Tennessee Form Inheritance Tax 2015

What is the Tennessee Form Inheritance Tax

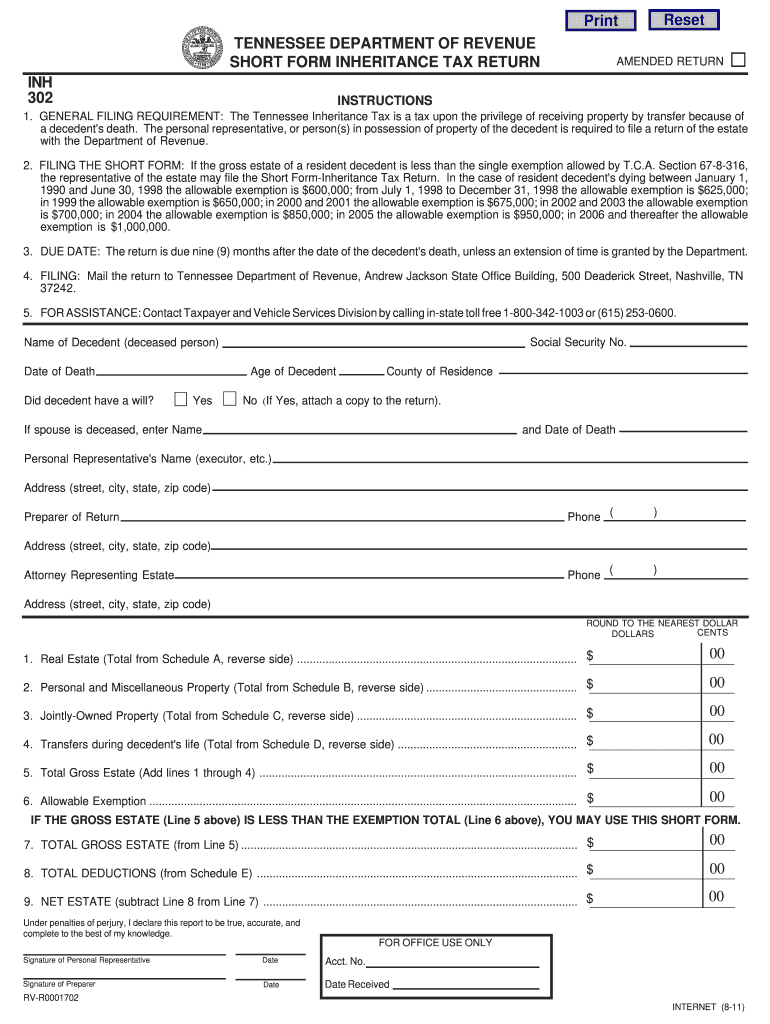

The Tennessee Form Inheritance Tax is a legal document required for the assessment and payment of inheritance taxes owed by beneficiaries receiving property or assets from a deceased individual. This form ensures compliance with state tax regulations and helps determine the tax liability based on the value of the inherited estate. It is essential for heirs to understand the implications of this form as it directly impacts their financial responsibilities following a loved one's passing.

Steps to complete the Tennessee Form Inheritance Tax

Completing the Tennessee Form Inheritance Tax involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding the deceased's estate, including asset valuations and beneficiary details. Next, fill out the form with precise data, ensuring all sections are completed. After completing the form, review it for any errors or omissions, as inaccuracies can lead to penalties. Finally, submit the form to the appropriate state tax authority by the specified deadline.

Key elements of the Tennessee Form Inheritance Tax

Understanding the key elements of the Tennessee Form Inheritance Tax is crucial for accurate completion. The form typically includes sections for the decedent's information, a detailed inventory of the estate's assets, and the identification of beneficiaries. Additionally, it requires calculations of the total inheritance tax owed based on the value of the estate. Accurate reporting of these elements ensures compliance with state laws and helps avoid potential disputes with tax authorities.

Required Documents

When filing the Tennessee Form Inheritance Tax, certain documents are required to support the information provided in the form. These may include the death certificate of the decedent, a will or trust documents, and documentation of asset valuations, such as appraisals or bank statements. It is important to compile these documents before starting the form to facilitate a smooth filing process and ensure all necessary information is readily available.

Form Submission Methods

The Tennessee Form Inheritance Tax can be submitted through various methods to accommodate different preferences. Individuals may choose to file the form online, which offers a convenient and efficient option for many. Alternatively, the form can be mailed directly to the appropriate tax office or submitted in person for those who prefer face-to-face interactions. Each method has its own processing times and requirements, so it is advisable to confirm the best option based on individual circumstances.

Penalties for Non-Compliance

Failure to comply with the requirements of the Tennessee Form Inheritance Tax can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from state authorities. It is essential for beneficiaries to be aware of these consequences and ensure timely and accurate filing of the form to avoid such penalties. Understanding the importance of compliance can help mitigate risks associated with inheritance tax obligations.

Quick guide on how to complete tennessee form inheritance tax 2011

Complete Tennessee Form Inheritance Tax seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Tennessee Form Inheritance Tax on any platform with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to modify and electronically sign Tennessee Form Inheritance Tax with ease

- Find Tennessee Form Inheritance Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers for that specific purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tennessee Form Inheritance Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee form inheritance tax 2011

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Tennessee Form Inheritance Tax?

The Tennessee Form Inheritance Tax is a legal document required to report and pay inheritance taxes on estates in Tennessee. It helps beneficiaries comply with state tax laws after the passing of an estate owner, ensuring proper tax payments based on the value of the inheritance received.

-

How can airSlate SignNow help with the Tennessee Form Inheritance Tax?

airSlate SignNow simplifies the process of completing and submitting the Tennessee Form Inheritance Tax by providing an intuitive eSignature platform. You can securely sign documents electronically, which speeds up the filing process and ensures compliance with legal requirements.

-

What are the pricing options for airSlate SignNow for filing the Tennessee Form Inheritance Tax?

airSlate SignNow offers competitive pricing plans tailored to various business needs, making it affordable for individuals and estates alike. Pricing starts with a basic plan, which includes essential features for submitting the Tennessee Form Inheritance Tax, ensuring you get value for your investment.

-

Is airSlate SignNow compliant with state regulations for the Tennessee Form Inheritance Tax?

Yes, airSlate SignNow is fully compliant with state regulations regarding electronic signatures and document submissions. This ensures that your Tennessee Form Inheritance Tax is legally valid and meets all necessary requirements for acceptance by the state.

-

What features does airSlate SignNow offer for managing the Tennessee Form Inheritance Tax?

airSlate SignNow provides features such as document templates, team collaboration, and secure storage, all of which streamline the management of the Tennessee Form Inheritance Tax. You can easily create, edit, and share documents, making the entire process efficient and organized.

-

Can I integrate airSlate SignNow with other tools for help with Tennessee Form Inheritance Tax?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage and productivity tools, enhancing your workflow for handling the Tennessee Form Inheritance Tax. This integration allows for smoother document management and collaboration across different platforms.

-

What are the benefits of using airSlate SignNow for the Tennessee Form Inheritance Tax?

Using airSlate SignNow for the Tennessee Form Inheritance Tax offers various benefits, including time savings, increased security, and reduced paperwork. The platform ensures that your documents are signed quickly and securely, allowing you to focus on other important aspects of estate management.

Get more for Tennessee Form Inheritance Tax

- State of new jersey department of the treasury fb0 form

- Verification of employment form north dakota board of nursing

- Initial bapplicationb pt assistant indirect supervision pa gov form

- Sample written program for fire prevention plan amtrust form

- Verification of hours verification of hours form

- Housing act of 1964 as amended andor a section 115 rehabilitation grant authorized under the housing act of 1949 as amended form

- Execupay w2 form

- This application is the property of mountaire form

Find out other Tennessee Form Inheritance Tax

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template