google Chrome

How to create an electronic signature for signing the Form 390 2015 in Gmail

How to make an electronic signature for the Form 390 2015 straight from your smart phone

How to create an electronic signature for the Form 390 2015 on iOS

How to generate an eSignature for the Form 390 2015 on Android

People also ask

-

What is Form 390, and why is it important for my business?

Form 390 is a crucial document for businesses that need to report specific financial information to the IRS. Utilizing airSlate SignNow to manage Form 390 ensures that your documents are securely signed and easily accessible, streamlining your compliance process. With our eSigning solution, you can efficiently handle Form 390 submissions and enhance your operational efficiency.

-

How does airSlate SignNow help with the electronic signing of Form 390?

airSlate SignNow provides a user-friendly platform for electronically signing Form 390, simplifying the process of obtaining signatures. Our tool allows you to send the document directly to your signers, who can easily review and sign it from any device. This not only saves time but also ensures that your Form 390 is signed securely and in compliance with legal standards.

-

What are the pricing options for using airSlate SignNow for Form 390?

Our pricing for airSlate SignNow varies based on the features you need, starting with a free trial that allows you to test our capabilities for Form 390. We offer flexible subscription plans that can accommodate businesses of all sizes, ensuring you have access to the tools necessary for efficient document management and eSigning. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software to manage Form 390?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easier to manage Form 390 alongside your existing tools. Whether you use CRM, accounting, or document management systems, our platform can connect with them to streamline your workflow. This integration capability helps enhance your overall efficiency in handling Form 390.

-

What security features does airSlate SignNow offer for Form 390 documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Form 390. We utilize advanced encryption technology to protect your data during transit and storage. Additionally, our platform complies with industry standards to ensure that your Form 390 and other documents are safe from unauthorized access.

-

How can airSlate SignNow improve my workflow when dealing with Form 390?

airSlate SignNow simplifies and automates the workflow related to Form 390, allowing you to send, sign, and store documents efficiently. By reducing manual processes and paper usage, you can enhance productivity and focus on your core business activities. Our platform's tracking and notification features help you stay updated on the status of your Form 390.

-

Is airSlate SignNow mobile-friendly for signing Form 390?

Absolutely! airSlate SignNow is fully optimized for mobile devices, enabling you to sign Form 390 documents on the go. Whether you are using a smartphone or tablet, our mobile app provides a seamless experience for reviewing and signing documents, ensuring you can manage your Form 390 anytime, anywhere.

Get more for Form 390

Find out other Form 390

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online